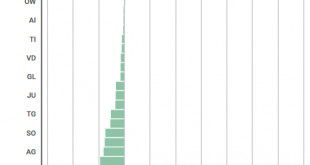

The percentage of economic output demanded by the tax authorities, sometimes referred to as the misery index, is set to fall in 18 of Switzerland’s 26 cantons in 2023, according to data published by the government this week. Basel – this years winner – © | Dreamstime.comIn 2023, the misery index will fall most in the cantons of Basel-City (-1.9 percentage points), Schaffhausen (-1.25), Obwalden (-0.75), Jura (-0.6), Solothurn (-0.55), Vaud (-0.55), Geneva (-0.45), Luzern (-0.35), Zurich...

Read More »Swiss cantons to get most of extra company tax money

On 12 January 2022, Switzerland’s Federal Council decided to implement the minimum tax rate for companies that was agreed by the OECD and G20 member states in 2021. The 15% minimum tax, which will be applied to large companies from 1 January 2024, will generate extra tax revenue. This week, after a degree of wrangling, the government agreed to split the extra tax collected 75%/25% in favour of the cantons. © Ginasanders | Dreamstime.comThe new rate of 15% will be applied to all companies...

Read More »Tax burden set to rise in 10 Swiss cantons in 2022

The tax burden is set to rise in 10 Swiss cantons and fall in 16 in 2022, according to data published this week by the Federal Finance Administration (FFA). Nationally, the tax burden in 2022 will represent 24.6% of Switzerland’s tax potential, down from 24.8% in 2021. © Francisco Javier Zea Lara | Dreamstime.comWhile the national tax burden percentage offers some indication of the average rate of income tax, it can differ significantly because of the complexity and incomparability of the...

Read More »The Swiss tax money transfers in 2021

Swiss cantons have very different tax bases, tax rates and costs. To even things up rich cantons are required to help those with less money via a system set up in 2008 known as the péréquation financière nationale (French) or Nationaler Finanzausgleich (German). Zug pays the most – © Avkost | Dreamstime.comThis week, the government decided on next year’s payments. The system relies on complicated formulae based on the tax and cost bases of each canton. In 2021, the top three payers...

Read More »The price of solidarity – Switzerland’s inter-cantonal payments for 2019

In Switzerland, much in life revolves around the canton. Cantons have their own health, social and education systems, parliaments and tax rates. Federal government, based in Bern, is a layer that sits over the top, bringing the cantons together as Switzerland. For some cantons, nationhood has a cost. For others it means extra money. Every year, based on a collection of complicated formulae, the federal government...

Read More »The price of solidarity – Switzerland’s inter-cantonal payments for 2019

In Switzerland, much in life revolves around the canton. Cantons have their own health, social and education systems, parliaments and tax rates. © Swisshippo | Dreamstime.com Federal government, based in Bern, is a layer that sits over the top, bringing the cantons together as Switzerland. For some cantons, nationhood has a cost. For others it means extra money. Every year, based on a collection of complicated formulae, the federal government calculates how much certain cantons must pay other...

Read More »Vaud Plans Tax Cuts

Last week, Vaud’s government announced a plan for future tax cuts. ©-Erix2005-_-Dreamstime.com_ - Click to enlarge The residents of Vaud are among the highest taxed in Switzerland. In 2016, a single person in Lausanne earning CHF 100,000 paid CHF 16,050 in cantonal and communal tax on top of CHF 1,840 of federal tax. This was the fourth highest across all of Switzerland’s 26 cantonal capitals, and almost triple Zug,...

Read More »Vaud plans tax cuts

Last week, Vaud’s government announced a plan for future tax cuts. © Erix2005 | Dreamstime.com The residents of Vaud are among the highest taxed in Switzerland. In 2016, a single person in Lausanne earning CHF 100,000 paid CHF 16,050 in cantonal and communal tax on top of CHF 1,840 of federal tax. This was the fourth highest across all of Switzerland’s 26 cantonal capitals, and almost triple Zug, the lowest, where the figure was CHF 5,750 – see chart below. Against this background, the news...

Read More »Swiss cantons consider imposing income tax at source

20 Minutes. To reduce the outstanding amount owed by taxpayers, Basel’s parliament is discussing imposing income tax at source. Vaud is considering a similar plan. © Kurhan | Dreamstime.com Every year, the canton Basel-City has to chase around 15,000 outstanding tax bills amounting to a total of CHF 80 million. According to the newspaper NZZ, getting employers to deduct tax from salaries before they are paid is one solution currently on the table. The plan would involve employers deducting...

Read More »Switzerland’s costliest cantons for tax, housing, health, commuting, and childcare

This week the bank Credit Suisse published its cantonal cost of living report. Its ranking considers a typical household’s biggest expenses: tax, housing, commuting, basic health insurance and childcare. It takes income and deducts all of these costs to arrive at a measure of disposable income. In a simplified world it might be expected that low tax rates would push up the cost of most other things as the wealthy...

Read More » Swiss Economicblogs.org

Swiss Economicblogs.org