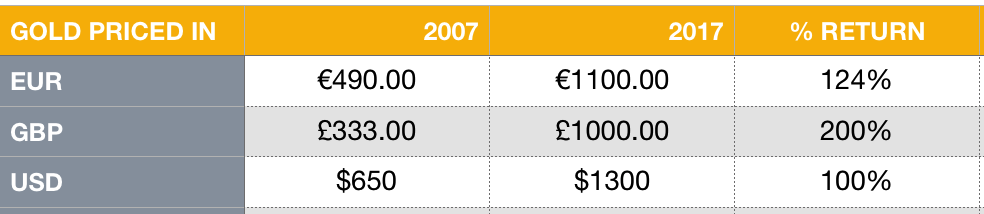

– Gold up over 100% in major currencies since financial crisis– Gold up 100% in USD, 124% in EUR and surged 200% in GBP– Gold has outperformed equity, bonds and most assets– Gold remains an important safe-haven in long term Gold Prices(see more posts on Gold prices, )Gold prices from August 9th 2007 to August 9th 2017 - Click to enlarge It has been ten years since the global financial crisis began to take hold. At the time few would have known that BNP Paribas’ decision to freeze three hedge funds was the signal for the deepest recession in living memory and a near-collapse of the financial system. As the French bank blamed a “complete evaporation of liquidity” on its decision the ECB flooded its the market with

Topics:

Jan Skoyles considers the following as important: Daily Market Update, Featured, gold price, GoldCore, manipulating silver, newsletter, silver, silver mining

This could be interesting, too:

RIA Team writes The Importance of Emergency Funds in Retirement Planning

Nachrichten Ticker - www.finanzen.ch writes Gesetzesvorschlag in Arizona: Wird Bitcoin bald zur Staatsreserve?

Nachrichten Ticker - www.finanzen.ch writes So bewegen sich Bitcoin & Co. heute

Nachrichten Ticker - www.finanzen.ch writes Aktueller Marktbericht zu Bitcoin & Co.

| – Gold up over 100% in major currencies since financial crisis – Gold up 100% in USD, 124% in EUR and surged 200% in GBP – Gold has outperformed equity, bonds and most assets – Gold remains an important safe-haven in long term |

Gold Prices(see more posts on Gold prices, ) |

| It has been ten years since the global financial crisis began to take hold. At the time few would have known that BNP Paribas’ decision to freeze three hedge funds was the signal for the deepest recession in living memory and a near-collapse of the financial system.

As the French bank blamed a “complete evaporation of liquidity” on its decision the ECB flooded its the market with billions of euros of emergency cash as it worked to prevent a seizure in the financial system. Very few realised how much the financial and investment landscape was set to change. In the proceeding decade we have seen unprecedented intervention by central banks which in turn has created a punishing financial landscape for savers and investors. |

Gold Price in Euro, Jan 2008-2017(see more posts on Gold prices, ) |

| For those who were unfortunate to experience bank bailouts first hand or a collapse in a housing market, an instant lesson was learnt about the importance of protecting your savings.

That would have been a savvy lesson to learn. Any investors feeling the ripples of the financial crisis and looking to protect their wealth may well have looked to gold as an option. By adding gold to their portfolio they would currently be looking at some extremely healthy returns. For those who were slower on the uptake of portfolio protection, they still would have benefited from gold’s decade climb and its performance alongside other major asset classes. Gold’s decade long climb Gold continues to be dismissed by the mainstream as an important asset-class for investors. However the decade long-climb for the precious metal is example enough of it’s strong performance against a backdrop of financial and political turmoil. |

Gold Price in USD, Jan 2008-2017(see more posts on gold price, ) |

| The yellow metal has outperformed a number of key assets and is up at least 100% in major currencies.

Gold price up by over 100% in major currencies Gold priced in sterling, euro and (US) dollar is up by at least 100%. Gold in a sterling a whopping 200%. |

Gold Price in GBP, Jan 2008-2017 |

| In contrast many major asset classes have not performed to the same extent, or met expectations.

For example, MSCI’s main world equity index might currently be on course for its longest monthly winning streak since 2003, but this is only 22% above levels in 2007. Plus, as central banks actively stockpiled bonds, yields on 10-year government debt benchmarks have more than halved. |

Global equities vs. bond yields, 2002-2016 |

| In the decade since the financial crisis gold has been one of the top performing assets. The table below shows the best performing asset classes in the last ten years.

It is clear to see that gold (when priced in sterling) has outperformed the majority of bonds and many equities (when priced in dollar and euro). The precious metal has held its own throughout a decade of financial confusion and distress. |

10 Year Cumulative Returns |

| This should come as no surprise to gold investors who are aware of gold’s ability to act as a long-term safe haven during times of crisis.

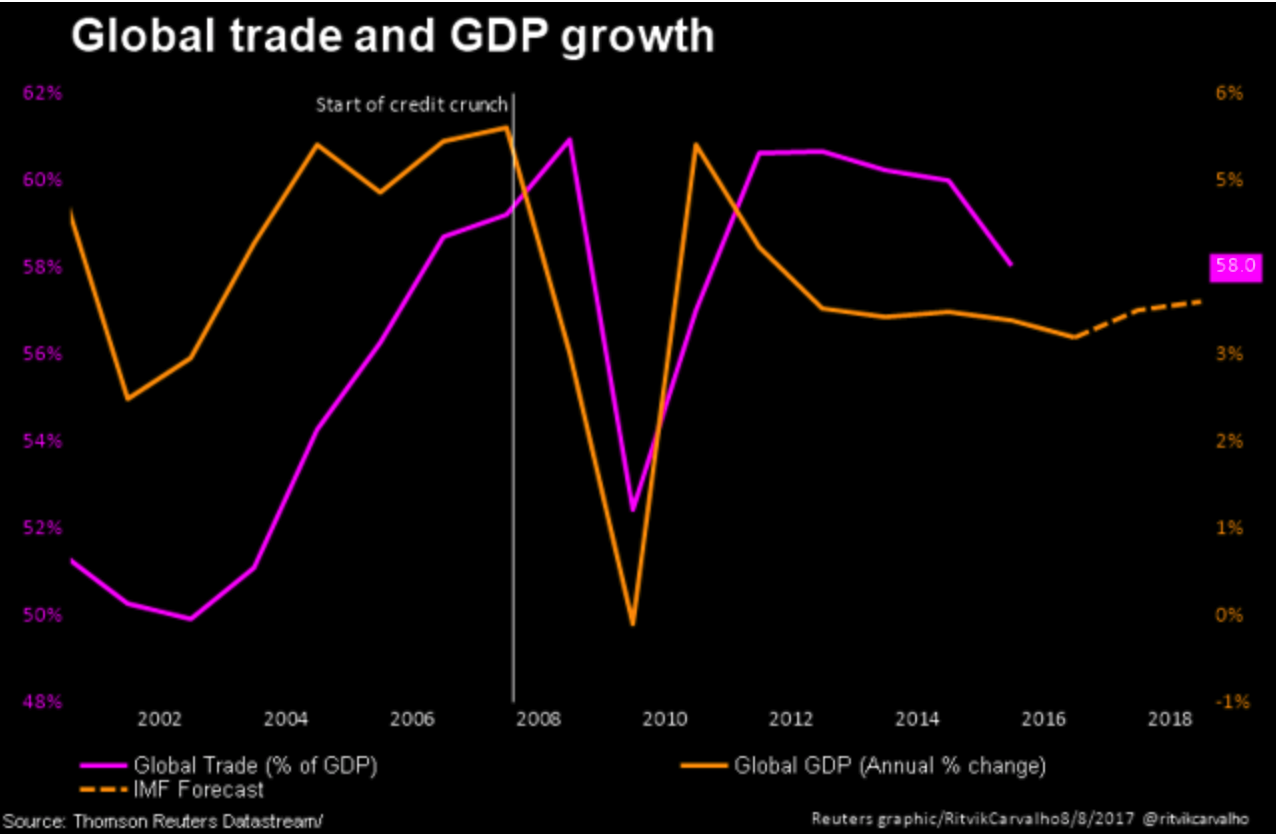

What is most interesting about the last ten years however is that the mainstream media and politicians are keen to promote the idea that the crisis is over. Yet, in many instances the situation is the same or, arguably, worse. |

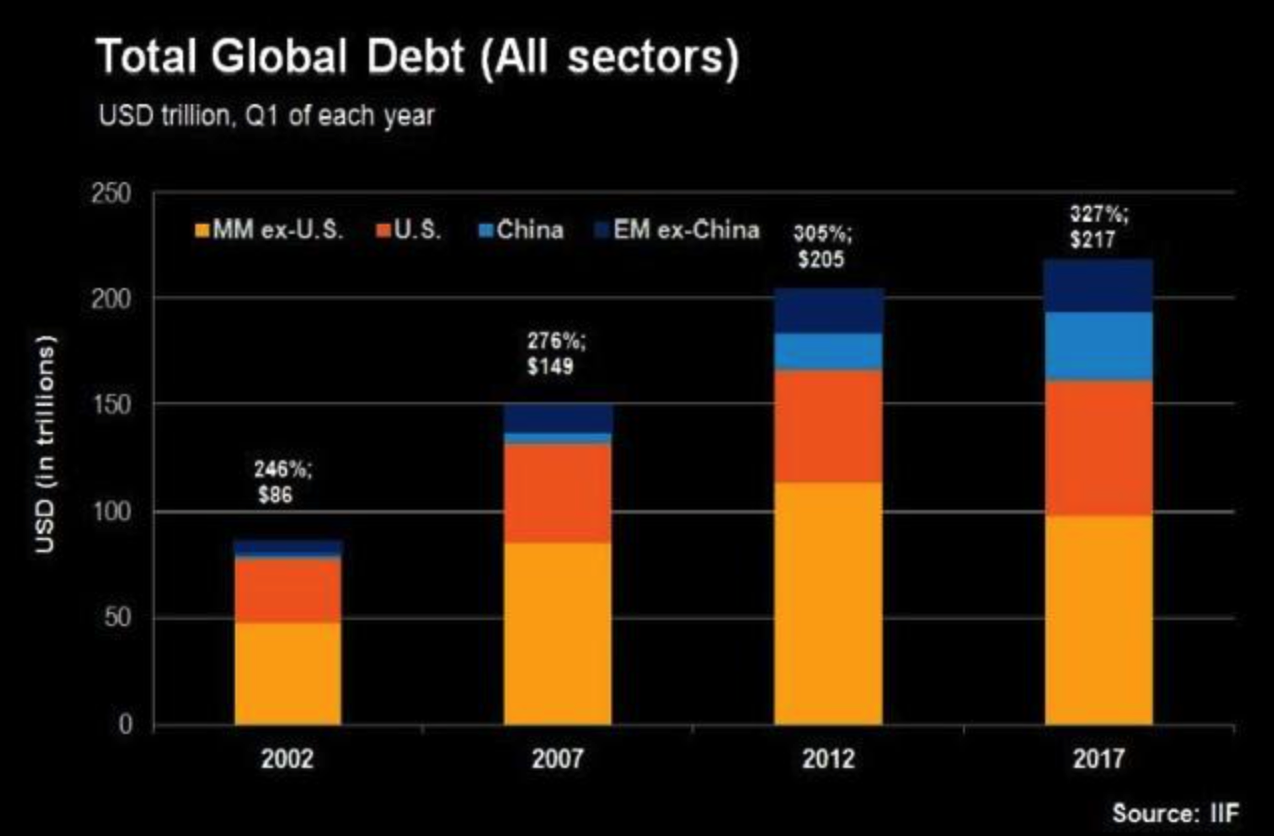

Total Global Debt |

| The financial environment is still an unattractive one for the average investor and saver.

A huge amount of leverage remains in the system, stocks are at unsustainable highs and geopolitical risks grow by the day. It is clear to see that the global recovery is not the win that so many governments wish us to believe. |

Global Trade and GBP Growth, 2002-2016 |

| Was cash king?

For many savers, the idea of investing in markets following the financial crisis may have seemed too risky. Instead they may have opted to hold cash than they would have previously. In times of crisis many argue that cash is king. This has certainly been evident in the short-term. However those who decided to hold cash over the last decade, as a form of insurance, will be hurting today. A saver putting away £5,000 each year into the average UK savings account over the last decade would have only seen their savings grow by a stomach-churning 1.2% to £50,619. Cash has been significantly devalued thanks to ongoing monetary easing programs by central banks. Savers have also lost out massively due to record low interest rates. |

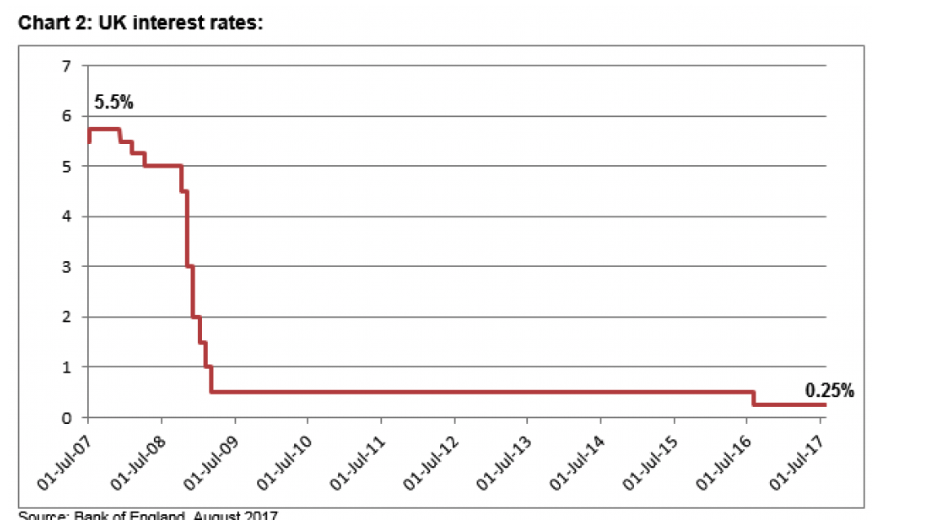

U.K. Interest Rates, Jul 2007-2017 |

| Counterparty risk: the only lesson to be learnt

Gold has stood strong and held its own in the face of pumped up asset classes, low interest rates and increased risk. This is largely thanks to its sovereignty in the marketplace. As we have repeatedly stated gold carries little counterparty risk and serves as a form of financial insurance whilst the walls of both the political and financial system grow increasingly weak. It is a myth that the worst of the financial crisis is over. The trigger to the collapse may well be different to that which took place a decade ago but the situation is very similar. Gold’s long-term rise and strong performance is not over as sadly the financial and geopolitical crises are still ongoing. |

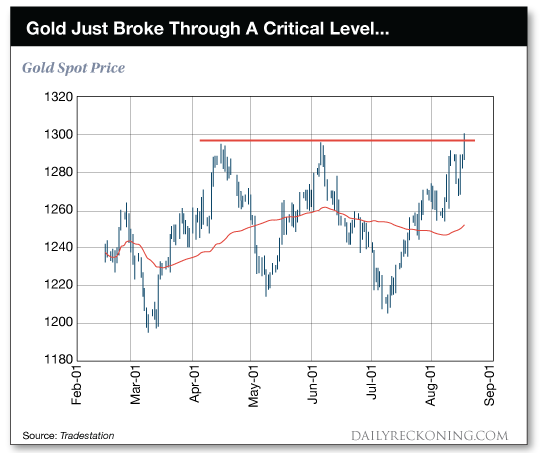

Gold Just Broke Through a Critical Level, Feb-Sep |

Low interest rates have been good news for borrowers. Rates have been low for so long that we are now faced with a generation of borrowers who have never experienced an interest rate rise.

For the UK we have not see interest rates above 5.5% for over ten years. This is great for those looking to get on the housing ladder or borrow for university but this will not be the norm.

Savers who have already been pushed through low rates may soon see further punishment once rates begin to rise and borrowers can no longer service their debts. How banks will cope is a question few people are able to answer.

Low interest rates are not the only impact from the financial crisis on cash savers. Negative rates are the true issue along with bank bail-ins of which few people are aware.

Tags: Daily Market Update,Featured,gold price,manipulating silver,newsletter,silver,silver mining