Gold Is Money While Currencies Today Are “IOU Nothings” Now that the international monetary system we have long known has broken down, and the world is groping through monetary reform for a new one, it is time to consider some fundamentals. - Click to enlarge What is money anyway? First, it is a means of payment or medium of exchange. I prefer that first phrase. It is simpler. We all use money to pay our bills, to buy goods and services. We also accept money when we sell. Second, it is a standard of value. We quote values of goods and services in terms of it. The resulting ratios are prices. Third, it is a store of value. We hope to avoid loss by holding it. Money holds its value if it is scarce and remains

Topics:

John Exter considers the following as important: Daily Market Update, Featured, GoldCore, newsletter

This could be interesting, too:

Nachrichten Ticker - www.finanzen.ch writes Die Performance der Kryptowährungen in KW 9: Das hat sich bei Bitcoin, Ether & Co. getan

Nachrichten Ticker - www.finanzen.ch writes Wer verbirgt sich hinter der Ethereum-Technologie?

Martin Hartmann writes Eine Analyse nach den Lehren von Milton Friedman

Marc Chandler writes March 2025 Monthly

Gold Is Money While Currencies Today Are “IOU Nothings”Now that the international monetary system we have long known has broken down, and the world is groping through monetary reform for a new one, it is time to consider some fundamentals. |

|

| What is money anyway?

First, it is a means of payment or medium of Second, it is a standard of value. We quote values of goods Third, it is a store of value. We hope to avoid |

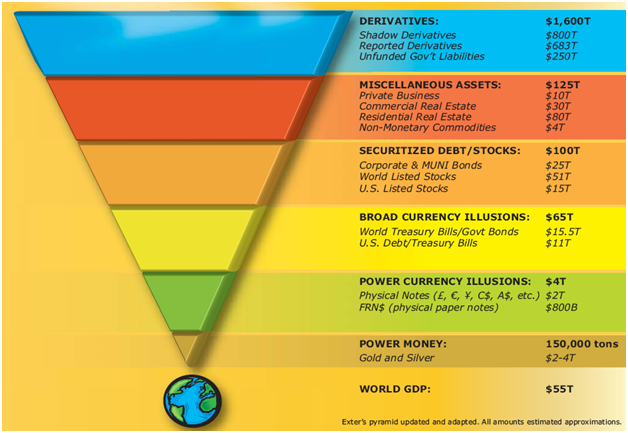

Exter Pyramid |

“Today no money in the world fully performs all

three services. National currencies are being used as

means-of-payment and standard-of-value money, but

none in this inflationary age is an assured store-of-value

money.

In fact, a foremost concern to voters and politicians

everywhere is that so many currencies are so rapidly losing

their value in terms of commodities and services.

Commodities like gold and silver, which are being used

as store-of-value money, are not being used as either

means-of-payment or standard-of-value money.

“Thus the world we have so long known, in

which most currencies were redeemable at a fixed

price in a store-of-value money like gold, is in

disarray. People are confused and wondering what

money they can trust.

Sensing the instability of the

system as a whole, they turn day by day from one

means-of-payment money to another in the foreign

exchange markets, and much more gradually to

store-of-value money like gold in the London and

Zurich gold markets.

Scarce Commodity

“If we carefully look into the meaning of this market

churning, it becomes clear that store-of-value money, if it is

to endure, must be a commodity, and a scarce commodity,

too. Silver has long been a less satisfactory store-of-value

money than gold, principally because it has been, and

promises to continue to be, more abundant. Many of

the currencies used as means-of-payment and standardof-value

money have not proved good store-of-value

money chiefly because they, too, have grown too

abundant. Since they are simply either paper (currency

notes) or bookkeeping (deposits) promises to pay, i.e.,

debt obligations or IOUs, the confidence of people in

them as store-of-value money depends heavily upon the

ability of the central banks responsible for their

issuance to honor those promises to pay in a

commodity that is indeed store-of-value money. This is

the issue of convertibility, which the Europeans,

especially the French, are emphasizing today.

“Until March 1968, when the two-tier gold

system was established, the central banks issuing all

major currencies were promising all holders: ‘IOU gold at

$35 an ounce.” Under the two-tier system, however, the

IOU-gold promise was abrogated for private people, and,

except for the South African Reserve Bank, central banks

refused to sell any gold at any price to private

people. The IOU-gold-at-$35-an-ounce promise was

honored only among central banks and governments,

and even among them it became gradually more

tenuous. On August 15, 1971, the IOU-gold promise was

abrogated even among central banks.

Same Relative Rates

So today all currencies in the world are saying,

‘I do not owe anybody anything.’ Each one says, in

effect, ‘IOU nothing’ in the way of any commodity

that is a store-of-value money. In that situation an

attempt was made at the Smithsonian to re-establish

fixed exchange rates, which meant making one central

bank’s IOU nothing equal to a certain number of

another central bank’s IOU-nothings, with a 2¼%

spread on either side of parity. It is obvious that such

an arrangement could last only if the exchange rates

agreed on at the time were equilibrium rates, and if

in future all central banks agreed to control the issue

of their new IOU-nothings at the same relative rates.

The second condition was certainly not met and no

one can be sure the first one was.

“Although it was agreed to raise the price of store-ofvalue

money, gold, to $38 an ounce, no arrangement was

made for a central bank that went into deficit because it

issued too many IOU-nothings to pay a surplus central bank

in gold at that fixed price. Meanwhile, the gold owned by

central banks remains for the most part buried inactive in

their vaults. Gresham’s Law has worked. Bad money has

driven good out of circulation, even among central banks.

All currencies are inconvertible into gold. We are in a world

of irredeemable paper money.

“Further conclusions follow from this analysis. Good

store-of-value money is clearly the strongest kind of

money. IOU-nothing money, which people may continue

to hold as a store of value for a long time, but only with

the enticement of ever higher rates of interest, may

continue, also for a long time, to serve as a means of

payment and standard of value. But as it becomes more

abundant, it will serve these functions less and less

satisfactorily—if too abundant, not at all. It would then

also cease being held as a store of value, ‘not worth a

Continental.’ History is full of examples of IOU-nothing

currencies that have disappeared. Some currencies will, of

course, become over-abundant faster than others. Over

time it is scarce store-of-value money like gold that

endures.

“If enduring store-of-value money must be a

commodity, it follows that governments and central banks

cannot create it, unless they were to go, let us say, into

the gold mining business. It follows also that if they

persist in creating IOU-nothing money, they will slowly

but surely run themselves out of the money-making

business altogether and have to start over again.

“So it is also apparent, and at the same time reassuring,

that it is private people in the marketplace, not governments,

who decide what money is, and what different kinds

of money they are going to use and hold, especially the

enduring store-of-value money, the most important of all.

Gresham’s Law

Governments will always try to shore up IOU-nothing

money with laws making it legal tender, or even laws prohibiting

the holding of store-of-value money like gold, but

such laws cannot for very long add value to something that

is losing value in the marketplace. Gresham’s Law, which is

really a special form of the law of supply and demand, will

override man-made laws. In fact, there would be no

Gresham’s Law if governments did not persistently try by

man-made laws to over-value their IOU-nothing money in

terms of store-of-value money. Thus laws prohibiting

people from holding store-of-value money like gold cannot

succeed, for gold as a commodity can be held in countless

forms and readily converted from one form to another.

People will hold jewelry, or old coins, or what have you.

And people whose governments permit them to hold gold

will do so in any form.

‘ It should also be apparent that monetary

theorists cannot arbitrarily decide what money is.

Theories that are based on an arbitrary definition of

the stock of money, particularly IOU·nothing money, will

slowly lose their relevance. Such theories try to over-value

IOU-nothing money just as governments do, and in the

marketplace Gresham’s Law will override man-made

theories just as it overrides man-made laws.

“So it also follows that governments cannot reduce

the importance of a store-of-value money like gold in the

monetary system, much less demonetize it. A monetary

authority monetizes anything by buying it and taking it

into its balance sheet as an asset and paying for it by

creating or issuing monetary liabilities (now IOU-nothings)

which are accepted by the seller. It demonetizes anything

by selling it from its assets and extinguishing an

equivalent amount of its liabilities tendered to it by the

buyer.

Obviously Inflationary

“To demonetize gold, the central banks of the world

would have to sell all of their holdings in the open market.

If they were to try, the exercise would be very deflationary,

for they would be extinguishing their monetary liabilities

with every sale. To avoid the risk of deflation in today’s

monetary world, they would simultaneously have to monetize

IOU-nothings like government securities by creating

new IOU-nothings of their own more rapidly then they

extinguished the old by demonetizing gold.

“Such an exercise would obviously be inflationary and

central bank IOU-nothings would steadily lose value in the

marketplace. Under Gresham’s Law the bad IOU-nothing

money would drive the good gold store-of-value money out

of circulation. But if the central banks persisted, and there

would be precious few restraints to stop them, their IOUnothings

would slowly lose value and, under runaway conditions,

all value in the marketplace. Thus over time the

marketplace would frustrate central banks if they tried all

together to demonetize gold. It would demonetize their

IOU-nothing money instead. So they are not likely to try.

“It is not even likely that one central bank would try.

Others would welcome the opportunity to monetize the

gold that it sold, and at the same time to demonetize some

of their IOU-nothings.

‘In recent years there has been an attempt to substitute

so-called paper gold, or special drawing rights (SDRs),

in the International Monetary Fund for real gold. One high

IMF official is even reported to have called gold ‘metallic

SDRs.’ If used seriously, such an appellation flies in the

face of marketplace assessment of store-of-value money.

The SDR has no obligor, no promise to pay any store of value

money at a fixed price, and no fixed maturity date

(other than a complicated reconstitution provision).

It cannot be sold at will, only by central banks in deficit and only

to central banks strong enough to be designated by the IMF

to receive them.

“So it is a ‘Who owes you nothing?’, and ‘When?’, and

it does not even pay a market rate of interest, only l½%. If

central banks ever monetize them in significant amounts,

they will have moved from days when they issued their

IOUs principally to buy enduring store-of-value money like

gold, to these days when they issue their IOU-nothings

principally to buy government IOU-nothings, to days

when they would issue their IOU-nothings to buy

who-owes-you-nothings.

“In days to come, international monetary

reformers will have to consider whether these new

kinds of money will produce a stable monetary

world. In the world’s marketplaces will they hold

their value against goods and services in general?

More particularly, will those issued by different

central banks hold their value against one another?

Most particularly, will any of them hold their value

against store-of-value money like gold?’

Tags: Daily Market Update,Featured,newsletter