Over the last number of years, one of the most interesting trends in the physical gold world is the ongoing conversion of large 400 ounce gold bars into smaller high purity 1 kilogram gold bars to meet the insatiable demand of Asian gold markets such as China and India. This transformation of 400 ounce bars into 1 kilogram bars is an established fact and is irrefutable given the large amount of evidence which proves it is happening, as has been documented on the BullionStar website and elsewhere. It is also something which causes plenty of excitement in the gold world as it underscores the huge movement of physical gold from West to East, and the continual depletion of gold inventories from locations such as the

Topics:

Ronan Manly considers the following as important: 400 ounce gold bar, Aelred Connelly, Argor-Heraeus, Bank of England, BullionStar, BullionStar gold bars, China, Chinese gold demand, Featured, gold bars, Hong Kong, India, Indian gold imports, LBMA, LBMA gold, LBMA silver, LBMA vaults, London Bullion Market Association, Metalor, newslettersent, PAMP, Ronan Manly (Bullionstar), Swiss gold refineries, Swiss gold trade, UK gold exports, Uncategorized, Valcambi, wholesale gold bar

This could be interesting, too:

Claudio Grass writes The Case Against Fordism

Nachrichten Ticker - www.finanzen.ch writes Die Performance der Kryptowährungen in KW 9: Das hat sich bei Bitcoin, Ether & Co. getan

Nachrichten Ticker - www.finanzen.ch writes Wer verbirgt sich hinter der Ethereum-Technologie?

Marc Chandler writes March 2025 Monthly

Over the last number of years, one of the most interesting trends in the physical gold world is the ongoing conversion of large 400 ounce gold bars into smaller high purity 1 kilogram gold bars to meet the insatiable demand of Asian gold markets such as China and India.

This transformation of 400 ounce bars into 1 kilogram bars is an established fact and is irrefutable given the large amount of evidence which proves it is happening, as has been documented on the BullionStar website and elsewhere.

It is also something which causes plenty of excitement in the gold world as it underscores the huge movement of physical gold from West to East, and the continual depletion of gold inventories from locations such as the London Gold Market.

The general movement is one of 995 purity 400 ounce gold bars coming out of gold-backed ETFs, central bank gold holdings and other wholesale gold holdings, and these bars making their way to the Swiss refineries where they are transformed / smelted / recast into smaller 9999 high purity gold bars. The smaller gold bars are then exported from Switzerland to India, China, Hong Kong, and the Middle East.

At the same time as the wider gold market acknowledges and publicises this trend, the establishment gold world and bullion banks (as represented by the London Bullion Market Association) tend to downplay this conversion of 400 ounce gold bars into 1 kilogram bars, presumably because it directly highlights the continual drain of real physical gold out of the London vaults into China and India, gold which has little chance of ever coming back again.

For an example of significant downplaying of conversion of 400 ounce gold bars into kilogram gold bars, see BullionStar post from September 2015 titled “Moving the goalposts….The LBMA’s shifting stance on gold refinery production statistics” which documents how a mammoth 2000 tonnes of LBMA gold refinery output attributed to the year 2013, mysteriously disappeared from the LBMA’s publications in early August 2015, after the original figure of 6,601 tonnes had been highlighted on this website, with the original figure being replaced by a far lower 4600 tonnes.

While gold refineries in countries other than Switzerland may be involved in these 400 ounce to 1 kilogram gold bar transformations, the Swiss refineries are the big players in this area, as they say so themselves. The names in question are Valcambi, PAMP, Argor Heraeus and Metalor. For a full understanding of the extent to which these large Swiss gold refineries process 400 ounce gold bars into kilobars and the importance that they attribute to this specific category of refinery activity, please see BullionStar blog from November 2015 titled “From Good Delivery bars to Kilobars – The Swiss Refineries, the GFMS data, and the LBMA“.

| But if you thought the massive conversion of large gold bars into kilogram bars that occurred in years such as 2013 and 2014 was an anomaly or a one-off, then think again. Because it also happened in 2015, and in a very big way. | |

LBMA Update – 2015 Gold Refinery StatisticsIn early May 2017, the London Bullion Market Association published a revised version of its 4 page ‘LBMA Overview Brochure’, the most notable update of which was that it revealed refinery production statistics for 2015 for the gold and silver refineries around the globe that are on the LBMA’s Good Delivery List. |

LBMA refinery statistics 2015 |

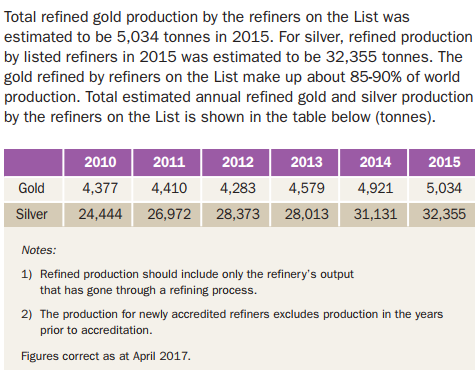

| A table in the updated brochure states that in 2015, the “total refined gold production by the refiners on the List was estimated to be 5,034 tonnes”. The corresponding figure for gold in 2014 was 4921 tonnes.

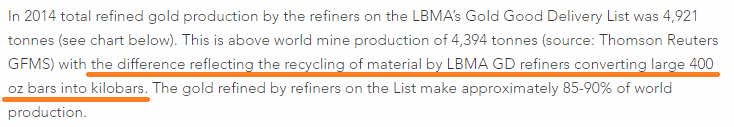

At some point each year, the LBMA will invariable release such refinery statistics, however, the lag in publication is inexplicably long, for example, 2015 data only gets released in May 2017. Why 2016 data is not released in 2017 remains a mystery. This length of lag would not happen in any other industry. Leaving aside this mystery, the 2015 statistics are interesting and worth analysing for a whole lot of reasons, which are discussed below. This year the LBMA update – of the 2015 data – was a very low-key affair indeed and did not even, in the LBMA’s eyes, merit a press release. This differs to May 2016, when the LBMA published 2014 gold and silver refinery statistics and at least accompanied the announcement with a press release which it titled “4,921 tonnes of gold production in 2014 – LBMA GD refiners”. The LBMA’s May 2016 press release stated that 2014 refinery gold production by the refiners on the LBMA’s Gold Good Delivery List for gold totalled 4921 tonnes, and importantly, it attributed the excess over ‘world mine production of 4,394 tonnes‘ to be due to “recycling of material by LBMA GD refiners converting large 400 oz bars into kilobars“. |

LBMA May 2016 Press Release |

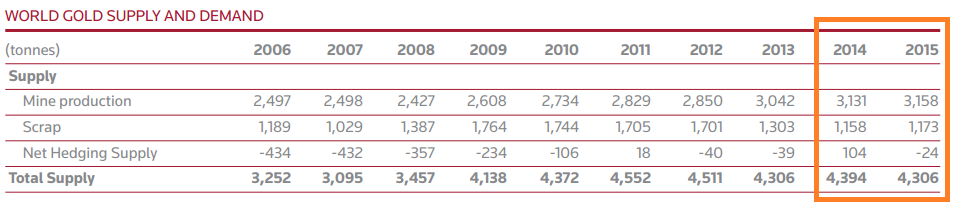

| This reference to ‘world mine production of 4,394 tonnes‘, which was itself attributed to Thomson Reuters GFMS, is incorrect, and the LBMA should have said that “world mine production + scrap recycling + net hedging supply” was 4394 tonnes, as is clear in the Thomson Reuters GFMS table from which the figure of 4394 tonnes was taken. This table is as follows: |

GFMS 2015 |

| The ‘net hedging supply’ category can be ignored as it is not relevant for gold-laden material arriving into gold refineries for processing. What the LBMA should have said in its 2016 press release is that in 2014, the gold refineries on its list (which generate 85% – 95% of world gold refinery output) produced 4921 tonnes of gold, which was in excess of combined gold mining production and scrap recycling i.e. in excess of 3131 + 1158 = 4289 tonnes. This excess was due to “recycling of material by LBMA GD refiners converting large 400 oz bars into kilobars”. |

Argor Heraeus |

| Given that the LBMA gold refiners only represent 85% – 90% of world gold refinery output, and not 100%, the mine and scrap material that they process is only 85% – 90% of global mine production and scrap production. Therefore, the GFMS figures should be scaled back to represent this 85% to 90% range.

It is however not realistic to expect that bullion banks which supply large 400 ounce gold bars to gold refineries for conversion into smaller gold bars would use non-LBMA accredited gold refineries to do so, since a) bullion banks are all members of the LBMA, and b) the London bullion banks use Swiss gold refineries which are all on the LBMA good delivery list. They would therefore not use a more obscure non-LBMA gold refinery, such as one of the smaller Indian gold refineries, to convert large wholesale / central bank gold bars into smaller gold bars. Therefore, what the LBMA press release in May 2016 should really have said is as follows: “In 2014, the gold refineries on the LBMA Good Delivery List (which generate 85% – 95% of world gold refinery output) produced 4921 tonnes of gold. This was in excess of the 85% – 90% of combined gold mining production and scrap gold recycling that these refineries are known to process. The LBMA refineries’ 4921 tonnes of refinery output in 2014 in excess of their mine and scrap processing of 3646 – 3860 tonnes (85% and 90% of combined mine and scrap supply) was due to recycling of material by LBMA GD refiners converting large 400 oz bars into kilobars.” Such a statement would then put conversion of large 400 ounce gold bars into kilogram gold bars by LBMA gold refineries in 2014 at between 1060 and 1275 tonnes of gold (4921 – 3860, and 4921 – 3646). It would also mean that large 400 ounce gold bars from existing above-ground stockpiles were topping up ‘normal’ physical gold supply (gold mining output and scrap recycling) by between 25% and 30% during 2014. These 2014 refinery figures have previously been covered in a BullionStar posting in June 2016. See BullionStar blog “An update on LBMA Refinery Statistics and GFMS”. The important take-away point here is that in 2014 the gold refineries on the LBMA good delivery list generated refined gold output in a distinct category attributed to recycling of material by LBMA good delivery refiners converting large 400 oz bars into kilobars. |

Argor Heraeus |

2015

Fast forwarding now to the 2015 LBMA figures and the 2015 Thomson Reuters GFMS figures, and repeating the above calculations:

For 2015, the LBMA states that the gold refineries on its list had total refined gold output of 5034 tonnes. In 2015, according to Thomson Reuters GFMS, gold mining production was 3158 tonnes, while scrap gold supply was 1173 tonnes, i.e. a combined mine and scrap gold supply of 4331 tonnes.

Since the gold refineries on the LBMA Good Delivery List for gold represent 85% to 90% of ‘world production’, which by LBMA logic is GFMS gold mining production and GFMS scrap recycling, then, these refineries would have processed between 3681 tonnes and 3898 tonnes (85% – 95%) of mine production and scrap supply during 2015.

This then implies that during 2015, these LBMA gold refineries also processed between 1136 tonnes and 1353 tonnes of gold due to converting large 400 oz bars into kilobars.

If the LBMA had have written a press release in May 2017 to coincide with updating its table of the output of LBMA Good Delivery refineries, it should have read something like the following:

“In 2015, the gold refineries on the LBMA Good Delivery List (which generate 85% – 95% of world gold refinery output) produced 5034 tonnes of gold. This was in excess of the 85% – 90% of combined gold mining production and scrap gold recycling that these refineries are known to process. The LBMA refineries’ 5034 tonnes of refinery output in 2015 in excess of their mine and scrap processing of 3681 – 3898 tonnes (85% and 90% of combined mine and scrap supply) was due to recycling of material by LBMA GD refiners converting large 400 oz bars into kilobars, which was in the range of 1136 to 1353 tonnes.”

Where would these huge quantities of 400 ounce gold bars have come from that were melted down during 2015, predominantly or even exclusively by the Swiss gold refineries? Because 1136 to 1353 tonnes of large wholesale market gold bars is a lot of gold. The most likely source of this gold is from the London Gold Market. Beyond that, gold which was already stored in Switzerland is also a possible pool from which to draw from.

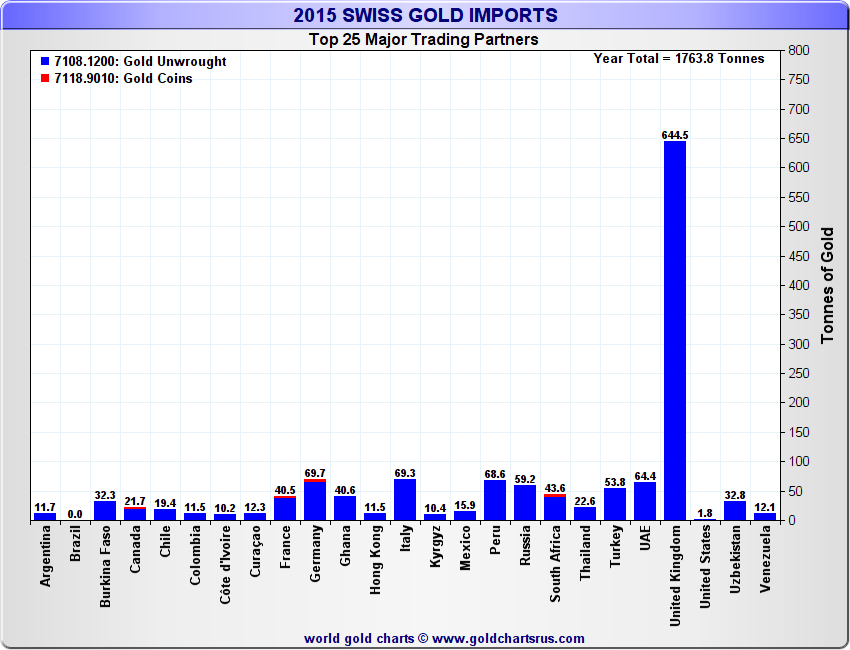

2015 UK to Switzerland Gold ExportsDuring 2015, Switzerland imported 1853 tonnes of non-monetary gold, and exported 1861 tonnes of non-monetary gold. By far the largest source of Swiss gold imports during 2015 was ‘the UK’, which in this case really means the London Gold Market. Non-monetary gold is just gold which is not monetary (central bank) gold. Non-monetary gold shows up on trade statistics. Monetary gold does not show up on trade statistics since central banks get an exemption from revealing physical movements of monetary gold across national borders. During 2015, Switzerland imported 644.5 tonnes of non-monetary gold from the UK (London). You can see from the below graph that no other source country came anywhere close to supplying non-monetary gold to Switzerland in 2015, with the next largest source countries each only sending less than 70 tonnes of gold to Switzerland. And London does not have any gold mines nor any major scrap gold collection facilities. Some of the other exporters of gold to Switzerland during 2015 were France, Germany, Italy and UAE/Dubai (none of which are gold mining countries), and South Africa, Russia, Peru (which have gold mining). Some of the gold sent from France, Germany, Italy and UAE was obviously scrap. Some of the gold sent from South Africa, Russia and Peru was most likely gold mining ore or gold doré. But somewhere within these numbers, there was also most likely good delivery gold bars. For example, why would Russia or South Africa send gold mining ore or gold doré or scrap to Switzerland when they have their own perfectly good gold refineries with huge capacity. |

Swiss Gold Imports, YoY 2015(see more posts on Swiss gold imports, ) The UK (London) was the biggest source of Swiss gold imports during 2015 Source: GoldChartsRUS - Click to enlarge |

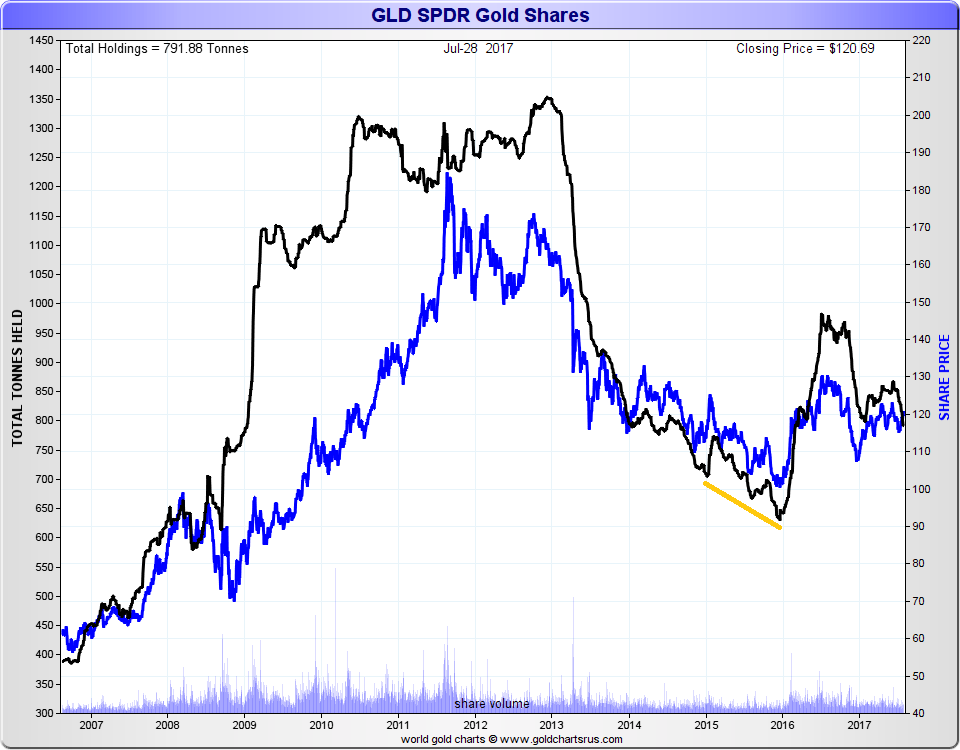

| Surprising perhaps, the largest gold-backed ETF, the SPDR Gold Trust (GLD) did not lose that much gold during 2015, with only a net 65 tonne gold loss. This is more so because the damage to GLD’s gold holdings had really been done in mostly in 2013 and to a lesser extent in 2014 when holdings had fallen from the 1350 tonne range down to the 700 tonne range. See chart. |

Gold SPDR Shares, 2007 - 2017(see more posts on Gold, ) SPDR Gold Trust – gold holdings 2007-2017 (black line). 2015 indicated in gold line Source: GoldChartsRus - Click to enlarge |

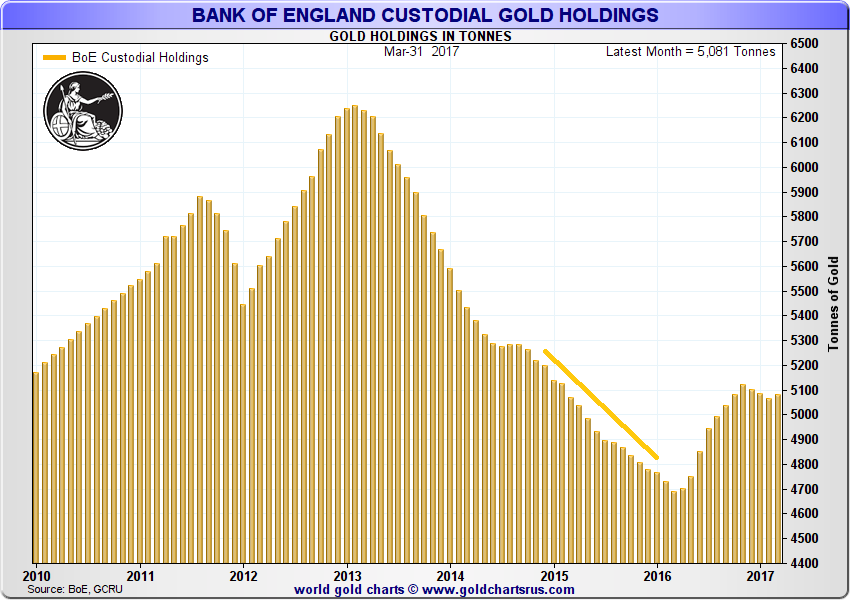

| Based on recently released data from the Bank of England, it can be seen that during 2015 the Bank of England gold vaults lost 13.5 million ounces of gold, with Bank of England total gold holdings dropping from 167.2 million ounces at the end of 2014 to 153.6 million ounces at the end of 2015. This is equivalent to a 421 tonne loss of gold from the Bank of England vaults during 2015. All gold held in the Bank of England is in the form of Good Delivery gold bars (i.e. the large 400 ounce gold bars. |

Bank of England Custodial Gold Holdings, 2010 - 2017(see more posts on Bank of England, Gold, ) Custody gold holdings at the Bank of England 2010 – 2017, 2015 indicated in gold line. Source: GoldChartsRus - Click to enlarge |

Whether gold lost from the Bank of England vaults during 2015 was central bank gold or bullion bank (commercial bank) gold is unclear since the Bank of England does not provide a breakdown of figures. It’s possible that some of this gold that left the Bank of England during 2015 was converted from monetary gold to non-monetary gold, and then sent to Switzerland to be transformed into kilogram gold bars. This would then show up in the Swiss trade statistics. If extracted from the Bank of England vaults and left as monetary gold and then exported to Switzerland, it would not show up in Swiss trade statistics.

If 644 tonnes of non-monetary gold, as per the Swiss trade statistics, were sent from London to Switzerland during 2015, and another 421 tonnes of monetary gold from the Bank of England were also sent to Switzerland during 2015, this in total would be 1065 tonnes of gold. This quantum would begin to account for the range of 1136 to 1353 tonnes being converted from 400 oz gold bars into 1 kilogram gold bars that the 2015 LBMA gold refinery statistics imply. Add in another 100 – 200 tonnes of Good Delivery bars from sources such as Russia, South Africa and Dubai and this huge scale of 400 ounce bar conversion begins to look achievable. There could also be Good Delivery bars flowing out of Swiss central bank vaults directly, i.e. the Swiss National Bank (SNB) gold vaults in Berne, which would not show up on any inbound gold trade customs statistics.

Within a 3 year period, we can see roughly that the following quantities of large gold bars were melted down into kilogram bars and sent to Asia:

- 2013: about 2000 tonnes of gold

- 2014: between 1060 and 1275 tonnes of gold

- 2015: between 1136 to 1353 tonnes of gold

Overall, within the 2013 – 2015 period that is about 4200 – 4600 tonnes of gold being converted into kilogram and other smaller denomination high purity gold bars and sent to markets in China, India, Hong Kong and elsewhere in Asia. This is gold above and beyond mine supply and scrap supply. Where has all of this gold come from? Some of it is proven to be from gold-backed ETFs. Some is most probably also from central bank vaults, in which case the central banks do not have the gold that they claim to have. Which everybody know anyway, as much central bank gold has been lent out and is merely a fiction on the central bank balance sheets. But there may also be other stockpiles of Good Delivery gold bars which are also feeding this huge trend. Until the LBMA begins to publish its vault statistics, any grey area unreported gold vault inventories in London are still being kept in the dark.

If the trend of raiding ETFs and borrowing central bank gold to send to Switzerland to convert into kilogram bars for the Asian markets continues, then this is not and cannot be sustainable. The question is how long it can remain sustainable, in other words when will it become unsustainable?

Tags: 400 ounce gold bar,Aelred Connelly,Argor-Heraeus,Bank of England,BullionStar,BullionStar gold bars,China,Chinese gold demand,Featured,gold bars,Hong Kong,India,Indian gold imports,LBMA,LBMA gold,LBMA silver,LBMA vaults,London Bullion Market Association,Metalor,newslettersent,PAMP,Swiss gold refineries,Swiss gold trade,UK gold exports,Uncategorized,Valcambi,wholesale gold bar