The headline reads “Moscow World Standard to Destroy LBMA’s Monopoly in Precious Metals Pricing”. Wow! Could it be? Is this it?! The gold revaluation we’ve all been waiting for! Someone, who has the power, will give us a venue in which we can sell our gold at its true price… how does $50,000 sound, eh? Not so fast. Betting Against the Incumbent? For one thing, there are sanctions. If you’re a citizen of a Western country, there is a legal barrier between you and a...

Read More »Does the recent spate of Central Bank gold buying impact demand and price?

There has been a lot of media coverage recently about the re-emergence of central bank gold buying and the overall larger quantity of gold than central banks as a group have been buying recently compared to previous years. For example, according to the World Gold Council’s Gold Demand Trends for Q3 2018, net purchases of gold by central banks in the third quarter of this year were 22% higher than Q3 2017, and the...

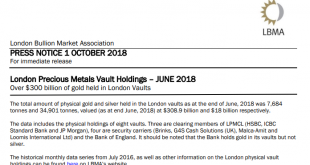

Read More »LBMA Clearing and Vaulting data reveal the absurdity of the London ‘Gold’ Market

The first day of each month sees the reporting of a number of statistics about the London Gold Market by the bullion bank led London Bullion Market Association (LBMA). These statistics focus on clearing data and vault holdings data and are reported in a 1 month lag basis for clearing activity and a 3 month lag basis for vault holdings data. Therefore the latest clearing data just published is for the month of August,...

Read More »Spoofing Futures and Banging Fixes: Same Banks, Same Trading Desks

On 29 January 2018, the Commodity Futures Trading Commission (CFTC) Division of Enforcement together with the Criminal Division of the US Department of Justice and the FBI announced criminal and civil enforcement actions against 3 global investment banks and 5 traders for involvement in trade spoofing in precious metals futures contracts on the US-based Commodity Exchange (COMEX). COMEX is by far the largest and most...

Read More »US Gold & Silver Futures Markets: “Easy” Targets

Following news coverage of the charging of five precious metals traders and three banks in January, Commodities Futures Trading Commission and Department of Justice documents reveal a global criminal cabal of 16 traders operating in at least four major financial institutions between 2008 and 2015 to defraud COMEX gold and silver futures markets. Of the many examples published, one reveals a UBS AG precious metals...

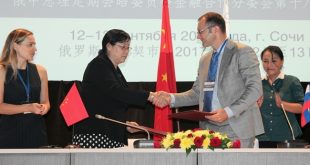

Read More »Russia, China and BRICS: A New Gold Trading Network

One of the most notable events in Russia’s precious metals market calendar is the annual “Russian Bullion Market” conference. Formerly known as the Russian Bullion Awards, this conference, now in its 10th year, took place this year on Friday 24 November in Moscow. Among the speakers lined up, the most notable inclusion was probably Sergey Shvetsov, First Deputy Chairman of Russia’s central bank, the Bank of Russia. In...

Read More »The West lost at least another 1000 tonnes of large gold bars in 2015

Over the last number of years, one of the most interesting trends in the physical gold world is the ongoing conversion of large 400 ounce gold bars into smaller high purity 1 kilogram gold bars to meet the insatiable demand of Asian gold markets such as China and India. This transformation of 400 ounce bars into 1 kilogram bars is an established fact and is irrefutable given the large amount of evidence which proves it...

Read More »Bank of England releases new data on its gold vault holdings

An article in February on BullionStar’s website titled “A Chink of Light into London’s Gold Vaults?” discussed an upcoming development in the London Gold Market, namely that both the Bank of England (BoE) and the commercial gold vault providers in London planned to begin publishing regular data on the quantity of physical gold actually stored in their gold vaults. Critically, this physical gold stored at both the Bank...

Read More »Death Spiral for the LBMA Gold and Silver auctions?

In a bizarre series of events that have had limited coverage but which are sure to have far-reaching consequences for benchmark pricing in the precious metals markets, the LBMA Gold Price and LBMA Silver Price auctions both experienced embarrassing trading glitches over consecutive trading days on Monday 10 April and Tuesday 11 April. At the outset, its worth remembering that both of these London-based benchmarks are...

Read More » Swiss Economicblogs.org

Swiss Economicblogs.org