See the introduction and the video for the terms gold basis, co-basis, backwardation and contango. Driven by Credit The jobs report was disappointing. The prices of gold, and even more so silver, took off. In three hours, they gained and 39 cents. Before we try to read into the connection, it is worth pausing to consider how another market responded. We don’t often discuss the stock market (and we have not been calling for an imminent stock market collapse as many others have). The initial reaction in the US equities market (futures, as this was before the opening bell) was down. But it was muted, and then in a few hours turned around and the market ended even higher. Each stock represents a business.

Topics:

Keith Weiner considers the following as important: Featured, Gold and its price, Gold and silver prices, gold basis, gold price, newsletter, Precious Metals, silver basis

This could be interesting, too:

Nachrichten Ticker - www.finanzen.ch writes Die Performance der Kryptowährungen in KW 9: Das hat sich bei Bitcoin, Ether & Co. getan

Nachrichten Ticker - www.finanzen.ch writes Wer verbirgt sich hinter der Ethereum-Technologie?

Martin Hartmann writes Eine Analyse nach den Lehren von Milton Friedman

Marc Chandler writes March 2025 Monthly

See the introduction and the video for the terms gold basis, co-basis, backwardation and contango.

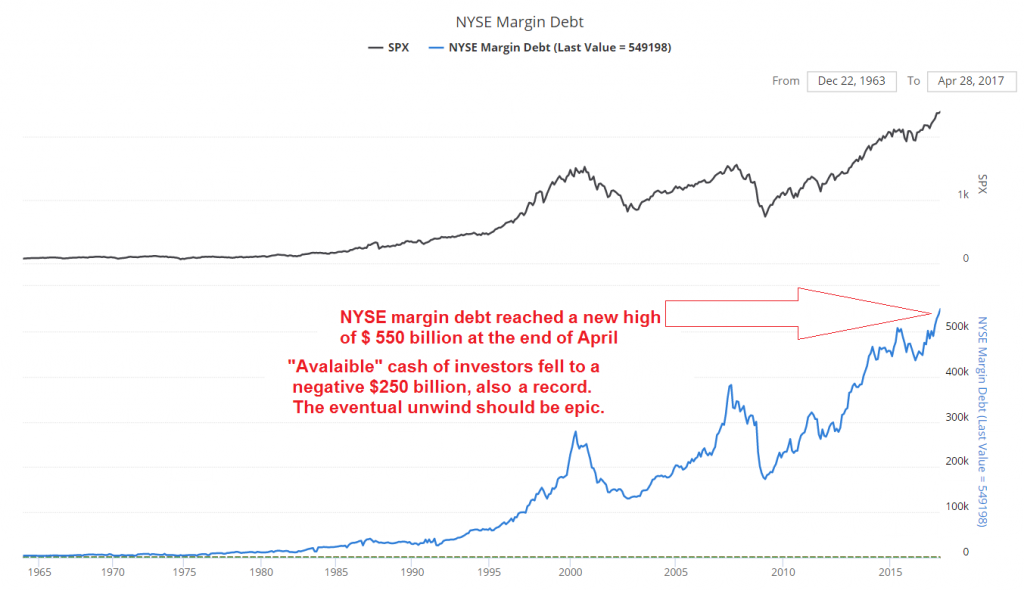

Driven by CreditThe jobs report was disappointing. The prices of gold, and even more so silver, took off. In three hours, they gained $18 and 39 cents. Before we try to read into the connection, it is worth pausing to consider how another market responded. We don’t often discuss the stock market (and we have not been calling for an imminent stock market collapse as many others have). The initial reaction in the US equities market (futures, as this was before the opening bell) was down. But it was muted, and then in a few hours turned around and the market ended even higher. Each stock represents a business. Presumably, if jobs growth was disappointing then this is bad for stocks on two grounds. One is that companies hire based on their revenue expectations. Slow or no hiring means slow or no revenue growth. The other is that people who aren’t hired don’t buy as much, and so there is a feedback loop into sluggish business revenue growth. However, the stock market disagreed. It said let’s cut the earnings yield a bit more, from 3.94% to 3.93%. This presumably means that earnings are set to take off (or it could mean that everyone from wage-earners who pour their surplus into the stock market to older speculators are not thinking about earnings yield). Not only did the stock market go up, so did the euro. As did US Treasury bonds. And, finally, gold and silver. What is the one thing that these all have in common? It is possible to borrow to buy these assets. We read this as a garden-variety day of credit expansion. Folks, this is how the monetary system is supposed to work, according to mainstream economic thought. Based on <insert story du jour>, people borrow to buy assets. This creates a wealth effect, as rising asset prices makes people (at least those who own those assets) feel richer. When they feel richer, they go out to eat more, buy more Rolexes and Porsches, and that employs everyone else. Or so their theory goes. |

Margin Debt, 1965 - 2017(see more posts on Margin Debt, ) |

Fundamental DevelopmentsStock analysts have a wealth of material to study the fundamentals of public companies. We leave that work to them. We have a theory, model, and now a robust software platform to study and calculate the fundamentals of gold and silver. We will show charts of the fundamental prices we calculate. But first, a look at the prices of the metals and gold-silver ratio. |

Gold And Silver Prices, January 2017 - June 2017(see more posts on Gold and silver prices, ) |

Gold: Silver Ratio, January 2017 – June 2017Next, this is a graph of the gold price measured in silver, otherwise known as the gold to silver ratio. It moved up a bit, though down on Friday. In this graph, we show both bid and offer prices. If you were to sell gold on the bid and buy silver at the ask, that is the lower bid price. Conversely, if you sold silver on the bid and bought gold at the offer, that is the higher offer price.

|

Gold: Silver Ratio, January 2017 - June 2017(see more posts on gold silver ratio, ) |

Gold Basis, January 2017 – June 2017Here is the gold graph. We had a dropping price of the dollar (the mirror image of the rising price of gold), and a slightly falling abundance (the basis) and slightly rising scarcity (the co-basis). Our old model shows an increase in the gold fundamental price of $19 ($1,267 to $1,286). Our new software also shows an increase, though smaller and at a higher level ($1,330 to $1,334). We plan an article to discuss this difference. |

Gold Basis, January 2017 - June 2017(see more posts on gold basis, ) |

Silver Basis Continuos, January 2017 – June 2017Now let’s look at silver. In silver, there is a slight increase in abundance and decrease in scarcity as the price has risen. Our old model shows an increase in the silver fundamental price of $0.05 ($16.12 to $16.17). Our new software, however, shows a decease and not a small one ($17.97 to $17.62). Here is a graph. Fundamental silver price vs. bid price in the market. Note that the fundamental price (new software platform) is range-bound from early March. It is considerably less volatile than the market price, which is what we would hope for. |

Silver Basis Continuos, January 2017 - June 2017(see more posts on silver basis, ) |

Tags: Featured,Gold and silver prices,gold basis,gold price,newsletter,Precious Metals,silver basis