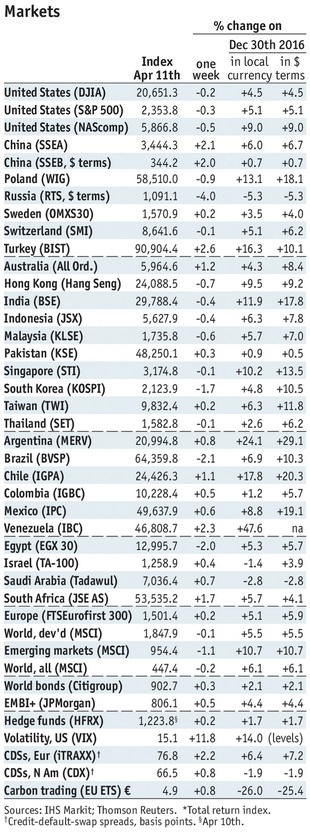

Summary Malaysia’s central bank said it will allow investors to fully hedge their currency exposure. Egypt declared a 3-month state of emergency after two deadly church attacks. South Africa’s parliamentary no confidence vote has been delayed Argentina central bank surprised markets with a 150 bp hike to 26.25%. Brazil central bank accelerated the easing cycle with a 100 bp cut in the Selic rate. Stock Markets In the EM equity space as measured by MSCI, South Africa (+3.1%), Turkey (+2.5%), and the Philippines (+0.9%) have outperformed this week, while Russia (-3.9%), Peru (-3.4%), and Brazil (-2.6%) have underperformed. To put this in better context, MSCI EM fell -0.3% this week while MSCI DM fell -0.7%. In the EM local currency bond space, South Africa (10-year yield -18 bp), Poland (-8 bp), and Indonesia (-8 bp) have outperformed this week, while Brazil (10-year yield +11 bp), Peru (+9 bp), and Colombia (+9 bp) have underperformed. To put this in better context, the 10-year UST yield fell 15 bp to 2.24%. In the EM FX space, ZAR (+2.5% vs. USD), RUB (+1.9% vs. USD), and ARS (+1.2% vs. USD) have outperformed this week, while HUF (-0.9% vs. EUR), KRW (-0.5% vs. USD), and PLN (-0.5% vs. EUR) have underperformed. Stock Markets Emerging Markets, April 11 Source: Economist.

Topics:

Win Thin considers the following as important: emerging markets, Featured, newslettersent

This could be interesting, too:

Nachrichten Ticker - www.finanzen.ch writes Die Performance der Kryptowährungen in KW 9: Das hat sich bei Bitcoin, Ether & Co. getan

Nachrichten Ticker - www.finanzen.ch writes Wer verbirgt sich hinter der Ethereum-Technologie?

Marc Chandler writes March 2025 Monthly

Mark Thornton writes Is Amazon a Union-Busting Leviathan?

Summary

Stock MarketsIn the EM equity space as measured by MSCI, South Africa (+3.1%), Turkey (+2.5%), and the Philippines (+0.9%) have outperformed this week, while Russia (-3.9%), Peru (-3.4%), and Brazil (-2.6%) have underperformed. To put this in better context, MSCI EM fell -0.3% this week while MSCI DM fell -0.7%. In the EM local currency bond space, South Africa (10-year yield -18 bp), Poland (-8 bp), and Indonesia (-8 bp) have outperformed this week, while Brazil (10-year yield +11 bp), Peru (+9 bp), and Colombia (+9 bp) have underperformed. To put this in better context, the 10-year UST yield fell 15 bp to 2.24%. In the EM FX space, ZAR (+2.5% vs. USD), RUB (+1.9% vs. USD), and ARS (+1.2% vs. USD) have outperformed this week, while HUF (-0.9% vs. EUR), KRW (-0.5% vs. USD), and PLN (-0.5% vs. EUR) have underperformed. |

Stock Markets Emerging Markets, April 11 Source: Economist.com - Click to enlarge |

MalaysiaMalaysia’s central bank said it will allow investors to fully hedge their currency exposure. However, details remain scant. Note that the current limit is up to 25% of their assets. Assistant Governor Zahid also said that all domestic investors will be allowed to short-sell government bonds to boost market liquidity. Currently, only banks are allowed to take short positions. The latest steps will take effect on May 2. EgyptEgypt declared a 3-month state of emergency after two deadly church attacks. ISIS took credit for the attacks on Palm Sunday. In related news, Israel closed its Taba border crossing with Egypt and warned of “imminent” attacks. South AfricaSouth Africa’s parliamentary no confidence vote has been delayed. It was originally scheduled for April 18, but the Constitutional Court will first have to rule on the opposition’s request for a secret ballot. ArgentinaArgentina central bank surprised markets with a 150 bp hike to 26.25%. It noted that data “monitored by the central bank suggest inflation in April could continue at a higher level than is compatible with the path established by the monetary authority.” This was the first change in the 7-day repo rate since it was adopted as the main policy rate. Move came after higher than expected CPI reading for March. BrazilBrazil central bank accelerated the easing cycle with a 100 bp cut in the Selic rate. It noted that for now, this acceleration of the easing cycle remains appropriate. That suggests that it will probably cut 100 bp at each of the May 31 and July 26 meetings. |

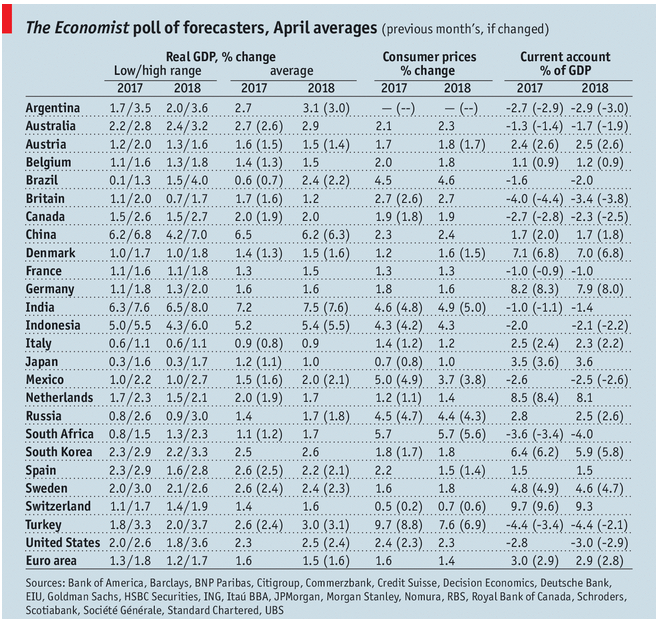

GDP, Consumer Inflation and Current Accounts The Economist poll of forecasters, April 2017 Source: economist.com - Click to enlarge |

Tags: Emerging Markets,Featured,newslettersent