Swiss National Bank leaves expansionary monetary policy unchanged The Swiss National Bank (SNB) is maintaining its expansio nary mo netary policy, thereby stabilising price developments and supporting economic activity. Interest on sight deposits at the SNB remains at –0.75% and the target range for the three-month Libor is unchanged at between –1.25% and –0.25%. The SNB will remain active in the foreign exchange market as necessary, while taking the overall currency situation into consideration. Since the monetary policy assessment of September 2018, the Swiss franc has depreciatedslightly on a trade-weighted basis. This development is primarily due to the strengthening of the US dollar. The franc is virtually

Topics:

George Dorgan considers the following as important: 1) SNB and CHF, Featured, Monetary Policy, newsletter, SNB Press Releases

This could be interesting, too:

Nachrichten Ticker - www.finanzen.ch writes Die Performance der Kryptowährungen in KW 9: Das hat sich bei Bitcoin, Ether & Co. getan

Nachrichten Ticker - www.finanzen.ch writes Wer verbirgt sich hinter der Ethereum-Technologie?

Martin Hartmann writes Eine Analyse nach den Lehren von Milton Friedman

Marc Chandler writes March 2025 Monthly

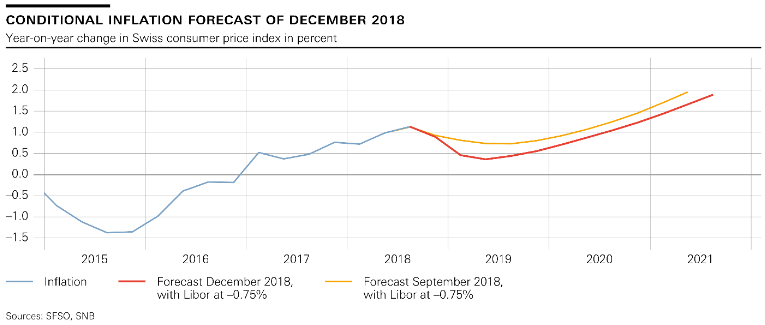

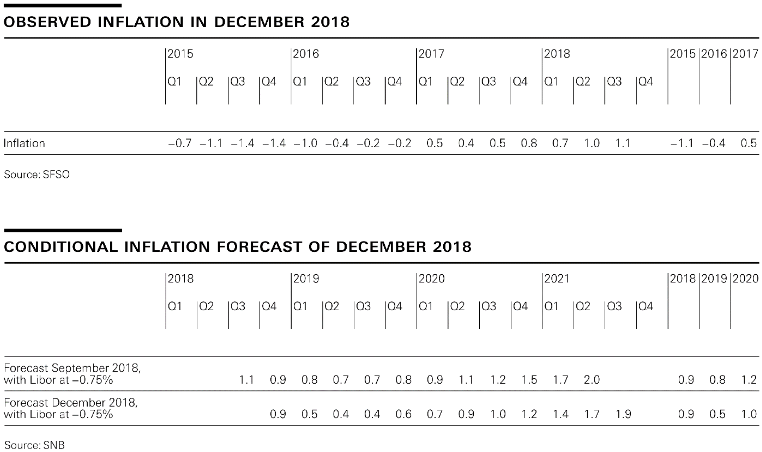

Swiss National Bank leaves expansionary monetary policy unchangedThe Swiss National Bank (SNB) is maintaining its expansio nary mo netary policy, thereby stabilising price developments and supporting economic activity. Interest on sight deposits at the SNB remains at –0.75% and the target range for the three-month Libor is unchanged at between –1.25% and –0.25%. The SNB will remain active in the foreign exchange market as necessary, while taking the overall currency situation into consideration. Since the monetary policy assessment of September 2018, the Swiss franc has depreciatedslightly on a trade-weighted basis. This development is primarily due to the strengthening of the US dollar. The franc is virtually unchanged against the euro. Overall, the Swiss franc is still highly valued, and the situation on the foreign exchange market continues to be fragile. The negative interest rate and the SNB’s willingness to intervene in the foreign exchange market as necessary remain essential. These measures keep the attractiveness of Swiss franc investments low and reduce upward pressure on the currency. The new conditional inflation forecast for the coming quarters is lower than it was in September. This is mainly due to the drop in oil prices. The medium-term inflation forecast is also slightly lower owing to more moderate growth prospects. For the current year, the SNB continues to anticipate inflation of 0.9%. The forecast for 2019 has been revised down from 0.8% to 0.5%. For 2020, the SNB expects inflation of 1.0%, compared with its previous forecast of 1.2%. The conditional inflation forecast is based on the assumption that the three-month Libor remains at –0.75% over the entire forecast horizon. Global growth lost mo mentum somewhat in the third quarter. However, this was largely attributable to special factors in the euro area and Japan. Economic expansion in the US and China remained robust. Employment figures in the advanced economies rose again and unemployment continued to decline. The growth in international trade in goods also continued. |

Conditional Inflation Forecast, December 2018 |

| In its baseline scenario for global economic develo pments, the SNB anticipates solid growth in the coming quarters. In the short term, the world economy is set to continue to expandsomewhat above potential, benefit ing from the clear improvement in the labour market situation and the ongoing expansionary monetary policy in the advanced economies. However, a gradual slowdown is likely in the medium term.

Nevertheless, there are significant risks to this positive baseline scenario, primarily in connection with political uncertainties and protectionist tendencies. These factors have had an increasingly negative effect on both business and financial market sentiment in recent months. Stronger turbulence could jeopardise glo bal economic growth and have an impact on monetary policy. In Switzerland, GDP fell by an annualised rate of 0.9%. Despite this decline, GDP was still 2.4% higher year-on-year thanks to the strong expansion in the previous quarters. A slowdown in GDP momentum was to be expected after several very strong quarters. Furthermore, the decline in GDP is also attributable to temporary factors. An analysis of all the available economic indicators points to momentum weakening slightly but remaining posit ive. The favourable development on the labour market also continued. Emplo yment increased strongly in the third quarter. The unemployment rate declined again through to November to stand at 2.4%. The SNB now anticipates slightly lower GDP growth of around 2.5% for 2018 as a whole. As in other countries, economic momentum in Switzerland is likely to weaken somewhat in 2019. The SNB expects a rise of around 1.5% in GDP for the coming year. Risks are to the downside, as is the case with the global economy. In particular, a sharp slowdown internationally would quickly spread to Switzerland. Imbalances on the mortgage and real estate markets persist. Both mortgage lending and prices for single-family homes and privately owned apartments continued to rise at a moderate rate over recent quarters. Although prices in the residential investment property segment have stabilised, there is the particular risk of a correction due to strong price increases in recent years and growing vacancy rates. The SNB will continue to monitor developments on the mortgage and real estate markets closely, and will regularly reassess the need for an adjustment of the countercyclical capital buffer. |

Observed Inflation, December 2018 |

Tags: Featured,Monetary Policy,newsletter