EUR/CHF The SNB is intervening for 3 bn. CHF per week, this is far too much at these elevated Euro and Dollar levels. With two times positive economic data (here and here) about good news on internal demand, she might be finally be ready to let the euro fall. EUR/CHF - Euro Swiss Franc, March 30(see more posts on EUR/CHF, ) - Click to enlarge GBP/CHF The Pound to Swiss Franc exchange rate has opened up flat this morning, trading at around the 1.2385 mark at the mid-market level. With the triggering of Article 50 yesterday many were under the impression that the Pound would fall further, but it appears that the Brexit and the fears/uncertainty surrounding it appear to have been priced into the Pounds current value. Since the unexpected Brexit vote the Pound has lost 15% against the Swiss Franc with its lowest level being hit in October last year. During this time the Pound fell below 1.20 as fears emerged that the UK would be going through a messy divorce with the EU although those fears now appear to have faded. Moving forward I’m expecting to see the Pound continue its recovery against CHF, although I wouldn’t expect to see the Pound hit its pre-Brexit levels anytime soon.

Topics:

Marc Chandler considers the following as important: EUR, Eurozone Consumer Confidence, Featured, FX Trends, GBP, Germany Consumer Price Index, JPY, newslettersent, Spain Consumer Price Index, U.S. Consumer Spending, U.S. Core PCE Price Index, U.S. Corporate Profits, U.S. Gross Domestic Product, USD

This could be interesting, too:

Nachrichten Ticker - www.finanzen.ch writes Die Performance der Kryptowährungen in KW 9: Das hat sich bei Bitcoin, Ether & Co. getan

Nachrichten Ticker - www.finanzen.ch writes Wer verbirgt sich hinter der Ethereum-Technologie?

Marc Chandler writes March 2025 Monthly

Mark Thornton writes Is Amazon a Union-Busting Leviathan?

EUR/CHFThe SNB is intervening for 3 bn. CHF per week, this is far too much at these elevated Euro and Dollar levels. With two times positive economic data (here and here) about good news on internal demand, she might be finally be ready to let the euro fall. |

EUR/CHF - Euro Swiss Franc, March 30(see more posts on EUR/CHF, ) |

GBP/CHFThe Pound to Swiss Franc exchange rate has opened up flat this morning, trading at around the 1.2385 mark at the mid-market level. With the triggering of Article 50 yesterday many were under the impression that the Pound would fall further, but it appears that the Brexit and the fears/uncertainty surrounding it appear to have been priced into the Pounds current value. Since the unexpected Brexit vote the Pound has lost 15% against the Swiss Franc with its lowest level being hit in October last year. During this time the Pound fell below 1.20 as fears emerged that the UK would be going through a messy divorce with the EU although those fears now appear to have faded. Moving forward I’m expecting to see the Pound continue its recovery against CHF, although I wouldn’t expect to see the Pound hit its pre-Brexit levels anytime soon. I think that how the Brexit negotiations unfold could have a major influence on Sterling’s value as this is likely to be the key topic for GBP exchange rates moving forward. There is also a high likelihood of an interest rate hike from the Bank of England in order to counter rising inflation levels in the UK, and this would likely give Sterling a boost helping the pair climb above 1.25. |

GBP/CHF - British Pound Swiss Franc, March 30(see more posts on GBP/CHF, ) |

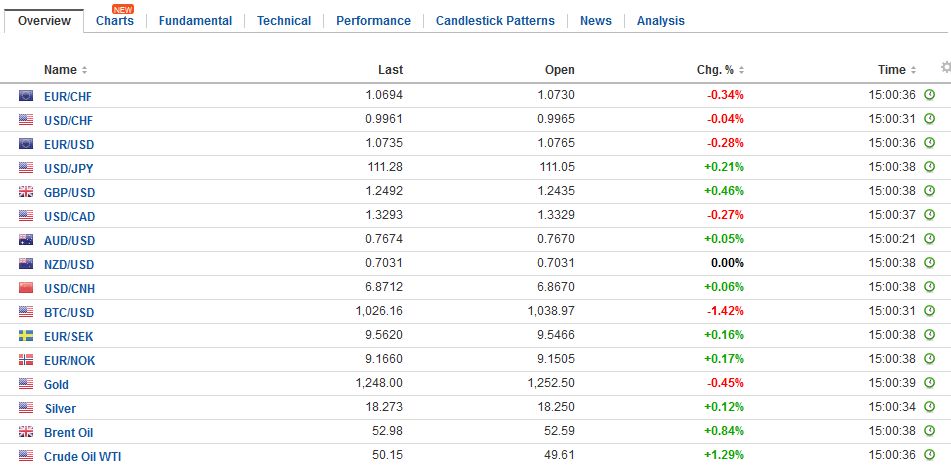

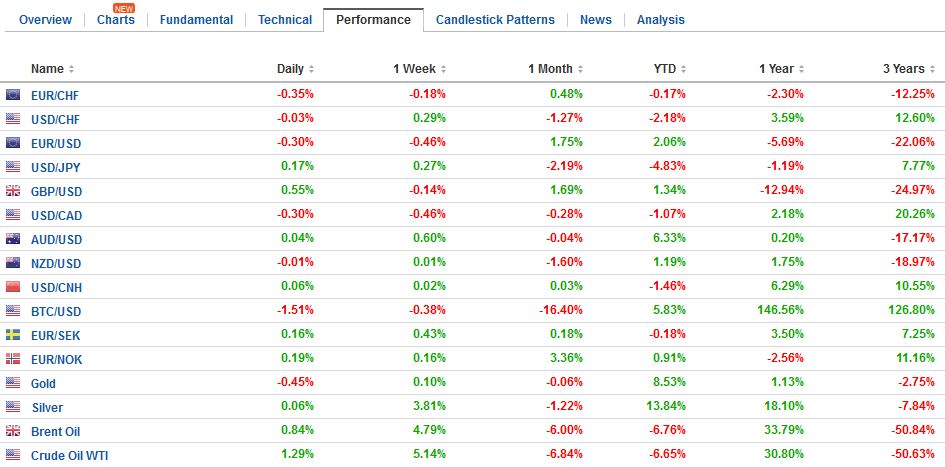

FX RatesThe US dollar starts the North American session narrowly mixed. Sterling, the Australian dollar, and Swiss franc are enjoying small gains. The Scandis, the New Zealand dollar and euro are nursing small losses. The euro is trading lower for the third consecutive session. It reached almost $1.0730 after having traded a little above $1.09 on Monday. There are several technical targets in the $1.0710-$1.0720. A convincing break seems unlikely now, if it does yield, the $1.06 area would be the next target. |

FX Daily Rates, March 30 |

| The US 10-year yield is struggling to resurface above 2.40%, and the dollar is struggling to gain much above JPY111.00. The high for the week was set earlier today just below JPY111.50.

Sterling dipped briefly below $1.24 yesterday and is holding above there today. A move above $1.25 is needed to lift the tone. It seems to early to put much importance in the initial banter between the UK and the EU. Although Prime Minister May has reject the “hard” or “soft” exit that observers use, but it does not change the fact that the EU is going to drive a very difficult negotiation in which it is difficult to envision a way for the UK to maintain access to a single market without significant concessions on the freedom of movement. |

FX Performance, March 30 |

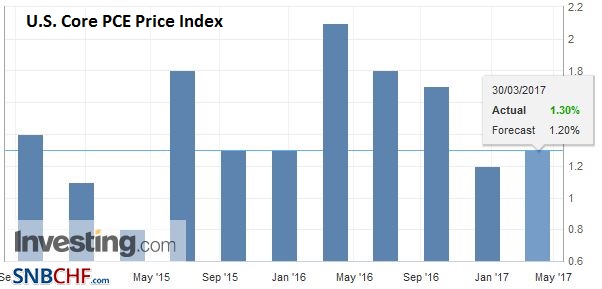

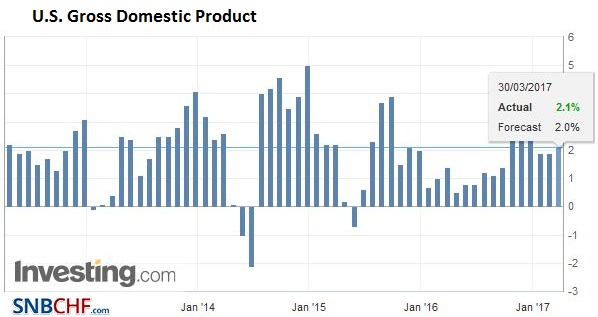

United StatesThe main talking point the improved signals from the US and the more cautious tone from Europe. In the US, there is talk of a compromise on health care reform a week after the bill was pulled to avoid defeat. In some ways, the issue comes down to whether a compromise can be found between the Freedom Caucus, a conservative group within the Republican Party, and the Tuesday Group of more moderate Republicans. Meanwhile, there is continued efforts to prepare for tax reform, and there are some reports suggesting the infrastructure initiative could be brought forward into this year from next. |

U.S. Gross Domestic Product (GDP), February 2017(see more posts on U.S. Gross Domestic Product, ) Source: Investing.com - Click to enlarge |

| At the same time, signals from the Trump Administration suggest moderating views on reform of NAFTA (and the peso has responded favorably), and that the US reluctance under Obama to regard China as a market economy (for WTO purposes) may be reconsidered. If these do come to fruition, it underscores advice to recognize that unlike comments from other heads of state, Trumps remarks to a great extent should be regarded as negotiating ploys. The bark may be worse than the bite. |

U.S. Corporate Profits, February 2017(see more posts on U.S. Corporate Profits, ) Source: Investing.com - Click to enlarge |

| Separately, in recent days, at least three regional Fed Presidents (Rosengren, Williams, and Evans) seemed to suggest upside risks to the Fed’s view. To be sure, the Fed’s leadership (Yellen, Fischer and Dudley) is more cautious, but even the two hikes that Fischer confirmed were likely over the remainder of the year are not fully discounted. The market has serious doubts. According to Bloomberg, the market does not have more than a 45% chance of one more hike discounted. The probability that Fed funds target range is 1.25%-1.50% at the end of this year is about one in three. |

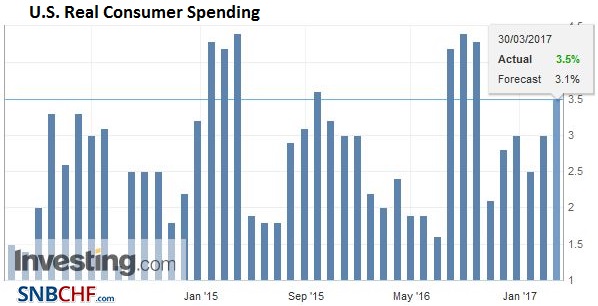

U.S. Real Consumer Spending, February 2017(see more posts on U.S. Consumer Spending, ) Source: Investing.com - Click to enlarge |

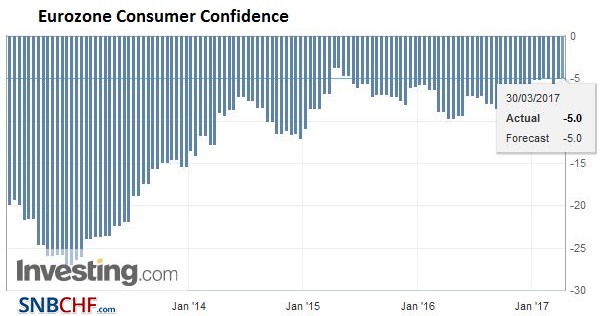

EurozoneIn Europe there has been a push against the hawkishness that had begun creeping into the market, encouraged by some official talk. The softer inflation numbers from Spain and Germany ahead of tomorrow’s flash reading for the eurozone as a whole helped underscore the less hawkish signal from the ECB. |

Eurozone Consumer Confidence, February 2017(see more posts on Eurozone Consumer Confidence, ) Source: Investing.com - Click to enlarge |

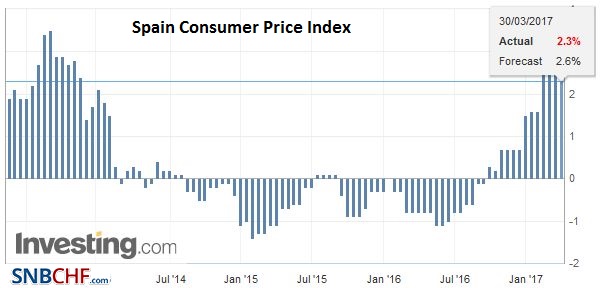

SpainSpain’s CPI fell to 2.3% from 3.0%. |

Spain Consumer Price Index (CPI) YoY, February 2017(see more posts on Spain Consumer Price Index, ) Source: Investing.com - Click to enlarge |

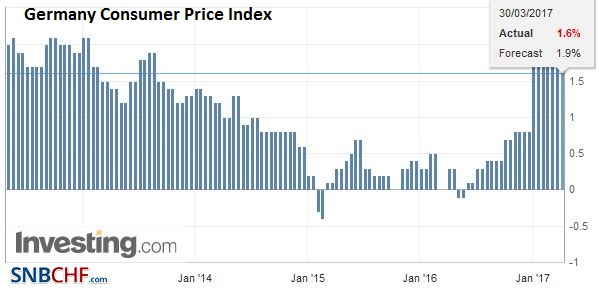

GermanyGerman inflation fell to 1.5% from 2.2%. Even if the base effect from last year’s early Easter played a role in the decline in these inflation readings, the point Draghi and Praet make is that eurozone inflation is still not on a convincing path higher. Core inflation bottomed at 0.6% and may have slipped back to 0.8% in March form 0.9% in February. |

Germany Consumer Price Index (CPI) YoY, February 2017(see more posts on Germany Consumer Price Index, ) Source: Investing.com - Click to enlarge |

Graphs and additional information on Swiss Franc by the snbchf team.

Tags: #GBP,#USD,$EUR,$JPY,Eurozone Consumer Confidence,Featured,Germany Consumer Price Index,newslettersent,Spain Consumer Price Index,U.S. Consumer Spending,U.S. Core PCE Price Index,U.S. Corporate Profits,U.S. Gross Domestic Product