The euro has hit new lows against the US dollar. We are revising down our EUR/USD projections for the next few months. The euro broke to the downside from its tight trading range relative to the US dollar since the end of May. These new lows go against our expectations of a gradual appreciation of the single currency relative to the greenback in the second half of the year and indicate that we have underestimated the short-term risks related to the euro. As a consequence, we have lowered our projections for the EUR/USD rate. While we continue to expect an appreciation of the euro against the dollar from current levels, the short-term downside pressures on the single currency are greater than previously thought. Euro

Topics:

Luc Luyet considers the following as important: 2) Swiss and European Macro, euro currency forecast, euro dollar exchange rate, euro dollar rate, Featured, Macroview, newsletter, Pictet Macro Analysis, US dollar strength

This could be interesting, too:

Nachrichten Ticker - www.finanzen.ch writes Die Performance der Kryptowährungen in KW 9: Das hat sich bei Bitcoin, Ether & Co. getan

Nachrichten Ticker - www.finanzen.ch writes Wer verbirgt sich hinter der Ethereum-Technologie?

Martin Hartmann writes Eine Analyse nach den Lehren von Milton Friedman

Marc Chandler writes March 2025 Monthly

The euro has hit new lows against the US dollar. We are revising down our EUR/USD projections for the next few months.

The euro broke to the downside from its tight trading range relative to the US dollar since the end of May. These new lows go against our expectations of a gradual appreciation of the single currency relative to the greenback in the second half of the year and indicate that we have underestimated the short-term risks related to the euro.

As a consequence, we have lowered our projections for the EUR/USD rate. While we continue to expect an appreciation of the euro against the dollar from current levels, the short-term downside pressures on the single currency are greater than previously thought.

| Euro weighed down by political uncertainties Brexit uncertainties and the upcoming Italian budget negotiations were two well identified, short-term negative factors for the euro. However, the increasing risk of a disorderly Brexit has weighed more on the euro than initially anticipated. Mean while, the spread between German and Italian rates has widened significantly over concerns of negative spill-over effects from Turkey’s currency crisis on the European banking sector.

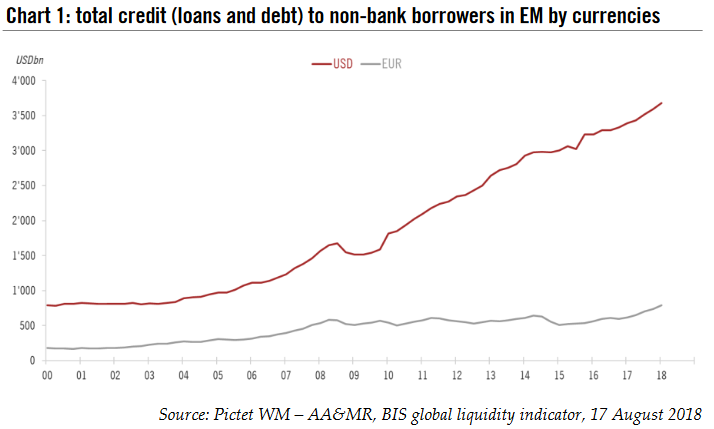

The sell-off of the Turkish lira has weighed on the euro relative to the US dollar through two different channels. First, capital outflows from EM assets tend to be supportive of the US dollar, given that the greenback is the main source of funding for EM asset purchases. In that regard, signs of contagion visible at the beginning of August have favoured the US dollar (chart 1). Second, due to European banks’ exposure to Turkish assets, the acute weakness of the Turkish lira has weighed on the euro. |

Total credit (loans and debt) to non-bank borrowers in EM by currencies |

It should be noted that seeds of the lira crisis were mostly idiosyncratic – high inflation due to an overheating economy and increasing investor concerns over the independence of the Central Bank of the Republic of Turkey (CBRT). Although contagion to other EM currencies remains a clear and present danger, the weakness of Turkey’s macro fundamentals relative to any other EM currency should be considered. Whether the euro’s recent decline overstates the threat to the euro area growth outlook also remains to be seen (see European banks’ exposure to Turkey looks contained).

That being said, the Turkish government’s aversion to high interest rates could hamper any sustained stabilisation of the lira. Furthermore, political noise from Italy is likely to increase ahead of 15 October, when Italy is due to send its draft budget plan for 2019 to the European commission. Finally, Brexit negotiations may further weigh on the euro this autumn, as further UK concessions to reach an agreement with the European Union could fuel higher political uncertainty. Overall, these short-term drivers will make any durable appreciation of the euro quite challenging over the next two months.

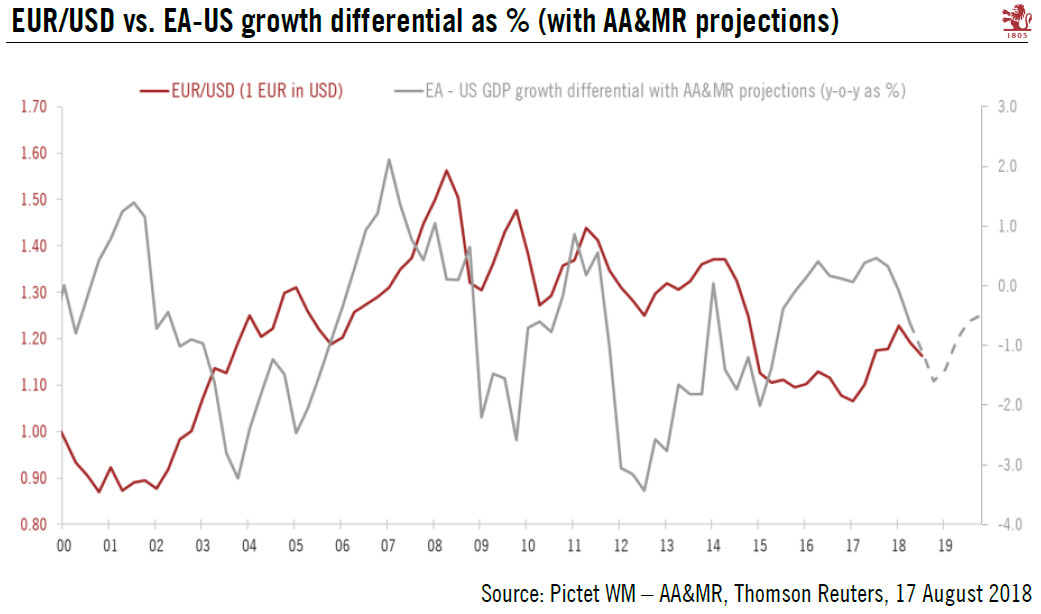

Medium-term drivers still in favour of euroMedium-term drivers, such as the growth differential and monetary policy divergence should turn in favour of the euro relative to the dollar later this year. While the growth differential has been in favour of the US dollar so far this year due to strong US growth vis-à-vis a soft patch in the euro area, we expect the gap to narrow as the US economy starts to moderate while the euro area stabilises around its current growth level (chart 2). Monetary policy should favour a stronger euro relative to the dollar as the Fed is expected to pause its tightening cycle in the middle of next year, while the European Central Bank (ECB) is likely to start raising rates in September, according to our scenario. Furthermore, markets have already nearly discounted four additional rate hikes (which, in our scenario, is the number of hikes the Fed will do before stopping its tightening cycle), whereas they have under-priced our scenario of two deposit rate hikes by the ECB in 2019. As such, we remain of the view that US dollar strength relative to the euro is limited. |

EUR/USD vs. EA - US growth differential as % (with AA&MR projections)(see more posts on EUR/USD, ) |

Downward revisions to our EUR/USD projections.

To conclude, the current lack of any explicit rate hike by the CBRT, despite an environment of high inflation (headline CPI inflation at 15.9% in July versus a target level of 5%) and growing doubts over the central bank’s independence should continue to weigh on the lira. Furthermore, the next few months will be busy with political uncertainties (Brexit and Italy) that will likely keep a lid on any appreciation of the euro. Although we remain of the view that mutually suitable agreements could be reached in both cases, we acknowledge some downside risks over the next two months.

Consequently, we have revised our projections for the EUR/USD rate as follows: the 3-month view is lowered to USD1.15 per EUR (versus USD1.18 previously), the 6-month view is lowered to USD 1.18 per EUR (versus USD1.20 previously) and the 12-month view is lowered to USD1.24 per EUR (versus USD1.26).

Tags: euro currency forecast,euro dollar exchange rate,euro dollar rate,Featured,Macroview,newsletter,US dollar strength