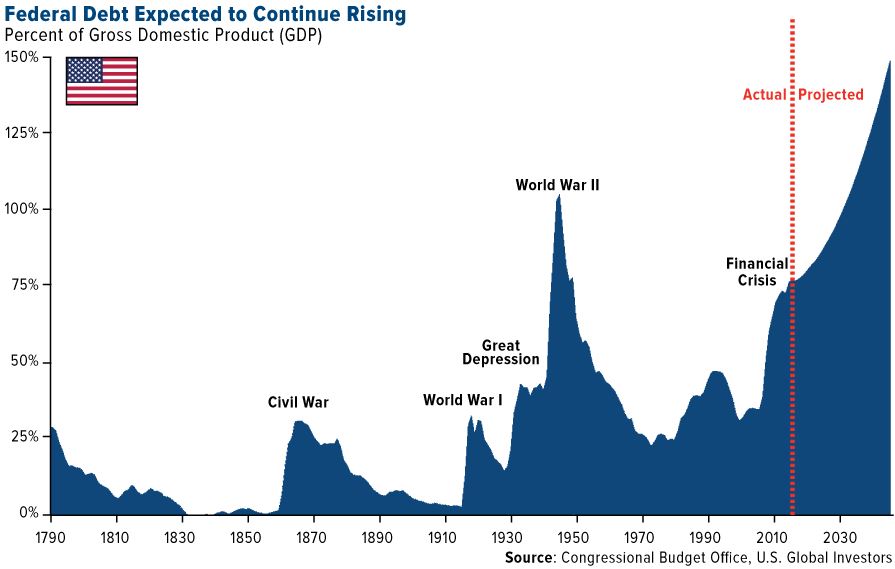

– “We have a stock market bubble” warns Greenspan– “Bond bubble will be the big issue” he tells Bloomberg TV (see video)– “Fiscally unstable long-term outlook in which inflation will take hold” – “Ratio of federal debt to GDP which is extraordinarily high” (see chart)– Higher interest rates, inflation and stagflation coming – Gold is the “ultimate insurance policy” – Greenspan Federal Debt Expected Rising, 1790 - 2030Source: US Funds - Click to enlarge via Bloomberg: The man who made the term “irrational exuberance” famous says investors are at it again. “There are two bubbles: We have a stock market bubble, and we have a bond market bubble,” Alan Greenspan, 91, said Wednesday on Bloomberg Television with Tom

Topics:

Mark O'Byrne considers the following as important: Daily Market Update, Featured, GoldCore, newsletter

This could be interesting, too:

RIA Team writes The Importance of Emergency Funds in Retirement Planning

Nachrichten Ticker - www.finanzen.ch writes Gesetzesvorschlag in Arizona: Wird Bitcoin bald zur Staatsreserve?

Nachrichten Ticker - www.finanzen.ch writes So bewegen sich Bitcoin & Co. heute

Nachrichten Ticker - www.finanzen.ch writes Aktueller Marktbericht zu Bitcoin & Co.

| – “We have a stock market bubble” warns Greenspan – “Bond bubble will be the big issue” he tells Bloomberg TV (see video) – “Fiscally unstable long-term outlook in which inflation will take hold” – “Ratio of federal debt to GDP which is extraordinarily high” (see chart) – Higher interest rates, inflation and stagflation coming – Gold is the “ultimate insurance policy” – Greenspan |

Federal Debt Expected Rising, 1790 - 2030 |

| via Bloomberg:

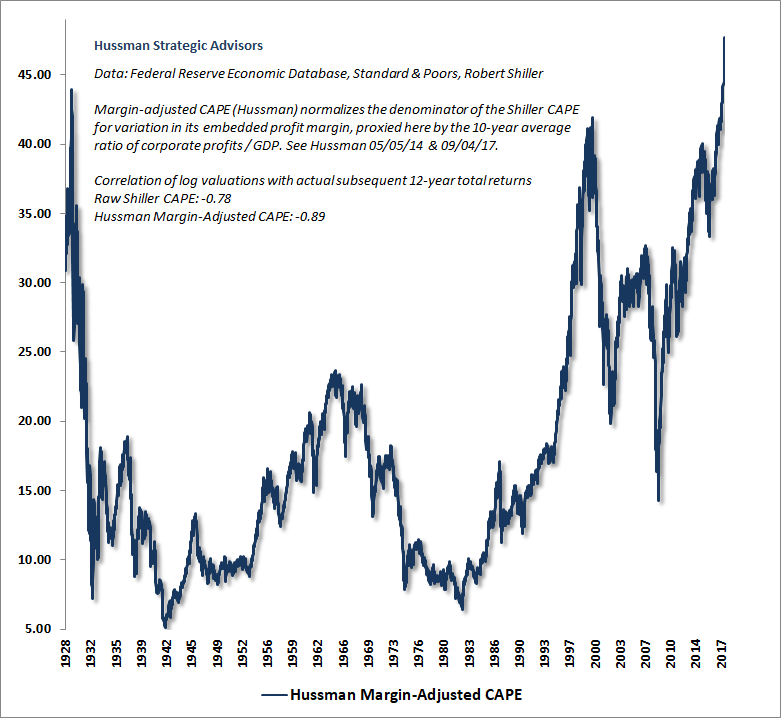

The man who made the term “irrational exuberance” famous says investors are at it again. “There are two bubbles: We have a stock market bubble, and we have a bond market bubble,” Alan Greenspan, 91, said Wednesday on Bloomberg Television with Tom Keene and Scarlet Fu. Greenspan, who led the Federal Reserve from 1987 until 2006, memorably used the phrase to describe asset values during the 1990’s dot-com bubble. Greenspan’s comments come as stock indexes remain near record highs, despite selling off in recent days, and as the yields on government notes and bonds hover not far from historic lows. Interest rates are expected to move up in coming years as the Fed continues with a campaign to gradually tighten monetary policy. “At the end of the day, the bond market bubble will eventually be the critical issue, but for the short term it’s not too bad,” Greenspan said. “But we’re working, obviously, toward a major increase in long-term interest rates, and that has a very important impact, as you know, on the whole structure of the economy.” The Fed on Wednesday opted to leave rates unchanged and markets are pricing in an increase at the central bank’s March meeting. Greenspan sounded an alarm on forecasts that the U.S. government deficit will continue to climb as a share of gross domestic product. He said he was “surprised” that President Donald Trump didn’t specify how he would fund new government initiatives in Tuesday’s State of the Union speech. The president last month signed into law about $1.5 trillion in tax cuts that critics say will further balloon the budget gap. |

|

|

U.S. Raises Longer-Term Debt Sales as Budget Deficit Worsens Greenspan blamed the growing fiscal shortfall for his bond call. “What’s behind the bubble? Well the fact, that, essentially, we’re beginning to run an ever-larger government deficit,” Greenspan said. As a share of GDP, “debt has been rising very significantly” and “we’re just not paying enough attention to that.” Editors Note Greenspan laughed when asked “what is behind the bubble” and explained that the deteriorating U.S. budget deficits are not sustainable and his comments in this regard are important to note: “Essentially, we are beginning to run ever larger government deficits. Remember, that we are talking about deficits going to a trillion dollars. But, debt has been rising very significantly and we are in fact – if you want to take the Congressional budget office figures at face value – we are going to run through the peaks of where we were during World War II on the ratio of federal debt to GDP which is extraordinarily high. I think that we are not paying enough attention to that.” As we noted in our recent podcasts, the total debt position of the U.S. is completely unsustainable and Trump’s irresponsible fiscal policies may speed up the slow bankruptcy of the U.S. Last February, Greenspan said that gold is the “ultimate insurance policy” and “the primary global currency.” He warned that “the eurozone isn’t working” and has “grave concerns about the euro.” “Investment in gold now is insurance…” |

Hussman Margin-Adjusted CAPE, 1928 - 2017 |

Tags: Daily Market Update,Featured,newsletter