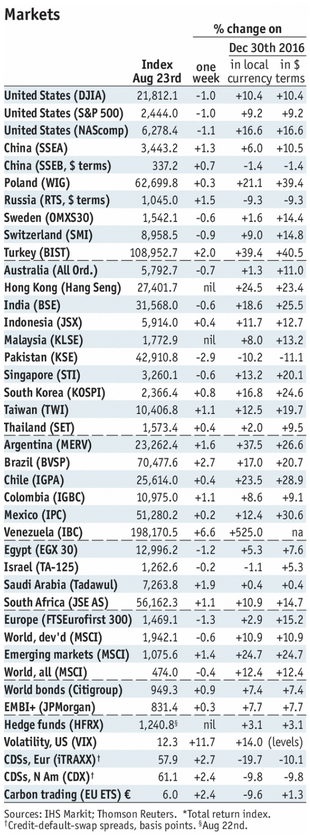

Stock Markets EM FX ended last week on a strong note, buoyed by perceived dovishness from Yellen at the Jackson Hole symposium. However, US jobs data this Friday could test the market’s convictions. Within EM, data are likely to support our view that EM central banks can retain their largely dovish posture into 2018. Stock Markets Emerging Markets, August 23 Source: economist.com - Click to enlarge Mexico Mexico reports July trade Monday, with a deficit of -.04 bln expected. Export growth was 11.5% y/y in June, driven by gains in both manufacturing and petroleum shipments. Import growth has lagged, leading the 12-month trade deficit to narrow over the past several months. Turkey Turkey reports July

Topics:

Win Thin considers the following as important: emerging markets, Featured, newsletter, win-thin

This could be interesting, too:

Nachrichten Ticker - www.finanzen.ch writes Die Performance der Kryptowährungen in KW 9: Das hat sich bei Bitcoin, Ether & Co. getan

Nachrichten Ticker - www.finanzen.ch writes Wer verbirgt sich hinter der Ethereum-Technologie?

Martin Hartmann writes Eine Analyse nach den Lehren von Milton Friedman

Marc Chandler writes March 2025 Monthly

Stock MarketsEM FX ended last week on a strong note, buoyed by perceived dovishness from Yellen at the Jackson Hole symposium. However, US jobs data this Friday could test the market’s convictions. Within EM, data are likely to support our view that EM central banks can retain their largely dovish posture into 2018. |

Stock Markets Emerging Markets, August 23 Source: economist.com - Click to enlarge |

MexicoMexico reports July trade Monday, with a deficit of -$1.04 bln expected. Export growth was 11.5% y/y in June, driven by gains in both manufacturing and petroleum shipments. Import growth has lagged, leading the 12-month trade deficit to narrow over the past several months. TurkeyTurkey reports July trade Tuesday, which is expected at -$8.8 bln. Export growth slowed to 2% y/y in June, but this was offset by a -1.5% y/y contraction in imports. As growth picks up, we expect the deteriorating trend in the external accounts to resume. IsraelBank of Israel meets Tuesday and is expected to keep rates steady at 0.10%. CPI contracted -0.7% y/y in July, well below the 1-3% target range. Yet the bank probably has a high bar for taking any further action. For now, it will continue its efforts to weaken the shekel. BrazilBrazil reports July central government budget data Tuesday, with a -BRL18 bln deficit expected. This will be followed by consolidated data Wednesday, where a -BRL17.1 bln primary deficit is expected. The government recently raised its 2017 and 2018 deficit targets to -BRL159 bln for both years vs. -BRL139 bln and -BRL129 bln, respectively. Brazil reports Q2 GDP Friday, which is expected to be flat y/y vs. -0.4% in Q1. August trade will be reported Friday too. South AfricaSouth Africa reports July budget, money, and loan data Wednesday. July trade data will be reported Thursday, where a ZAR7.1 bln surplus is expected. With the economy still sluggish, we expect SARB to continue easing. The next policy meeting is September 21, and another 25 bp cut to 6.5% seems likely then. KoreaBank of Korea meets Thursday and is expected to keep rates steady at 1.25%. CPI rose 2.2% y/y in July, close to the 2% target. However, with growth concerns still present, the central bank is likely to remain on hold for now. Prior to the BOK decision, Korea reports July IP and the contraction is expected to remain steady at -0.3% y/y. July CPI and trade will be reported Friday. Inflation is expected to remain steady at 2.2% y/y. ChinaChina reports official August manufacturing PMI Thursday, which is expected at 51.3 vs. 51.4 in July. Caixin reports its August manufacturing PMI Friday, which is expected at 50.9 vs. 51.1 in July. The mainland economy appears to have stabilized for now, which should help the other regional economies as well. IndiaIndia reports Q2 GDP Thursday. The growth outlook remains in flux, which is why the RBI decided to cut rates this month. Inflation remains low, but the RBI believes it has bottomed. The next policy meeting is October 4. It will be a close call, but another 25 bp cut then seems likely. PolandPoland reports August CPI Thursday. Inflation was 1.7% y/y in July, below the 2.5% target but within the 1.5-3.5% target range. The next central bank policy meeting is September 6, and it is expected to keep rates steady at 1.5%. With price pressures remaining low, the bank is unlikely to hike rates in 2017. ColombiaColombia’s central bank meets Thursday and is expected to cut rates 25 bp to 5.25%. The bank has cut six meetings in a row, for a total of 200 bp. CPI rose 3.4% y/y in July, the lowest since October 2014. While still above the 3% target, the poor growth outlook has led the central bank to continue its easing cycle. ThailandThailand reports August CPI Friday, which is expected to rise 0.4% y/y vs. 0.2% in July. If so, inflation would still be well below the 1-4% target range. Bank of Thailand next meets September 27, and is likely to keep rates on hold at 1.5%. PeruPeru reports August CPI Friday, which is expected to rise 3.0% y/y vs. 2.9% y/y in July. This would be back at the top of the 1-3% target range. As a result, the central bank is easing cautiously, cutting rates 25 bp every other meeting. If this pattern holds, the bank should cut rates 25 bp to 3.5% at its next policy meeting September 14. |

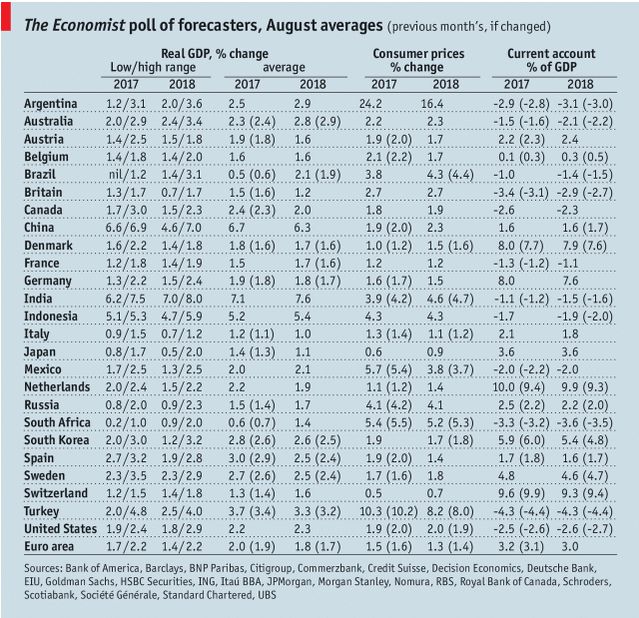

GDP, Consumer Inflation and Current Accounts The Economist poll of forecasters, August 2017 Source: economist.com - Click to enlarge |

Tags: Emerging Markets,Featured,newsletter,win-thin