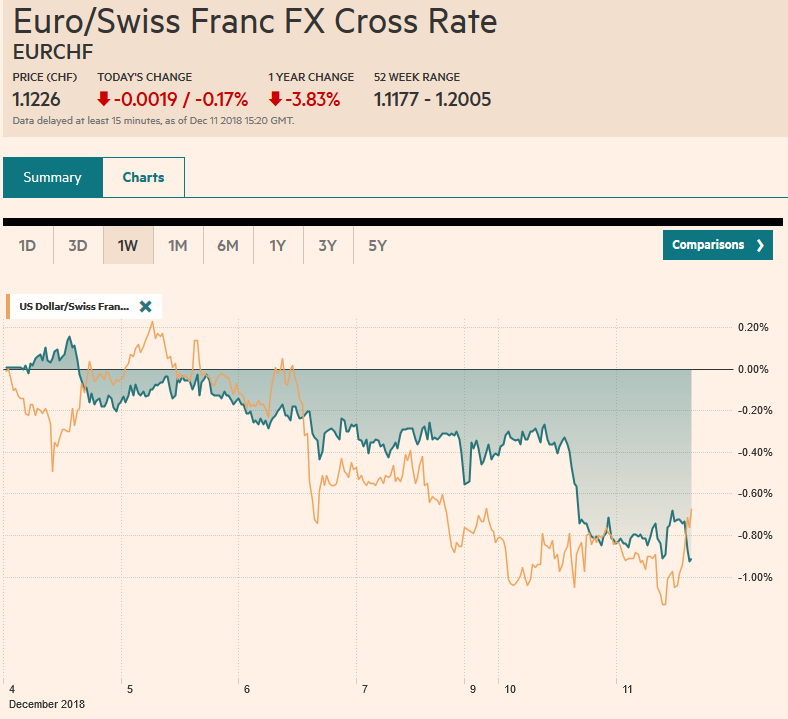

Swiss Franc The Euro has fallen by 0.17% at 1.1226 EUR/CHF and USD/CHF, December 11(see more posts on EUR/CHF and USD/CHF, ) Source: markets.ft.com - Click to enlarge FX Rates Overview: Indications that US and Chinese trade talks are proceeding, coupled with a dramatic reversal in the S&P 500 yesterday is helping stabilize the capital markets today. Asian equities were mixed, but the Greater China (China, Hong Kong, and Taiwan markets) alongside India and Australia posted modest gains. European bourses have followed suit with the Dow Jones Stoxx 600 advancing around 0.8% in late morning turnover on the Continent. Bond yields are mostly higher, with President Macron’s reversal weighing on French bonds.

Topics:

Marc Chandler considers the following as important: 4) FX Trends, CAD, EUR, Featured, GBP, JPY, newsletter, SPX, USD

This could be interesting, too:

Nachrichten Ticker - www.finanzen.ch writes Die Performance der Kryptowährungen in KW 9: Das hat sich bei Bitcoin, Ether & Co. getan

Nachrichten Ticker - www.finanzen.ch writes Wer verbirgt sich hinter der Ethereum-Technologie?

Martin Hartmann writes Eine Analyse nach den Lehren von Milton Friedman

Marc Chandler writes March 2025 Monthly

Swiss FrancThe Euro has fallen by 0.17% at 1.1226 |

EUR/CHF and USD/CHF, December 11(see more posts on EUR/CHF and USD/CHF, ) Source: markets.ft.com - Click to enlarge |

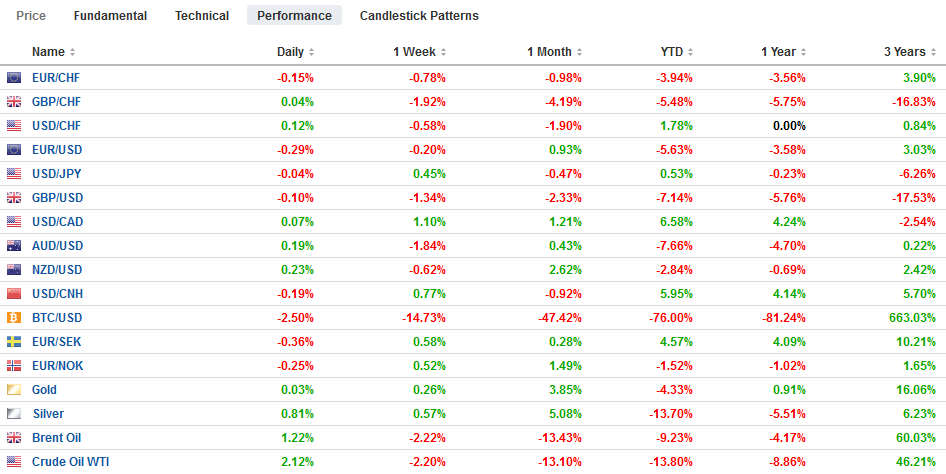

FX RatesOverview: Indications that US and Chinese trade talks are proceeding, coupled with a dramatic reversal in the S&P 500 yesterday is helping stabilize the capital markets today. Asian equities were mixed, but the Greater China (China, Hong Kong, and Taiwan markets) alongside India and Australia posted modest gains. European bourses have followed suit with the Dow Jones Stoxx 600 advancing around 0.8% in late morning turnover on the Continent. Bond yields are mostly higher, with President Macron’s reversal weighing on French bonds. Although the Indian rupee is rivaling the Turkish lira as the weakest of the emerging market currencies (losing about 0.8%) following the resignation of the governor of the central bank, Indian bonds and stocks are among the best performers today. More broadly, yesterday’s US dollar gains are being pared, and the greenback has largely been confined to yesterday’s range, though it has made marginal new highs against the Canadian dollar. |

FX Performance, December 11 |

Asia Pacific

The Governor of the Reserve Bank of India resigned yesterday ostensibly in protest for the erosion of his independence. The Modi government wants to take its reserves and soften its regulatory stance. The rupee rallied in November snapping a nine-month streak without a gain. The appreciation of the rupee in November (~5.4%) took place as 10-year yields fell by 40 bp, matching the October decline which had been cited as a drag on the currency. The countertrend move looked vulnerable at the end of last week, and Patel’s resignation seemed to provide the spark to the kindling. While asset prices recouped the initial losses today, the political and policy challenges are set to increase. The early state election results suggest Modi’s BJP losing two states to the Congress Party. National elections are due in May 2019.

Central bank independence needs to be thought through more. Independent from what? In whose name in the power exercised? Since the Great Financial Crisis when many believe that monetary and fiscal policy became blurred, the seemingly resolved issue of central bank independence came under closer scrutiny while the rise of non-liberal governments has seen apparent encroachments of central bank independence. The Turkish lira was punished earlier this year, in part due to the seeming politicization of monetary policy. Although US President Trump has been more explicitly critical of the Federal Reserve than any president in half a century, the institutional strength leaves many believing the independence of the Fed is untarnished. Nevertheless, the market expects the FOMC to be less aggressive now than before Trump’s criticism, which at one point warned that the Fed was a bigger threat than China.

The Nikkei is testing the October lows near 21000, while the Topix fell to new lows for the year, unable to find much consolation in the recovery of US stocks yesterday or the weaker yen. The dollar staged a big reversal against the yen yesterday recovering smartly from a test on JPY112.25 to approach JPY113.40. The greenback has been confined to about a third of a yen above JPY113.00. There are about $1.9 bln in option struck in the JPY112.80-JPY113.00 that expire today. The intraday technicals favor the dollar at the start of the North American session, though resistance in the JPY113.50-60 area may hamper stronger gains.

Europe

Who would have imagined that as the year winds down, London and Paris are among the most pressing sources of instability? Despite former Prime Minister Cameron offering no regrets from the 2016 referendum that was supposed to unite the party if not country, what has unfolded has been nothing short of a historic tragedy, from both sides of the issue. The non-binding referendum that was narrowly decided became the will of the people, which was difficult to precisely define, let alone operationalize.By the very nature of the issue, rather than any personal animosities, the EC’s position was deeply anchored in defending the four freedoms at the core of the European project and ensuring a better deal was always to be found within the club than without it. After months of negotiating, an over 500-page withdrawal agreement was struck between the heads of more than two dozen countries, and yet its defeat in the House of Commons was going to be so odious that the Prime Minister pulled it. Now the May intends on seeking the EC to re-open or modify the agreement. The UK Parliament’s recess begins on December 20 making a vote this year is all but impossible.

The UK’s employment report showed a steady unemployment rate of 4.1% (International Labour Organization) and rising wage. The base rate, excluding bonus, rose 3.3% in the three-months year-over-year comparison and finished last year with a 2.5% increase. This is the fastest in a decade. And with CPI around 2.5%, the wage growth would have spurred speculation of a BOE rate hike. Now, the implied yield of the June 2019 short-sterling futures contract increased by a single basis point and is about six basis points lower than at the end of November.

After several weekends of mass demonstrations, French President Macron reversed himself. From fiscal austerity and regress taxes, Macron offered a pro-labor package, whose details are not sufficiently concrete to signal an end to the crisis. He urged companies to pay a year-end bonus, which would not be taxed. Really? Taxes overtime pay would end, but it is not clear when. The government would fund a 100 euro a month increase in the minimum wage, which was a repackaging of increases that had already been planned for the next few years. Macron has offered to abolish the hated tax on pensions below 2000 euros a month.

The President claimed France was in a state of social and economic emergency and said that in many ways the anger of the Yellow Vests was justified. Ironically, Macron’s retreat may not soothe the Yellow Vests but to embolden it. Will Macron reinstate the wealth tax he cut? Even before the withdrawal of the petrol tax, France was looking at a 2.8% budget deficit in 2019 and some estimates, put it near 3.5% following Macron’s pledges. The populist-nationalist Italian government proposed a 2.4% budget deficit. Of course, the debt levels are different, and the structural deficit is different, but surely whatever “social and economic emergency” is being experienced in France and justifies some fiscal forbearance is afflicting Italy as well.

The current assessment in the German ZEW survey fell to 45.3 from 58.2 in November. It is the third consecutive monthly decline. In September it stood at 76. If there is less bad news, it is from the expectation component. Things cannot get much worse, it appears, and expectations improved to -17.5 from -24.1. It is the third month in a row that expectations edged higher. Consider that a year ago, they stood at +17.4.

The euro is in almost a half-cent range above $1.1350. There has been no follow-through selling after yesterday’s downside reversal. Now, ahead of the ECB meeting, where the euro has fallen on days of such meetings this year except in September, the short-term market lacks conviction. There is a nearly 950 mln euro option struck at $1.1360 that is expiring today. The inability to recovery above $1.14 may embolden the sellers in early North American turnover. Sterling has also stabilized and resurfaced above $1.26. It is stalling in front of $1.2650, and that may entice new selling. There are modest expiring options at $1.2625 (~GBP300 mln) and $1.2675 (~GBP200 mln).

North America

After breaking below the October low near 2600, and falling to an eight-month low, the S&P 500 reversed higher and eked out a small gain to end the three-day slide. Despite the impressive recovery and bullish hammer candlestick pattern, more work needs to be done to turn sentiment. Some stale longs in the levered community are thought to be trapped from higher levels, making them likely sellers into a bounce. Initial resistance is seen near 2660 but to boost confidence that a low is in place, a move above 2700-15 may be necessary.

The US reports November PPI figures. Barring a significant surprise, it is unlikely to be a market-mover. The drop in energy prices will weigh on the headline rate, while the core is expected to hold up much better. Tomorrow the CPI figures will be released, and the story will likely be similar. Weaker energy prices are a drag, but the core CPI rate may tick up to 2.2% from 2.1%, according to the median forecast in the Bloomberg survey.

Canada’s economic calendar is light, and the US dollar is continuing to straddle the CAD1.34-level. The high from last week is near CAD1.3445, near where a $615 mln option is struck that will be cut today. The threat of retaliation by China over Meng’s arrest, while US-Chinese trade talks go forward, maybe weighing the Canadian dollar as the market reassesses the trajectory of monetary policy. Initial support for the greenback is seen nearby at CAD1.3380.

Graphs and additional information on Swiss Franc by the snbchf team.

Tags: #GBP,#USD,$CAD,$EUR,$JPY,Featured,newsletter,SPX