Consumer confidence has been sky-high for some time now, with the major indices tracking various definitions of it at or just near highs not seen since the dot-com era. Economists place a lot of emphasis on confidence in all its forms, including that of consumers, and there is good reason for them to do so; or there was in the past. Spending and consumer sentiment used to track each other very closely and in terms of...

Read More »The (Economic) Difference Between Stocks and Bonds

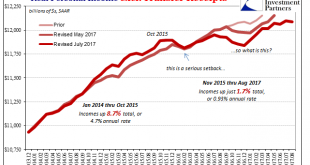

Real Personal Consumption Expenditures (PCE) rose 0.6% in September 2017 above August. That was the largest monthly increase (SAAR) in almost three years. Given that Real PCE declined month-over-month in August, it is reasonable to assume hurricane effects for both. Across the two months, Real PCE rose by a far more modest 0.5% total, or an annual rate of just 3.4%, only slightly greater the prevailing average. It is...

Read More »The Damage Started Months Before Harvey And Irma

Ahead of tomorrow’s payroll report the narrative is being set that it will be weak because of Harvey and Irma. Historically, major storms have had a negative effect on the labor market. Just as auto sales were up sharply in September very likely because of the hurricane(s) and could remain that way for several months, payrolls could be weak for the same reasons and the same timeframe. That said, we can’t pretend as if...

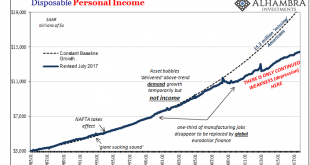

Read More »Incomes Are What Matters, So Bad Month, Bad Year, Bad Decade

Sometimes economics can be complicated, such as why the labor market has slowed in such lingering fashion since early 2015. Sometimes economics can be easy, such as why there is so much less to the economy this year than thought. The easy part relates to the hard part. The labor market slowed and so did national income. Though so much of official focus is on debt supplementation, it’s always, always about income. US...

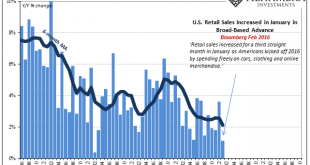

Read More »Retail Sales and the End of ‘Reflation’

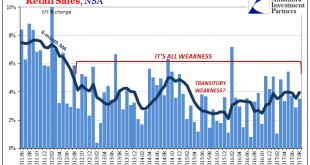

There will be an irresistible urge to the make this about the weather, but more and more data shows it’s not any singular instance. Nor is it transitory. What does prove to be temporary time and again is the upside. The economy gets hit (by “dollar” events), bounces back a little, and then goes right back into the dumps. This, it seems, is the limited extent of cyclicality in these times. Retail sales were again very...

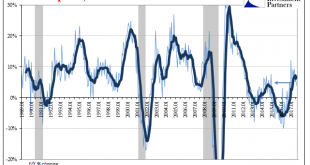

Read More »Net National Savings Rate, the Best Alternative Indicator to GDP Growth

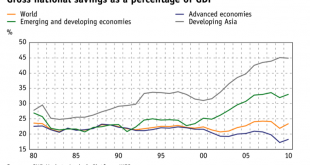

For us the Net National Savings Rate is the best alternative indicator to GDP growth. The Net National Savings Rate (NNSR) is rather positively correlated with the change in wealth, with the establishment of future productive capacity, the price of government bonds and currency valuations. The relationship of GDP growth to those four criteria, however, is often a negative correlation. We critized GDP growth that has...

Read More »FX Daily, August 02: Greenback Slides Despite RBA Rate Cut and 7-year Low in UK Construction PMI

Swiss Franc The euro appreciated against both Swiss Franc and dollar. Swiss retail sales was again very weak, but emphasize our last month comment: The measurement of retail sales (and also GDP) ignore the active second-hand markets in Switzerland. The Swiss SVME PMI was at 50.1 close to contraction, another piece of bad data. Click to enlarge. FX Rates The US dollar is offered against the major currencies, but...

Read More » Swiss Economicblogs.org

Swiss Economicblogs.org