Summary: China plans to issue its first USD-denominated bond since 2004. China’s largest banks banned North Koreans from opening new accounts. The UN Security Council approved new sanctions on North Korea. Relations between Poland and the European Commission remain tense. Brazil’s central bank appears to be signaling discomfort with ongoing BRL strength. Brazil President Temer faces a second set of criminal charges. Peru’s entire cabinet resigned after losing a confidence vote in Congress. Stock Markets In the EM equity space as measured by MSCI, Czech Republic (+2.7%), China (+2.4%), and Korea (+2.3%) have outperformed this week, while Qatar (-2.0%), Singapore (-0.9%), and Egypt (-0.7%) have underperformed. To put

Topics:

Win Thin considers the following as important: emerging markets, Featured, newsletter, win-thin

This could be interesting, too:

Nachrichten Ticker - www.finanzen.ch writes Die Performance der Kryptowährungen in KW 9: Das hat sich bei Bitcoin, Ether & Co. getan

Nachrichten Ticker - www.finanzen.ch writes Wer verbirgt sich hinter der Ethereum-Technologie?

Martin Hartmann writes Eine Analyse nach den Lehren von Milton Friedman

Marc Chandler writes March 2025 Monthly

Summary:

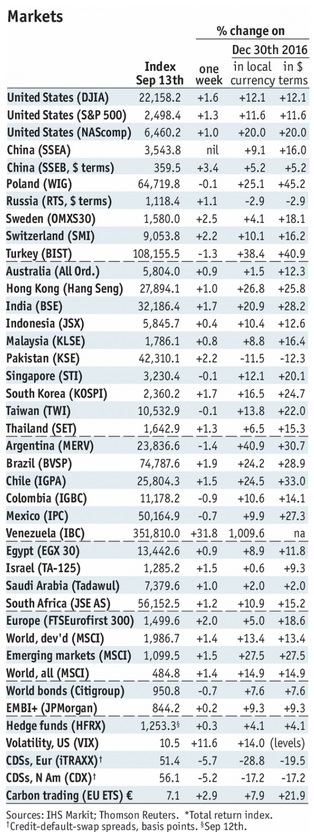

Stock MarketsIn the EM equity space as measured by MSCI, Czech Republic (+2.7%), China (+2.4%), and Korea (+2.3%) have outperformed this week, while Qatar (-2.0%), Singapore (-0.9%), and Egypt (-0.7%) have underperformed. To put this in better context, MSCI EM rose 1.0% this week while MSCI DM rose 1.0%. In the EM local currency bond space, Argentina (10-year yield -43 bp), Colombia (-13 bp), and Nigeria (-12 bp) have outperformed this week, while Indonesia (10-year yield +14 bp), Czech Republic (+10 bp), and Thailand (+10 bp) have underperformed. To put this in better context, the 10-year UST yield rose 15 bp to 2.20%. In the EM FX space, ARS (+1.3% vs. USD), COP (+0.4% vs. USD), and MXN (+0.2% vs. USD) have outperformed this week, while ZAR (-1.9% vs. USD), BRL (-1.3% vs. USD), and HUF (-0.9% vs. EUR) have underperformed. |

|

ChinaChina plans to issue its first USD-denominated bond since 2004. The $2 bln issuance will mostly serve as a benchmark for corporate issuance, as the sovereign clearly does not need to raise foreign currency. At the same time, China announced that it will issue only CNY14 bln of so-called dim sum bonds in Hong Kong this year, the smallest since 2010. China’s largest banks banned North Koreans from opening new accounts. Some banks are going even further, saying they are cleaning out existing accounts held by North Koreans by preventing new deposits. Perhaps this is another clear sign that China has finally run out of patience with Pyongyang. North KoreaThe UN Security Council approved new sanctions on North Korea. This was in response to its latest missile and nuclear tests. After the US dropped demands for an oil embargo, it won support from Russia and China as the 15-member Security Council passed the resolution unanimously. PolandRelations between Poland and the European Commission remain tense. The European Commission sent a final warning to the government over its planned judicial reform legislation, stressing that “the independence of Polish courts will be undermined.” The Polish government has one month to take the necessary measures to address these concerns. If Poland does not take appropriate measures, the EC may refer the case to the EU court in Luxembourg. BrazilBrazil’s central bank appears to be signaling discomfort with ongoing BRL strength. It announced a partial roll over of FX swaps, allowing an estimated $4 bln worth to expire. This will in turn create USD demand. We do not think the bank is targeting any particular level of the exchange rate, however. Brazil President Temer faces a second set of criminal charges. Chief prosecutor Janot formally charged Temer with obstruction of justice and criminal conspiracy, adding that he and several of his aides took kickbacks worth BRL587 mln relating to government contracts. The president’s press office denied the charges, saying that Janot “accepted false and lying testimony.” PeruPeru’s entire cabinet resigned after losing a confidence vote in congress. The vote was a lopsided 77-22 with 16 abstentions. Education Minister Martens is under fire for the government’s handling of a teachers strike. If the new cabinet also loses a confidence vote, President Kuczynski can dissolve congress and call fresh elections. |

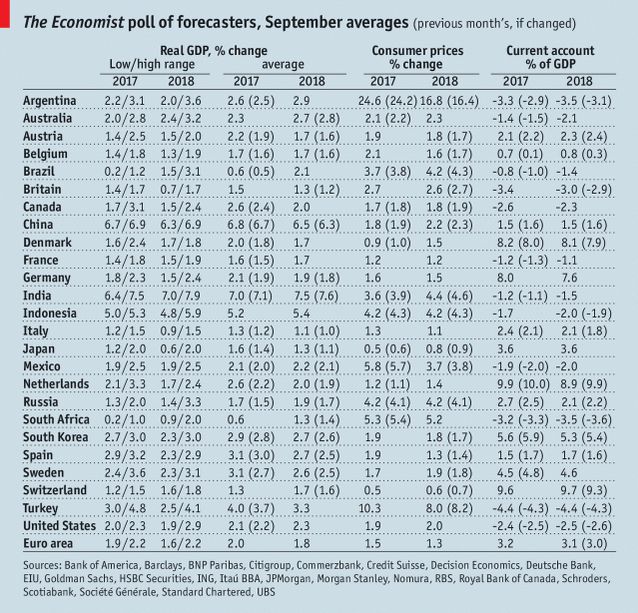

GDP, Consumer Inflation and Current Accounts The Economist poll of forecasters, September 2017 Source: economist.com - Click to enlarge |

Tags: Emerging Markets,Featured,newsletter,win-thin