Trump’s aggressive trade war overtures and China’s initial retaliatory moves have spooked Wall Street over the past week and again on Monday, which helped drive down the Dow Jones by 459 points, with the Nasdaq Composite quickly approaching correction territory. And as the mass exodus continues out of Wall Street’s highest-flying stocks, trade war concerns are sparking political, regulatory and market challenges that could soon derail the global growth narrative for months or even years to come. According to Reuters, China is preparing aggressive counter-measures of the “same proportion, scale and intensity” if the Trump administration imposes further tariffs on Chinese goods, China’s Ambassador to the United States

Topics:

Tyler Durden considers the following as important: 5) Global Macro, Featured, newsletter

This could be interesting, too:

Nachrichten Ticker - www.finanzen.ch writes Die Performance der Kryptowährungen in KW 9: Das hat sich bei Bitcoin, Ether & Co. getan

Nachrichten Ticker - www.finanzen.ch writes Wer verbirgt sich hinter der Ethereum-Technologie?

Martin Hartmann writes Eine Analyse nach den Lehren von Milton Friedman

Marc Chandler writes March 2025 Monthly

Trump’s aggressive trade war overtures and China’s initial retaliatory moves have spooked Wall Street over the past week and again on Monday, which helped drive down the Dow Jones by 459 points, with the Nasdaq Composite quickly approaching correction territory. And as the mass exodus continues out of Wall Street’s highest-flying stocks, trade war concerns are sparking political, regulatory and market challenges that could soon derail the global growth narrative for months or even years to come.

According to Reuters, China is preparing aggressive counter-measures of the “same proportion, scale and intensity” if the Trump administration imposes further tariffs on Chinese goods, China’s Ambassador to the United States Cui Tiankai warned. And, as we discussed here previously, the worst-case scenario of a looming trade war could soon be realized, forcing the U.S. into a recession.

Tiankai made the provocative comments in an interview with China’s CGTN news channel on Tuesday, ahead of President Trump’s announcement of additional duties on “$50 billion to $60 billion in Chinese imports” following an examination under Section 301 of the 1974 U.S. Trade Act.

While China had previously signaled that it is prepared to escalate the trade war with Washington, Cui Tiankai was straight to the point in the interview: the latest tit-for-tat trade war measures between the West and the East are just the beginning. On Monday China officially launched new tariffs on 128 U.S. imports in direct response to the Trump administration’s recent decision to increase taxes on imported steel and aluminum. The Chinese Ministry of Finance announced tariffs on $3 billion in imports of U.S. food and other goods. But the big event will come later this week, when Washington is expected to reveal the next round of tariffs targeting Chinese imports, and with Cui’s warning, it is almost certainly a prelude to a much broader trade war that investors should strap in and hold on. Reuters said President Trump initiated the Section 301 investigation, which “focuses on accusations of theft of intellectual property and forced technology transfer by China.” Beijing continues to reject the accusations of mass intellectual property theft but over the years has made efforts strengthen its legal system.

|

|

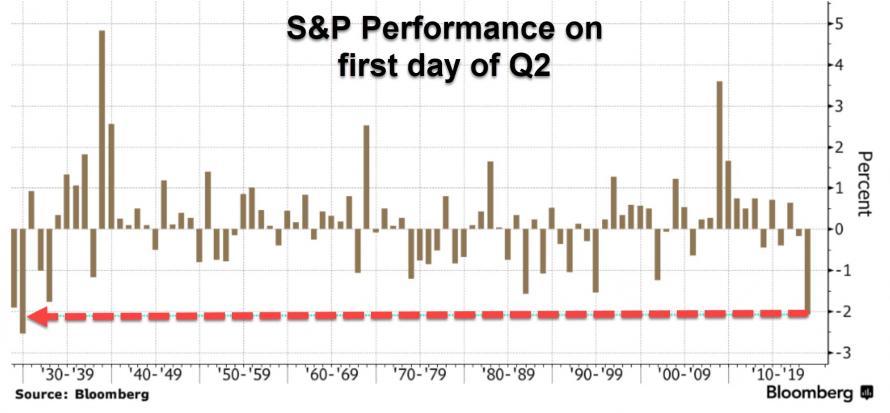

| Meanwhile, as the trade battle between both countries heats up, American stocks had their worst April start since the Great Depression.

Previewing what’s coming, Chris Kreuger, a strategist at Cowen Washington Research Group, said to keep a close eye on China’s retaliation if Trump continues the trade tariff assault.

Meanwhile, Horizon Investments’ Greg Valliere said Monday China is preparing for the next leg up in trade wars.

Incidentally, KPMG warned that a full blown “global trade war would be worse than 2009 global recession” while Jeremy Grantham warned that a Global Trade War would lead to a 40% market crash. Will Trump be willing to risk his previous stock market, and suffer another historic crash in equities just to make a point? We will find out shortly. |

S&P Performance, First day of Q2 |

Tags: Featured,newsletter