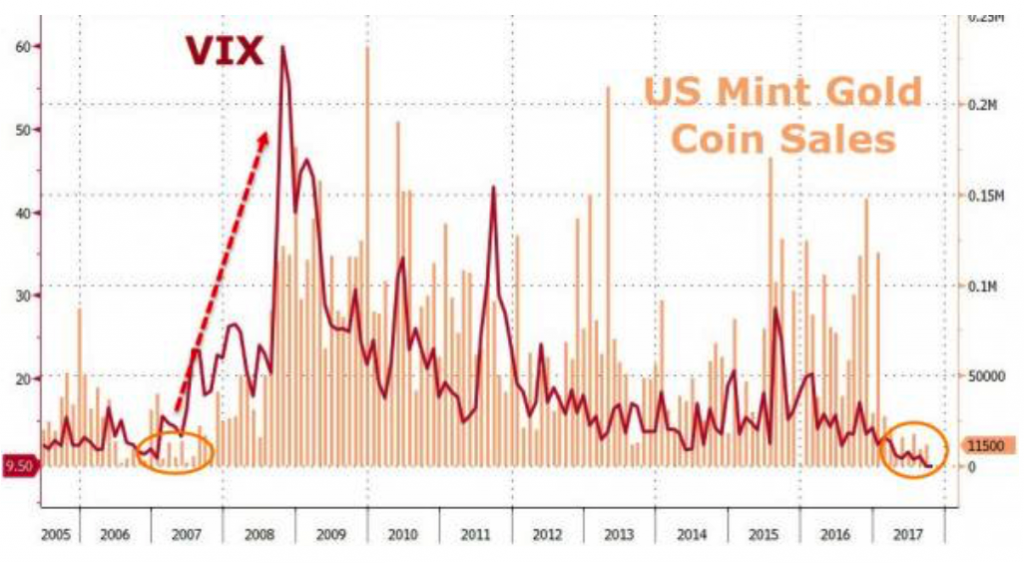

– US Mint gold coin sales and VIX at weakest in a decade– Very low gold coin sales and VIX signal volatility coming– Gold rises 1.7% this week after China’s Golden Week; pattern of higher prices after Golden Week– U.S. Mint sales do not provide the full picture of robust global gold demand– Perth Mint gold sales double in September reflecting increased gold demand in both Asia and Europe– Middle East demand likely high given geopolitical risks – Iran seeing increased gold demand and Iran’s gold coin price up by 5% – Trump’s war mongering could see demand accelerate– Germany seeing very robust demand and now world’s largest gold buyer US Mint Gold Coin Sales, 2005 - 2017(see more posts on Gold coin, )Source:

Topics:

Jan Skoyles considers the following as important: Bitcoin, Featured, Gold coin, GoldCore, newsletter, Weekly Market Update

This could be interesting, too:

Nachrichten Ticker - www.finanzen.ch writes Die Performance der Kryptowährungen in KW 9: Das hat sich bei Bitcoin, Ether & Co. getan

Nachrichten Ticker - www.finanzen.ch writes Wer verbirgt sich hinter der Ethereum-Technologie?

Martin Hartmann writes Eine Analyse nach den Lehren von Milton Friedman

Marc Chandler writes March 2025 Monthly

| – US Mint gold coin sales and VIX at weakest in a decade – Very low gold coin sales and VIX signal volatility coming – Gold rises 1.7% this week after China’s Golden Week; pattern of higher prices after Golden Week – U.S. Mint sales do not provide the full picture of robust global gold demand – Perth Mint gold sales double in September reflecting increased gold demand in both Asia and Europe – Middle East demand likely high given geopolitical risks – Iran seeing increased gold demand and Iran’s gold coin price up by 5% – Trump’s war mongering could see demand accelerate – Germany seeing very robust demand and now world’s largest gold buyer |

US Mint Gold Coin Sales, 2005 - 2017(see more posts on Gold coin, ) |

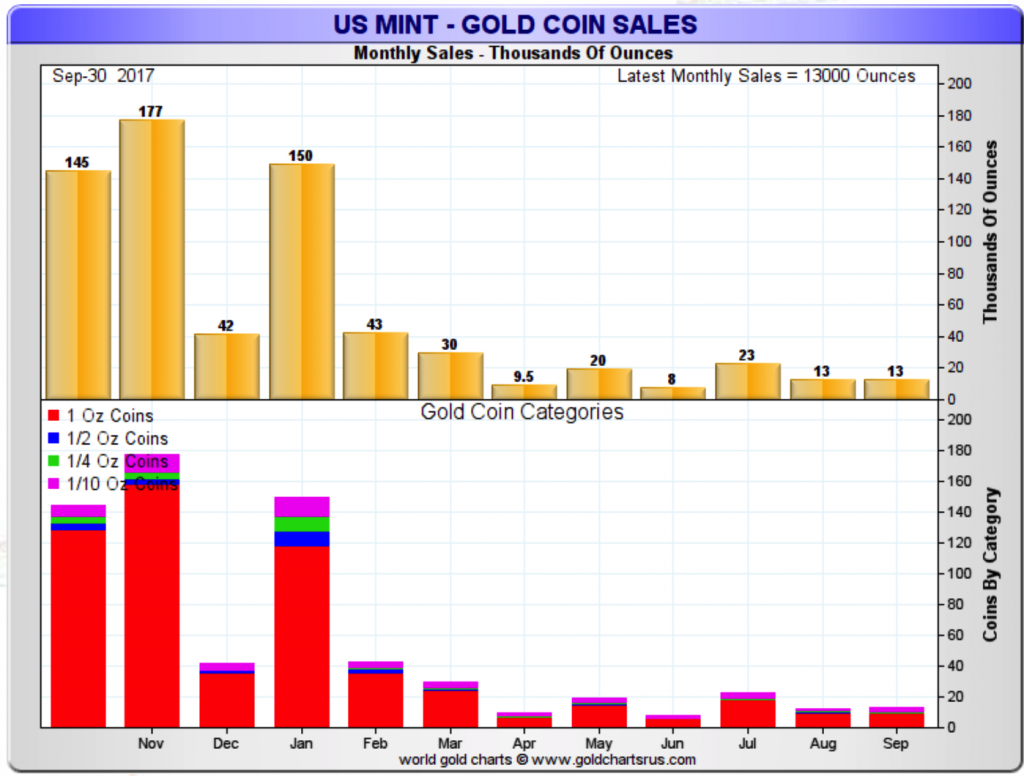

| US Mint coin sales fell to a decade low last month. This follows poor sales since the beginning of 2017. In the third quarter sales reached nearly 3.7 million ounces. September gold coin sales were down a whopping 88% compared to the same period last year.

Year to date sales at 232,000 ounces are 66.5% lower than the 692,500 ounces delivered during the first nine months of 2016, according to the U.S. Mint. American Eagle gold coin sales did see a slight uptick in demand from very low levels and increased by 11,500 ounces in September which was up by 21.1% in August. Is this pick-up in US coin demand a sign of things turning around? Perhaps, but we believe the low coin sales this year might say something else about the wider economy. It is also important to look at gold coin and bar sales across the globe to get a better feel for actual demand. |

US Mint Gold Coin Sales, Nov - Sep 2017(see more posts on Gold coin, ) |

| Sign of the end, but for what?

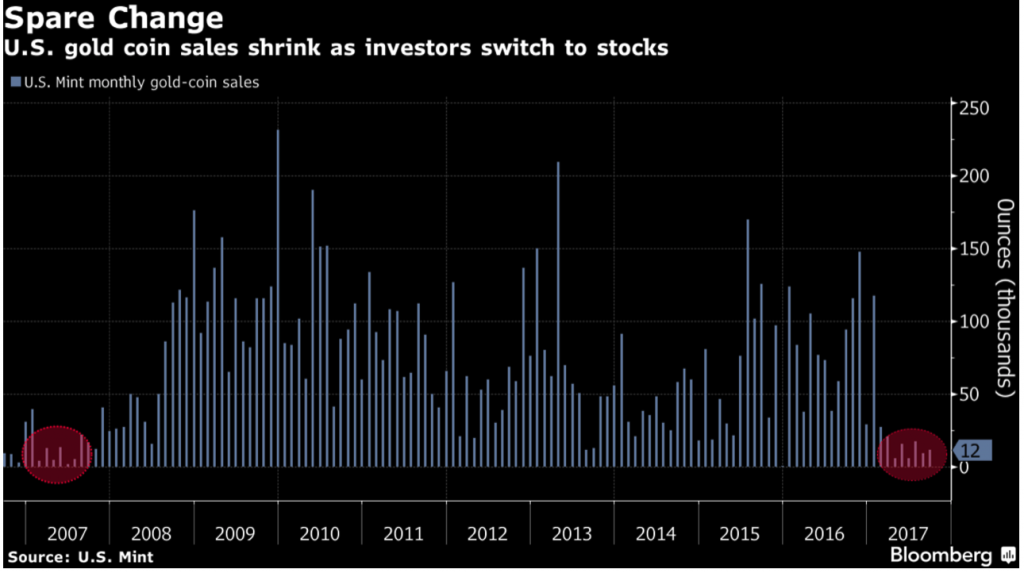

Bloomberg were quick to point out that US Mint sales were at a decade low. They believed this was due to investors turning ‘sour on bullion’ and that gold’s appeal ‘is waning as retail investors seek better returns in equities, lured by the S&P 500 Index’s climb to records.’ However, the picture of declining gold coin sales has not been taken against the backdrop of the last decade. ZeroHedge were quick to spot a potential pattern and correlation with the VIX which may point to increased volatility and uncertainty and a prompt recovery in the gold price: “The first nine months of 2017 have seen demand for gold coins slump. As stocks soar unendingly (and vol drops unerringly) the US Mint notes that sales of coins is at its weakest in a decade as complacency in the face of ever-increasing potential-crisis-events nears record highs. The question is – what happened the last time the public gave up on buying “protection against the idiocy of the political cycle”? The answer is awkwardly simple… everything collapsed.” This is important news for those who are getting wary about the massive complacency and “irrational exuberance” currently seen in global stock and bond markets. |

US Gold Coin Sales, 2007 - 2017 |

| It’s not all about the U.S. Mint gold coin demand

Given how much Trump dominates the headlines it might be hard to remember that U.S. demand is not a reflection of total gold demand. Whilst the U.S. Mint poor gold coin continued in September, their cousins ‘down under’ recorded excellent sales in September. On Monday we covered how Perth Mint gold coins sales doubled in September. Last month the Perth Mint sold 46,415 ounces of gold in bars and coins. In August, its gold bullion sales were just 23,130 ounces. Silver product sales soared by 78 percent from the previous month. Why is this relevant? The Perth Mint sells gold all over the world. The US Mint predominantly sells domestically and would be more dependent on domestic demand. The Australian Mint’s sales figures are a better reflection of the robust demand in the likes of Asia and Europe, where investors are growing increasingly risk aware. Data released by the World Gold Council last week showed Germany is now the world’s largest buyers of gold. We explained:

We have long said that German physical and ETF gold demand is a very important demand factor in the gold market and one that is continuously underestimated. It was good to have the WGC research bolster our view. |

Gold Coins Sold, Aug 2012 - Jul 2017(see more posts on Gold coin, ) |

| No way of knowing real levels of demand

In the short-term we need to remind ourselves that these are only official figures for two mints. When we reported on the 11% increase in gold bar and coin demand for the first half of 2017, we reminded readers that there are likely other sources of demand that are not recorded. We said that it is “Important to note this is all official, transparent and recorded demand. There is demand and flows of gold that cannot be and are not recorded – especially into the Middle East, India, Russia and of course China.” The Government of India Ministry Of Commerce and Industry reported this month that $1.9 billion worth of gold was imported to the county in August. In the same month last year, it was more than $1.1 billion worth of gold We also see record numbers of gold imports and exchange activity in the Middle East, especially in Dubai. Last month the Central Bank of Iran cut interest rates. Since then the gold price has surged, setting a new five-year record. The price of a gold coin in Iran, according to the Tehran Gold and Jewelry Union, has climbed by 5% in the last month. What about China? The mainstream have also been quick to point to weak sales despite China’s Golden Week. This is also missing the bigger picture, argues ZeroHedge.

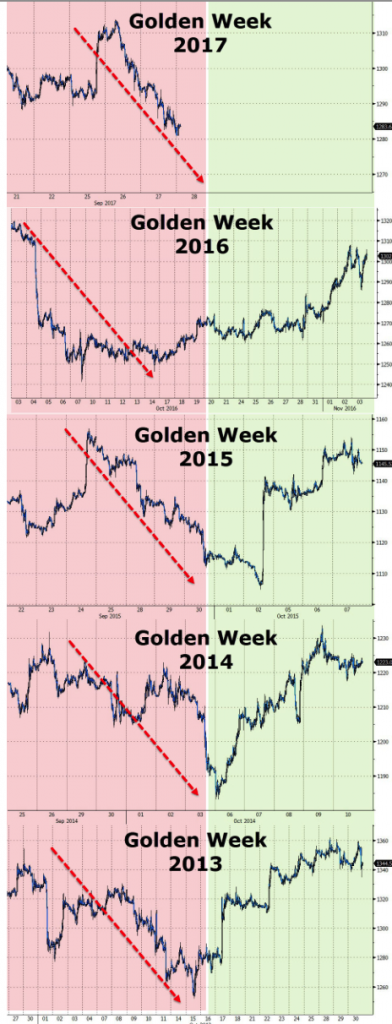

China’s Golden Week might even point to a quick recovery and the gold price coming back stronger than before, if earlier years are anything to go by: |

China Golden Week, 2013 - 2017 |

| Complacency dominates

Currently the mood of markets is thick with complacency. Risk is significantly under priced and underestimated. It is tough to reconcile the risks we see currently and on the horizon against the backdrop of record stock market prices. Complacency may well have seeped into the market for the US Mint’s coins. However, it is clear market volatility is coming. It looks like central bankers and governments won’t be able to forestall the inevitable for much longer. Some in the mainstream media are, as ever, keen to point to ‘disaster’ in the gold market. At worst, the US Mint figures are a small snapshot of complacency in a world which is otherwise focused on stocking up on gold. At best they are an indication that markets are due to have another roller coaster ride of uncertainty and volatility making the case for hedging with gold even more compelling. Investors should be taking advantage of the valuable time in this the ‘calm before the storm’ and the low gold price. In Europe and Asia it is the imminent feeling of uncertainty and growing instability which is driving buyers to allocate more to gold. This might not be felt just yet in the United States, but lots of indications suggest it soon will be. As ever, best to hope for the best but be financially prepared for less benign scenarios … |

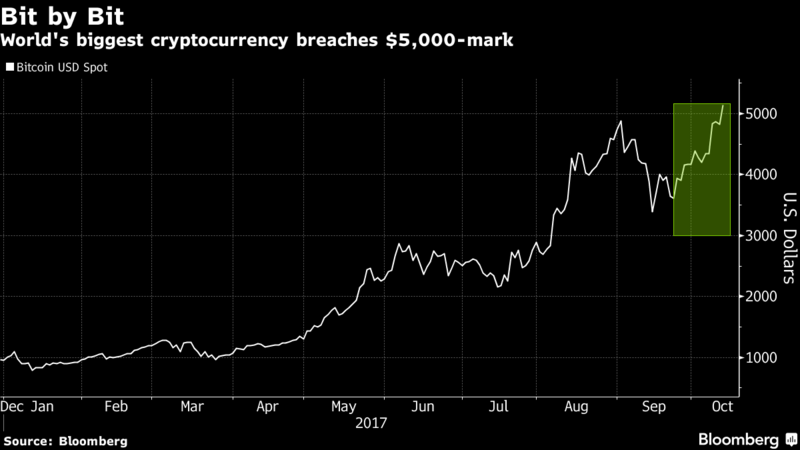

Bitcoin USD Spot, Dec 2016 - Oct 2017(see more posts on Bitcoin, ) |

Tags: Bitcoin,Featured,Gold coin,newsletter,Weekly Market Update