Headlines Week April 10, 2017 We were arguing in the previous months, that the EUR/CHF is trending towards parity. There are three reasons: Continuing SNB interventions Strengthening Swiss local demand, as also visible in the GDP release. Speculators increase their dollar shorts against Euro and reduce them against CHF. The tendency of point 3 had been interrupted when the ECB appeared to be less dovish. FX Last Week: Low Eurozone inflation let the euro fall again versus both dollar and Swiss franc. The EUR/CHF ended at 1.0680 for the week. At the End of march, Eurozone inflation data was released. Core inflation has even fallen from 0.9 to 0.7%. Therefore a ECB rate hike will not come soon. This implies that the EUR/CHF may fall towards parity in the next two years. The SNB might allow this because of the positive developments in Swiss internal demand mentioned above. Euro/Swiss Franc FX Cross Rate, April 10(see more posts on EUR/CHF, ) Source: markets.ft.com - Click to enlarge . SNB sight deposits Swiss private investors do not export their massive trade surplus with purchases assets in foreign currency, apparently because valuations of stock markets are too high and bond rates are too low still. As consequence the SNB intervenes and takes the risk that private investors do not want.

Topics:

George Dorgan considers the following as important: currency reserves. intervention, Featured, monetary data, newslettersent, SNB, SNB sight deposits

This could be interesting, too:

investrends.ch writes Der Franken und die Grenzen der Geldpolitik

investrends.ch writes UBS-Prognose: Dollar tendiert seitwärts – Euro steigert sich

investrends.ch writes SNB passt Verzinsung von Sichtguthaben erneut nach unten an

investrends.ch writes Inflation 2025 auf tiefstem Stand seit fünf Jahren

Headlines Week April 10, 2017

We were arguing in the previous months, that the EUR/CHF is trending towards parity. There are three reasons:

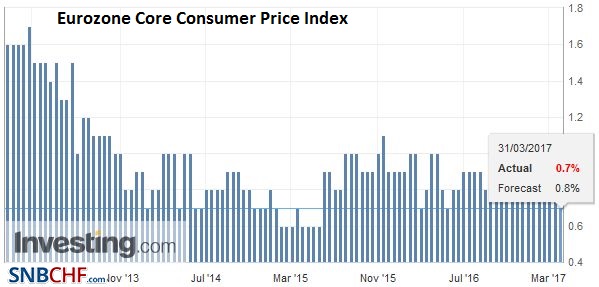

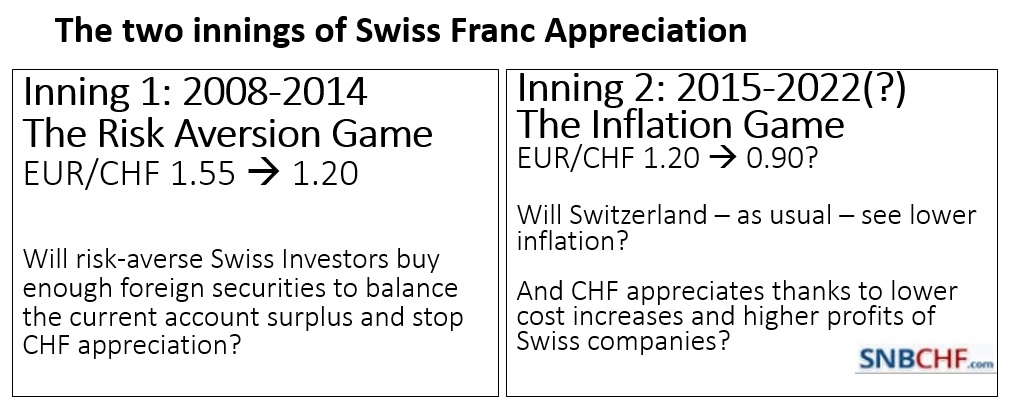

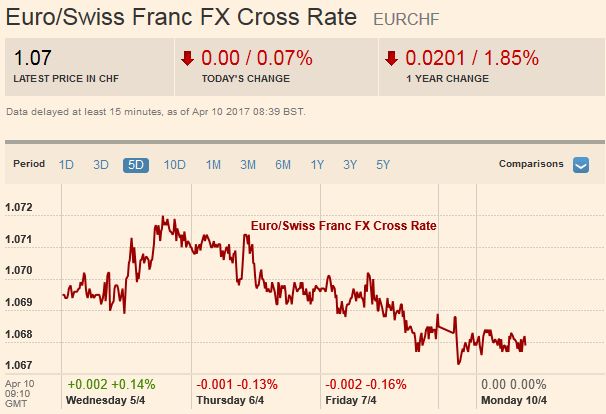

The tendency of point 3 had been interrupted when the ECB appeared to be less dovish. FX Last Week: Low Eurozone inflation let the euro fall again versus both dollar and Swiss franc. The EUR/CHF ended at 1.0680 for the week. At the End of march, Eurozone inflation data was released. Core inflation has even fallen from 0.9 to 0.7%. Therefore a ECB rate hike will not come soon. This implies that the EUR/CHF may fall towards parity in the next two years. The SNB might allow this because of the positive developments in Swiss internal demand mentioned above. |

Euro/Swiss Franc FX Cross Rate, April 10(see more posts on EUR/CHF, ) Source: markets.ft.com - Click to enlarge |

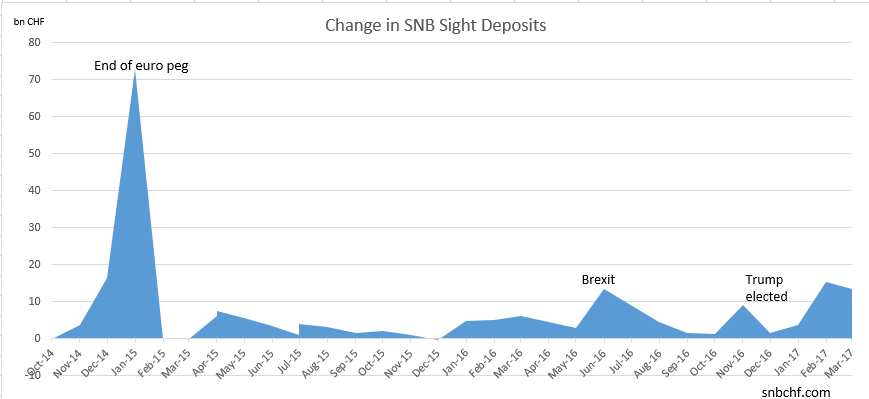

SNB sight depositsSwiss private investors do not export their massive trade surplus with purchases assets in foreign currency, apparently because valuations of stock markets are too high and bond rates are too low still. As consequence the SNB intervenes and takes the risk that private investors do not want. With this measure she either risks its bankruptcy or – over the long-term – she deviates from its mandate to avoid inflation. The last time she realized that was in January 2015, when the peg broke. We should remind that the EUR/CHF is clearly higher than the 0.90 that we expect in a couple of years – in the case of a combination of inflation and recession. Intervening at elevated exchange rates – buying euros at 1.08 or dollars at 1.00 – is risky. It obliges the SNB to accumulate owners’ capital – for example with dividends and coupons. Thinking that stock markets will always go up, is an illusion. Last week’s data: |

Change in SNB Sight Deposits March 2017(see more posts on SNB sight deposits, ) Source: SNB - Click to enlarge Two Innings of Swiss Franc Appreciation |

Speculative PositionsSpeculators were net short CHF in January 2015, shortly before the end of the peg, with 26.4K contracts. Then again in December 2015, when they expected a Fed rate hike, with 25.5K contracts.The biggest short CHF, however, happened in June 2007, when speculators were net short 80K contracts. Shortly after, the U.S. subprime crisis started. The carry trade against CHF collapsed. The reverse carry trade in form of the Long CHF started and lasted - without some interruptions - until the peg introduction in September 2011. In mid 2011, the long CHF trade became a proper carry trade - and not a reverse carry trade anymore - because investors thought that the SNB would hike rates earlier than the Fed. Last data as of April 4: In the last week, speculators reduced their CHF net short position to 13K contracts (against USD). |

Speculative Positions

source Oanda |

| Date of data (+ link to source) | avg. EUR/CHF during period | avg. EUR/USD during period | Events | Net Speculative CFTC Position CHF against USD | Delta sight deposits if >0 then SNB intervention | Total Sight Deposits | Sight Deposits @SNB from Swiss banks | “Other Sight Deposits” @SNB (other than Swiss banks) |

|---|---|---|---|---|---|---|---|---|

| 07 April | 1.0696 | 1.0648 | US GDP release | -13825X125K | +2.4 bn. per week | 564.1 bn. | 476.2 bn. | 87.9 bn. |

| 31 March | 1.0709 | 1.0754 | Eurozone core inflation only at 0.7% | -16392X125K | +1.6 bn. per week | 561.7 bn. | 475.1 bn. | 86.6 bn. |

| 24 March | 1.0718 | 1.0786 | Fed meeting | -11979X125K | +2.9 bn. per week | 560.1 bn. | 476.3 bn. | 83.8 bn. |

| 17 March | 1.0726 | 1.0699 | SNB meeting | -8997X125K | +1.8 bn. per week | 557.2 bn. | 470.9 bn. | 86.3 bn. |

| 10 March | 1.0722 | 1.0587 | ECB meeting | -10016X125K | +2.1 bn. per week | 555.4 bn. | 467.4 bn. | 88 bn. |

For the full background of sight deposits and speculative positions see

SNB Sight Deposits and CHF Speculative Positions

Tags: currency reserves. intervention,Featured,monetary data,newslettersent,SNB sight deposits