Swiss Franc EUR/CHF - Euro Swiss Franc, May 10(see more posts on EUR/CHF, ) - Click to enlarge FX Rates Investors absorbed a few developments that might have been disruptive for the markets with little fanfare. North Korea’s ambassador to the UK warned that his country would go ahead with its sixth nuclear test, as South Korea elected a new president who wants to reduce tensions on the peninsula. The Dollar Index gapped lower in response to the first round of the French election. That gap was closed yesterday and the Dollar Index in the upper half of yesterday’s range. If it can hold on to the recent gains, the five-day moving average can cross back above the 20-day for the first time in a nearly a month. A similar gap in the euro, however, has not been filled. The gap is found between .0738 and .0821. The 20-day average is found near .0830, and the euro has not closed below that average since April 17. The 200-day average is also at .0830. Sterling remains firm but continues to encounter selling pressures in front of .30. Initial support is seen near .29. The Bank of England meets tomorrow.

Topics:

Marc Chandler considers the following as important: $CNY, AUD, CAD, China Consumer Price Index, China Producer Price Index, EUR, EUR/CHF, Featured, FX Daily, FX Trends, GBP, Italy Industrial Production, JPY, Korea, newsletter, Oil, U.S. Crude Oil Inventories, USD

This could be interesting, too:

Nachrichten Ticker - www.finanzen.ch writes Die Performance der Kryptowährungen in KW 9: Das hat sich bei Bitcoin, Ether & Co. getan

Nachrichten Ticker - www.finanzen.ch writes Wer verbirgt sich hinter der Ethereum-Technologie?

Martin Hartmann writes Eine Analyse nach den Lehren von Milton Friedman

Marc Chandler writes March 2025 Monthly

Swiss Franc |

EUR/CHF - Euro Swiss Franc, May 10(see more posts on EUR/CHF, ) |

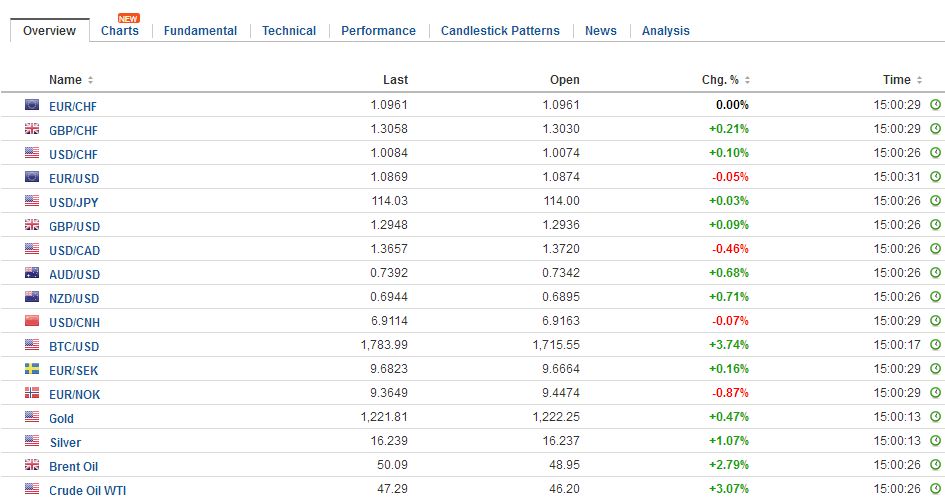

FX RatesInvestors absorbed a few developments that might have been disruptive for the markets with little fanfare. North Korea’s ambassador to the UK warned that his country would go ahead with its sixth nuclear test, as South Korea elected a new president who wants to reduce tensions on the peninsula. The Dollar Index gapped lower in response to the first round of the French election. That gap was closed yesterday and the Dollar Index in the upper half of yesterday’s range. If it can hold on to the recent gains, the five-day moving average can cross back above the 20-day for the first time in a nearly a month. A similar gap in the euro, however, has not been filled. The gap is found between $1.0738 and $1.0821. The 20-day average is found near $1.0830, and the euro has not closed below that average since April 17. The 200-day average is also at $1.0830. Sterling remains firm but continues to encounter selling pressures in front of $1.30. Initial support is seen near $1.29. The Bank of England meets tomorrow. Although no change in policy is warranted, the MPC may recognize the continued resilience of the economy, and reiterate its patience with an overshoot of inflation is not boundless, which could see another attempt on the $1.3000-$1.3055 objectives. Forbes who dissented at the last meeting, in favor of an immediate hike, is likely to dissent again. It is unlikely that she convinced any of her colleagues, and if she did, that could also see sterling spike higher. |

FX Daily Rates, May 10 |

| South Korea equities fell nearly 1% from record highs, while the MSCI Asia Pacific Index rose 0.2%. The Korean won fell 0.4% and is the weakest among emerging market currencies. The dollar has pulled back against the yen. Yesterday in the North American afternoon, the dollar was stretching through JPY114.30 when the news broke and pushed it back below the figure. The dollar held above JPY113.60 in Asia, and before Europe opened, it made an attempt to resurface above JPY114.00 but met new sellers. Recall last week; the dollar finished near JPY112.70. The price action may be best understood as consolidation, perhaps encouraged by the couple basis point pullback in the US 10-year yield.

Dollar-bloc currencies are consolidating. The Australian dollar’s losses were extended yesterday on the back of soft retail sales. The government’s budget proposals showed a wider than expected deficit, but many focused on the new tax on banks. The Australian equity market rose 0.6%, and although financial stocks gained (0.2%), bank shares remained under pressures. The US dollar recorded a key reversal against the Canadian dollar at the end of last week, but so far this week, it has traded within last Friday’s trading range. It continues to straddle the CAD1.37 area. Recall that speculators in the futures market had a record large gross short Canadian dollar position as of a week ago. |

FX Performance, May 10 |

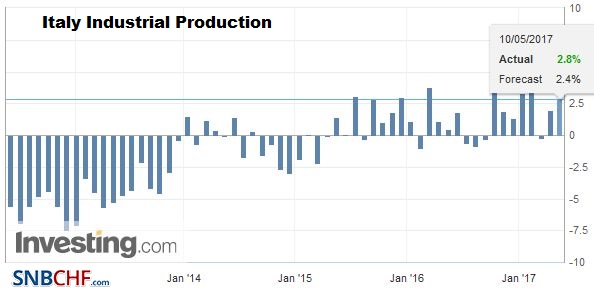

ItalyIt has not often been when it can be said, but Italy reported a larger than expected rise in March industrial output. The 0.4% increase builds on the 1.0% rise in February. On a workday adjusted basis, Italian industrial output rose 2.8% compared with the 2.0% pace seen in February. Next week Italy will report Q1 GDP. It is expected to rise 0.2%, the same as in Q4 16. |

Italy Industrial Production YoY, March 2017(see more posts on Italy Industrial Production, ) Source: investing.com - Click to enlarge |

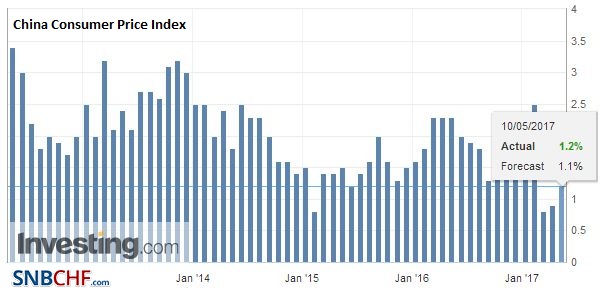

ChinaThe economic news has been largely limited today to China’s price gauges and Italy’s industrial output figures. China’s CPI ticked up to 1.1% from 0.9%; It was 2.1% at the end of last year. |

China Consumer Price Index, April 2017(see more posts on China Consumer Price Index, ) Source: Investing.com - Click to enlarge |

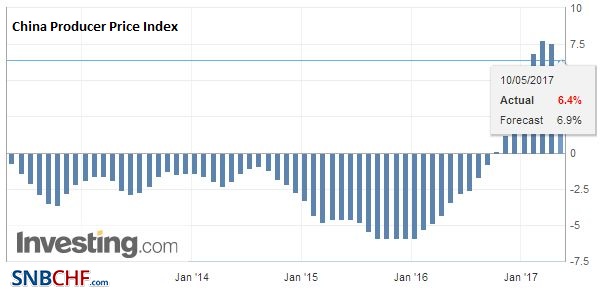

| The subdued price pressures will give officials room to stimulate later this year if needed, and the 0.4% decline in the month-over-month measure of producer prices may warn that it may indeed be needed. PPI rose 6.4% year-over-year. The median in the Bloomberg survey expected a 6.7% increase after 7.6% in March. The moderation comes as commodity prices, such as iron ore, steel, and oil prices retreated. The government has used the better growth numbers to focus on the credit excesses and to tighten lending to the housing market. The Chinese yuan is flat. It is up almost 0.6% against the dollar this year, and for the fourth month, it is in narrow ranges. |

China Producer Price Index, April 2017(see more posts on China Producer Price Index, ) Source: Investing.com - Click to enlarge |

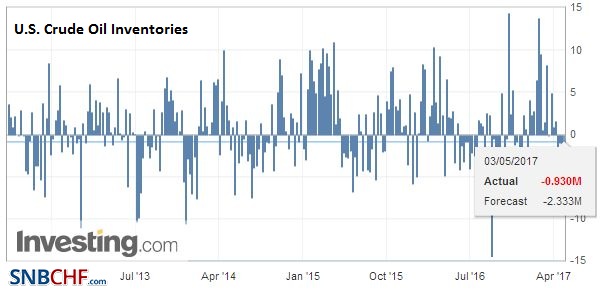

United StatesThe American Petroleum Institute estimated that US oil inventories fell for a fifth consecutive week, and the 5.8 mln barrel draw down was the most so far this year. Gasoline inventories rose (3.17 mln barrels) in line with the seasonal build, while distillates stocks fell 1.17 mln barrels. June light sweet crude oil stabilized and is holding above $46 a barrel. Recall that a month ago, the futures contract was near $54 a barrel and plunged to $44 at the start of this week. The bounce is muted and needs to rise above $48 to be of technical significance. The EIA is expected to show oil inventories fell 2.1 mln barrels. Since the beginning of March, the EIA’s estimates of US oil stocks has alternated between builds and draw downs. The anticipated draw down would keep the pattern intact. On the supply side, the EIA estimate of US output this year and next from forecasts made last month. Meanwhile, as the May 25 OPEC meeting approaches, there is talk about extending the output cuts not just until the end of the year but into next year as well. |

U.S. Crude Oil Inventories, April 2017(see more posts on U.S. Crude Oil Inventories, ) Source: Investing.com - Click to enlarge |

President Trump fired the widely criticized director of the FBI yesterday. It is unusual for a president to fire the head of the FBI. The optics are horrible as the FBI was investigating the campaign’s ties to Russia. However, the impact the Administration’s economic agenda is minimal, and while the drama will continue to play out, it is a domestic political story. It still seems important to keep in mind that although Trump’s overall approval rating is low in relative and absolute terms, he continues to draw high levels of support from the Republican constituency.

Today’s US calendar features the import and export prices ahead of tomorrow’s PPI report. Friday sees the more important CPI and retail sales. The Fed’s Rosengren and Kashkari speak today. Dudley speaks tomorrow. The Canadian calendar is light today and sees March house prices tomorrow.

Eurozone

European shares have been unable to match the minor strength seen in Asia. The Dow Jones Stoxx 600 is off about 0.2%, led by industrials and telecoms. Energy and utilities are posting small gains. Energy relates to the firmer oil story, while the rise the utility sector may have been helped by the decline in bond yields.

Graphs and additional information on Swiss Franc by the snbchf team.

Tags: #GBP,#USD,$AUD,$CAD,$CNY,$EUR,$JPY,China Consumer Price Index,China Producer Price Index,EUR/CHF,Featured,FX Daily,Italy Industrial Production,Korea,newsletter,OIL,U.S. Crude Oil Inventories