‘Digital Gold’ Bitcoin Flight To Safe Haven Physical Gold – Latest bitcoin, crypto crash causes gold coin and bar demand to surge– Bitcoin down 40% from high, Ripple down 50% and Ethereum down 30%– Ripple and ‘Digital gold’ Bitcoin fall past key psychological price levels– 0bn wiped from cryptocurrency fortunes in just 36 hours– New research says that there is ‘Price Manipulation in the Bitcoin Ecosystem’– Savvy crypto buyers converted their short term gains into physical gold bars, coins– Bitcoin and Ripple sellers bought gold both for delivery and storage from GoldCore – Gold ETF holdings rise – Assets in iShares Gold soar to .7 b, highest in 5 years – 95% of cryptocurrencies will go to zero … Editor: Mark

Topics:

Jan Skoyles considers the following as important: Bitcoin, Daily Market Update, Featured, gold prices, GoldCore, newslettersent

This could be interesting, too:

Nachrichten Ticker - www.finanzen.ch writes Die Performance der Kryptowährungen in KW 9: Das hat sich bei Bitcoin, Ether & Co. getan

Nachrichten Ticker - www.finanzen.ch writes Wer verbirgt sich hinter der Ethereum-Technologie?

Marc Chandler writes March 2025 Monthly

Mark Thornton writes Is Amazon a Union-Busting Leviathan?

| ‘Digital Gold’ Bitcoin Flight To Safe Haven Physical Gold

– Latest bitcoin, crypto crash causes gold coin and bar demand to surge Editor: Mark O’Byrne |

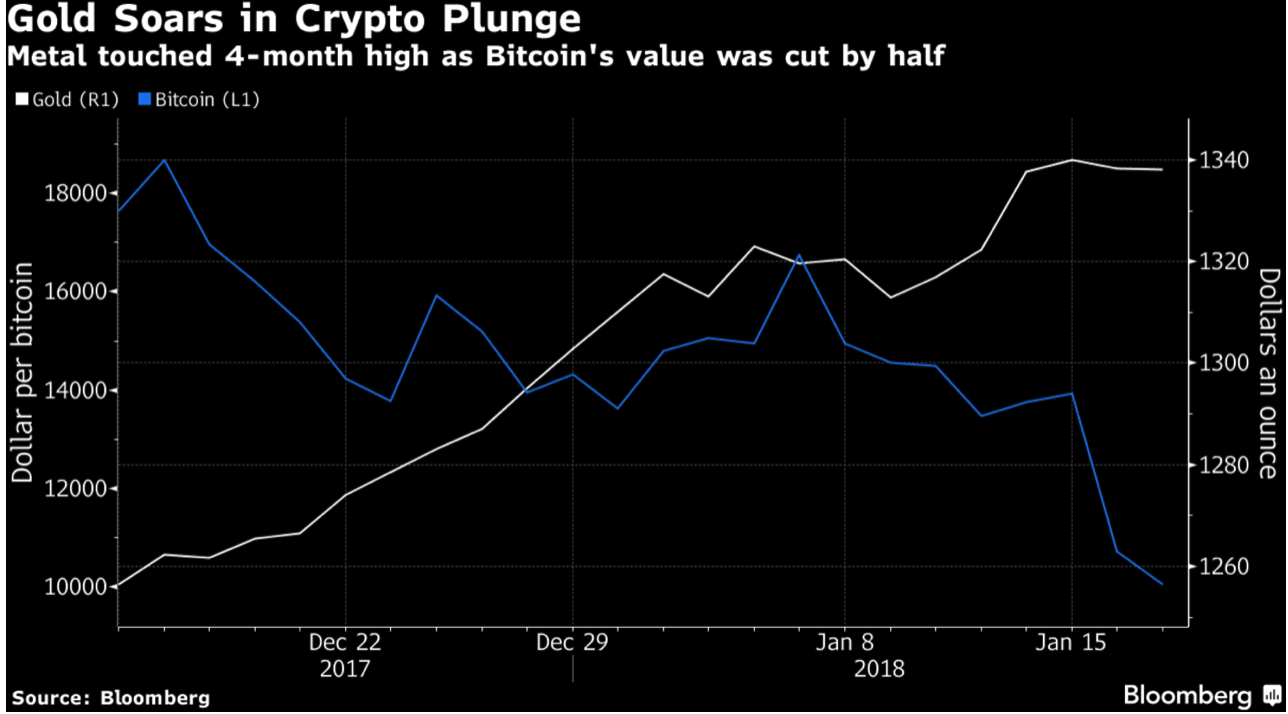

Gold and Bitcoin prices, Dec 2017 - Jan 2018(see more posts on Bitcoin, Gold prices, ) |

| 30% to 50% price drops in a matter of days and the loss of $300 billion in value is quite a knock for a market that was not meant to be in a speculative bubble.

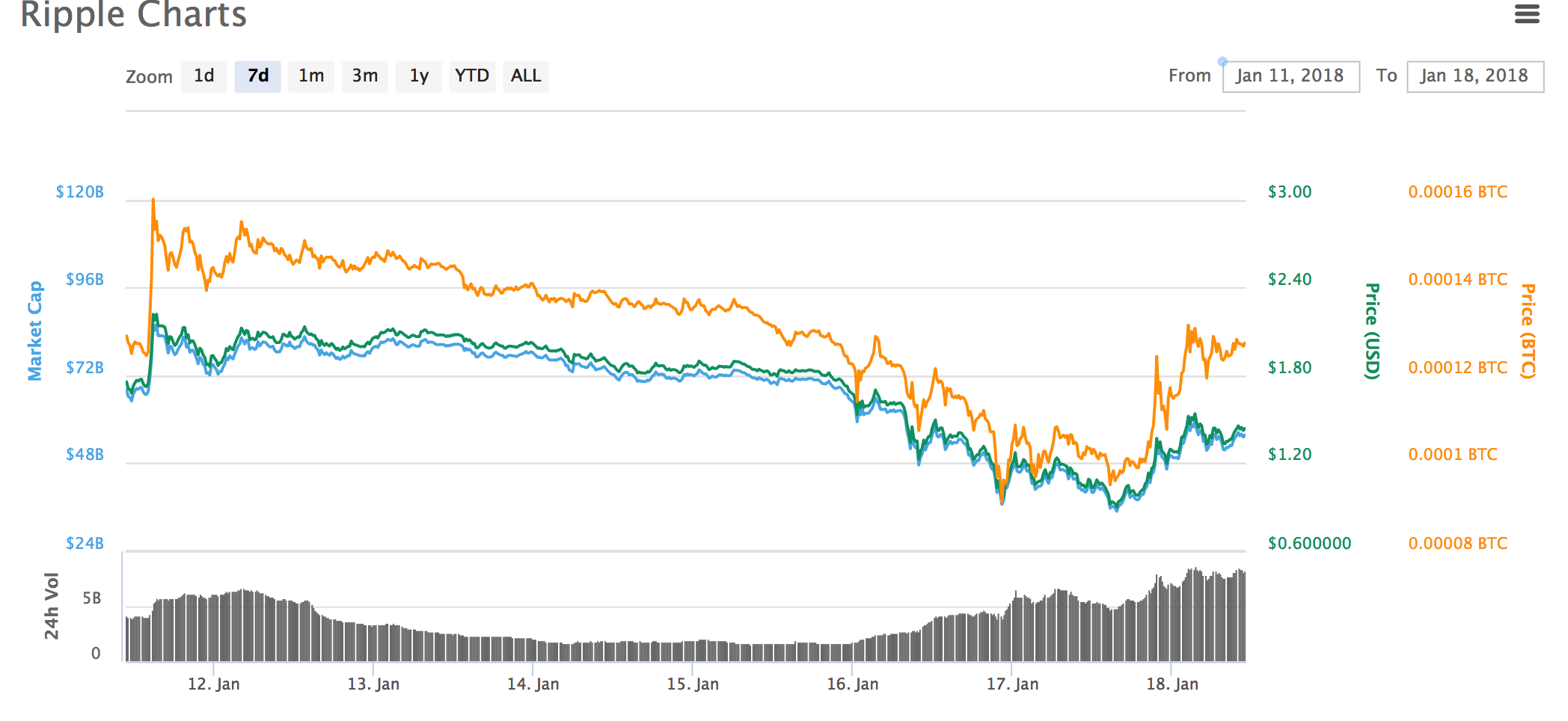

In just 36 hours the cryptocurrency market has managed to make a fair few people feel very nervous as they watched crypto currency prices fall very sharply. The two most popular cryptocurrencies (as measured by market cap) saw the biggest losses over Tuesday and Wednesday, this week. Digital gold bitcoin dropped below it’s key psychological level of $10,000, whilst ether also made a drop below the all-important level of $1,000. The crypto market has been on a tear for the last few months. We are frequently asked by people about bitcoin and whether or not they ‘should’ be getting into it. Gold is the best way to secure value from crypto volatility Unsurprisingly many cryptocurrency buyers or investors have been looking at how they can secure their gains. Since early December and continuing in recent days, we are seeing numerous existing and new clients who had seen massive gains in bitcoin, ripple etc diversifying into physical gold. They have been buying both gold coins and bars, for both delivery and storage. One high net worth British entrepreneur involved in tourism sold a substantial amount of bitcoin and bought kilo bars (gold) for storage in Zurich. Another tech entrepreneur told us he was selling Ripple after having very large profits and a “nine bagger” meaning his initial punt on Ripple had surged nine times. He bought a substantial amount , over 100, of gold maple leaf coins for insured delivery. Ripple lost 50% of value in one day It’s not just digital gold bitcoin gains that have people diversifying into gold. In the last two weeks, we have had a few clients who had seen huge short term gains in Ripple diversify back into gold. They told us they were concerned that the massive price appreciation was unsustainable and they got nervous about it and decided it was a good time to sell and take some profits. This was a fortuitous move given XRP (the Ripple currency) lost 50% of its value on Tuesday alone. |

Ripple Charts, Jan 2018 |

| This price action (along with the other major cryptocurrencies) has got many asking as to where the value in a cryptocurrency really is. Some in the newly rich crypto community are recognising that it is about realising real value when you cash out and place it into real assets such as gold and silver.

Those we have spoken to and have assisted in recent weeks are selling a very overvalued asset and putting it into a still undervalued asset. Gold prices remain quite depressed, especially from where they were compared to six or seven years ago, and sentiment is still quite poor. There is a definitely a trend there and we think that trend is likely to continue given the overvaluation of crypto currencies and the undervaluation of precious metals. This trend is already playing through the price of gold which has been on a winning streak just as cryptos begin to fall out of favour (see chart above). It is also being seen in a sharp increase for gold coins and bars as reported by Bloomberg overnight. |

|

| There are people in the cryptocurrency industry that have been trying to position cryptocurrencies as alternatives to gold and indeed as “digital gold.” We think increasingly people are realizing that these digital assets have much higher risk levels than the traditional safe haven asset – gold.

Risk of manipulation As we explained earlier this week, there are some dodgy dealings and market manipulation going on in the world of precious metals namely silver but also gold. Whilst it is a disconcerting prospect, the beauty of it is that precious metal investors can take advantage of it and secure physical silver and gold at relatively low prices, in preparation for the coming bull markets. However, when it comes to the manipulation of digital or ‘paper’ assets then it doesn’t work out so well for the average investor. One of the reasons so many of the early adopters took to bitcoin wasn’t just because it was a cheap punt but also because it was supposedly more secure and offered a more honest form of exchange than those currently seen in the wider financial world. Yet it has been victim to a number of security breaches and even price manipulation scandals. A new paper by researchers at Tel Aviv University and the University of Tulsa finds that bitcoin has been victim to price manipulation. In a paper entitled ‘Price Manipulation in the Bitcoin Ecosystem’ , they find that ‘Suspicious trades on a Bitcoin currency exchange are linked to rises in the exchange rate.’ Making particular reference to the infamous Mt Gox debacle they analyse:

So bitcoin might be vulnerable to manipulation and not be as unbreakable after all. From digital gold to real physical gold As we have explained repeatedly, bitcoin (or any other crypto) is not a substitute for gold or silver. But, they can have a complementary relationship as we are seeing today. Bitcoin and crypto currencies are digital assets. Most are no more secure in terms of value or pricing than any other form of digital gold, stock or ETF. However, many of those who choose to hold cryptocurrencies do so for the same reason many choose precious metals – because they wish to diversify outside of the global monetary and financial system. Physical gold and silver bullion that is allocated and segregated in your name is the best way to guarantee the securing of the profits achieved from and wealth created by cryptocurrencies. Most crypto currencies have little real value whatsoever other than to make hard and fast profits from – or indeed hard and very large losses. The lesson here is to take profits on overvalued assets – be they cryptos, stocks, bonds or property. Sell over valued assets and buy undervalued assets. Rebalance investments and diversify into undervalued assets such as gold bullion – the proven safe haven. |

Gold Spot, Oct 2017 - Jan 2018(see more posts on Gold, ) |

Tags: Bitcoin,Daily Market Update,Featured,Gold prices,newslettersent