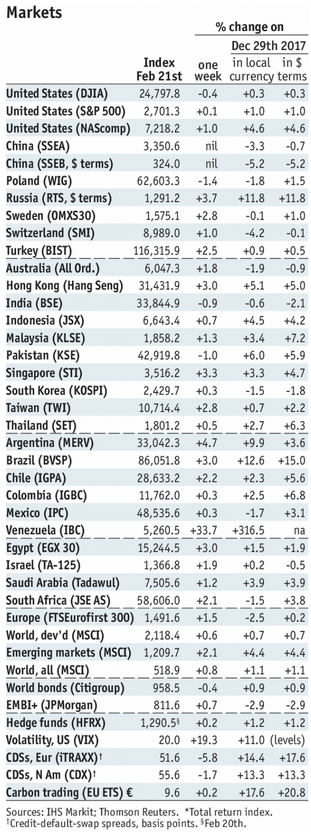

Stock Markets EM FX ended Friday on a mixed note and capped off a soft week overall. Best performers last week were ZAR, CLP, and PHP while the worst were TRY, ARS, and IDR. Fed Chief Powell’s testimony to Congress will likely draw market attention back to Fed policy. Stock Markets Emerging Markets, February 21 Source: economist.com - Click to enlarge Singapore Singapore reports January IP and is expected to rise 7.8% y/y vs. -3.9% in December. February PMI will be reported Friday. January CPI was flat y/y vs. 0.4% expected. While the MAS does not have an explicit inflation target, the lack of any price pressures should allow it to remain on hold at its April policy meeting. Brazil Brazil reports January

Topics:

Win Thin considers the following as important: emerging markets, Featured, newsletter

This could be interesting, too:

Nachrichten Ticker - www.finanzen.ch writes Die Performance der Kryptowährungen in KW 9: Das hat sich bei Bitcoin, Ether & Co. getan

Nachrichten Ticker - www.finanzen.ch writes Wer verbirgt sich hinter der Ethereum-Technologie?

Martin Hartmann writes Eine Analyse nach den Lehren von Milton Friedman

Marc Chandler writes March 2025 Monthly

Stock MarketsEM FX ended Friday on a mixed note and capped off a soft week overall. Best performers last week were ZAR, CLP, and PHP while the worst were TRY, ARS, and IDR. Fed Chief Powell’s testimony to Congress will likely draw market attention back to Fed policy. |

Stock Markets Emerging Markets, February 21 Source: economist.com - Click to enlarge |

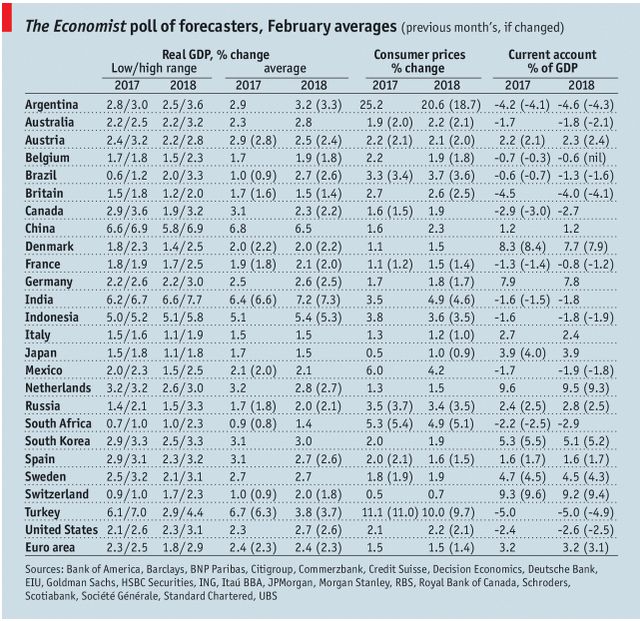

SingaporeSingapore reports January IP and is expected to rise 7.8% y/y vs. -3.9% in December. February PMI will be reported Friday. January CPI was flat y/y vs. 0.4% expected. While the MAS does not have an explicit inflation target, the lack of any price pressures should allow it to remain on hold at its April policy meeting. BrazilBrazil reports January current account and FDI on Monday. January central government budget data will be reported Tuesday. Consolidated budget data will be reported Wednesday. Q4 GDP will be reported Thursday, which is expected to grow 2.8% y/y vs. 1.4% in Q3. IsraelBank of Israel meets Monday and is expected to keep rates steady at 0.10%. CPI rose only 0.1% y/y in January, the lowest since September and well below the 1-3% target range. Yet the bar to further action is very high. For now, the bank is likely to continue its efforts to weaken the shekel to stimulate the economy. KoreaBank of Korea meets Tuesday and is expected to keep rates steady at 1.5%. CPI rose only 1.0% y/y in January, well below the 2% target. February trade data will be reported Thursday. Exports are expected to rise 0.8% y/y but will be distorted from the timing of the Lunar New Year. January IP will be reported Friday, which is expected to rise 1.8% y/y vs. -6% y/y in December. HungaryNational Bank of Hungary meets Tuesday and is expected to keep rates steady at 0.90%. CPI rose only 2.1% y/y in January, right near the bottom of the 2-4% target range. As such, there is some risk that the bank adds more stimulus via unconventional measures. MexicoMexico reports January trade Tuesday. Banco de Mexico releases its quarterly inflation report Wednesday. Inflation has eased recently and could allow the central bank to remain on hold at its next policy meeting April 12. However, much will depend on the peso and general EM sentiment. ChinaChina reports official February manufacturing PMI Wednesday, which is expected at 51.2 vs. 51.3 in January. Caixin reports its manufacturing PMI Thursday, which is expected at 51.3 vs. 51.5 in January. For now, markets are comfortable with the mainland macro outlook as well as policymakers’ efforts to deleverage the financial system. MalaysiaMalaysia reports January CPI Wednesday, which is expected to rise 2.9% y/y vs. 3.5% in December. While Bank Negara does not have an explicit inflation target, easing price pressures should allow it to follow a very modest tightening cycle. It hiked 25 bp to 3.25% at its last meeting January 25, but no move is expected at the next meeting March 7. South AfricaSouth Africa reports January money and private sector credit, PPI, trade, and budget data Wednesday. January CPI rose 4.4% y/y, the lowest rate since March 2015 and in the bottom half of the 3-6% target range. The central bank started the easing cycle last July with a 25 bp cut to 6.75% but has been on hold since. If the rand remains relatively firm, we think a 25 bp cut to 6.5% is likely at the next policy meeting March 28. TurkeyTurkey reports January trade Wednesday, which is expected at -$9.12 bln. If so, the 12-month total would rise to -$81.5 bln, the largest since March 2015. The external accounts are worsening sharply and should put some downward pressure on the lira. IndiaIndia reports Q4 GDP Wednesday, which is expected to grow 6.9% y/y vs. 6.3% in Q3. RBI minutes from this month’s meeting were more hawkish than expected. With inflation running above 5%, officials fretted that the 2-6% target band will be breached as fiscal policy runs too hot. Next policy meeting is April 5 and markets should start preparing for a possible rate hike then. IndonesiaIndonesia reports February CPI Thursday. CPI rose 3.3% y/y in January, which is near the bottom of the 3-5% target range. This should allow the central bank to remain on hold for now. Next policy meeting is March 22, rates are likely to be kept steady at 4.25%. PeruPeru reports February CPI Thursday, which is expected to remain steady at 1.3% y/y. If so, inflation would remain near the bottom of the 1-3% target range. Next policy meeting is March 8. The bank has been cutting rates every other month, which points to a 25 bp cut to 2.75% then after it stood pat in February. ThailandThailand reports February CPI Friday, which is expected to rise 0.8% y/y vs. 0.7% in January. If so, inflation would still be below the 1-4% target range. Next BOT policy meeting is March 28 and is expected to keep rates steady at 1.5%. The firm baht is one factor behind the central bank’s reluctance to tighten policy anytime soon. |

GDP, Consumer Inflation and Current Accounts Source: economist.com - Click to enlarge |

Tags: Emerging Markets,Featured,newsletter