Medical vs. Financial Engineering

I broke my elbow a month ago, pretty badly as I was told. The surgeon screwed the pieces back together, using a steel alloy bracket and six screws. Two hours later, I left the hospital with no cast, a bandage (just to cover a very ugly scar), a prescription for painkillers and therapy started a week later.

What would have happened if I had suffered the same accident in 1975? The surgery would probably be in-patient, requiring a couple of days in the hospital. The broken fragments would take weeks to heal, in a cast. Rehab would take many months while I may never regain the previous range of motion or strength again. Medical engineering has advanced so much in the last forty years.

Before I stray too far, why 1975? That was the year in which I entered the real estate market. In comparison, real estate involves just simple transactions, nowhere near the complexity of cutting up a body, drilling holes and screwing some plate into human bones.

In forty years, the real estate market should have advanced to the point where a transaction is no more cumbersome than ordering some merchandise on Amazon, prepackaged with financing, right? Wrong.

Articles by Ramsey Su

Housing Affordability – A Dose of Reality

July 5, 2016Restless Peasants

First, a few quick words on Brexit. Being the always positive and optimistic person that I am (big grin), I see one very positive outcome of Brexit – it is a revolution without bloodshed.

For once, I’m not digressing. Brexit has a lot of parallels with housing affordability in the US. Brexit is a clear illustration of how politicians, policy makers and the establishment have lost touch with the peasants, and the peasants are getting restless. Allow me to elaborate.

The peasants are getting restless… Illustration via squadron.com

The State of Affordability

Down-payment – Down-payment is more of an issue for entry level buyers than for trade-up buyers. When affordability was first measured, a 20% down-payment was very common. Forget nothing down sub-prime loans, a 3% to 5% FHA or agency loan is the new norm for the entry level buyers. The current trend is toward even smaller down-payments.

Mortgage payments – rates have never been lower and it looks like the Brexit will drive them even lower. In other words, it has never been cheaper to cover debt service. Are zero interest, or even negative interest mortgages possible?

Credit Scores – once insignificant, credit scores are now used as hurdles for qualification.

Is it Time to Buy Real Estate? Yes and No

June 7, 2016Is it Time to Buy Income-Producing Real Estate?

No, No, No. Much to the dismay of my real estate buddies, who are complaining about how high prices while watching the cash flow of their portfolios bursting at the seams from a few good years of rent increases, the answer is no.

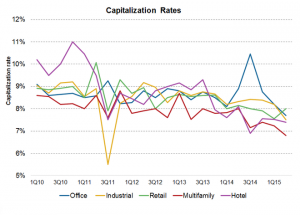

Capitalization Rates

REIT cap rates (as of mid 2015, they have declined further since then)

Capitalization Rates

Valuation is one big red flag. There is so much money chasing yield that somewhat decent apartments in San Diego are asking for 3% cap rates. The current cap rates are about as low as I have ever experienced. It wasn’t that long ago (measured by my investment lifetime) that a 10% cap was not that rare.

This is equivalent to the S&P trading at record high PE. The cost of debt is at record low, which has a similar effect on the stock market. Rents are at record highs. Where is the upside going to come from – even higher rents, even lower cap rates and/or lower debt service costs?

Valuation is not my biggest concern. The biggest risk is income stability. I have been trying to digest the Report on the Economic Well-Being of the US Households in 2015 since it was released by the Federal Reserve a few weeks ago.

Is it Time to Buy Real Estate? Yes and No

June 7, 2016Is it Time to Buy Income-Producing Real Estate?

No, No, No. Much to the dismay of my real estate buddies, who are complaining about how high prices while watching the cash flow of their portfolios bursting at the seams from a few good years of rent increases, the answer is no.

Capitalization Rates

REIT cap rates (as of mid 2015, they have declined further since then)

Capitalization Rates

Valuation is one big red flag. There is so much money chasing yield that somewhat decent apartments in San Diego are asking for 3% cap rates. The current cap rates are about as low as I have ever experienced. It wasn’t that long ago (measured by my investment lifetime) that a 10% cap was not that rare.

This is equivalent to the S&P trading at record high PE. The cost of debt is at record low, which has a similar effect on the stock market. Rents are at record highs. Where is the upside going to come from – even higher rents, even lower cap rates and/or lower debt service costs?

Valuation is not my biggest concern. The biggest risk is income stability. I have been trying to digest the Report on the Economic Well-Being of the US Households in 2015 since it was released by the Federal Reserve a few weeks ago.

Why is Freddie Mac Reporting a Loss?

May 9, 2016A Sudden Turn for the Worse

Freddie Mac HQ – a strange time for posting losses Photo via nytstyle.com

Freddie Mac posted a loss of $354 million this quarter, versus a $2.16 billion gain the previous quarter. Fannie Mae did slightly better with net earnings of $1.1 billion, which were still substantially down from $2.5 billion the previous quarter though.

Instead of delving into the entrails of the financial statements, I would like to ask a broader question: Why is Freddie reporting a loss at all (and why is Fannie barely profitable)?

Using September 2008 as a starting point, what kind of business climate have they been operating under since the Treasury took over as conservator?

Monopolistic Dominance. The agencies are now over 70% of the residential mortgage market, and increasing, with no competition in sight.

Historical performance of Case-Shiller US Home Price Indexes.

Price Appreciation. Per Case Shiller, housing price has been appreciating steadily for the last 4-5 years. In other words, loan to value ratios should be decreasing, reducing the risk of loan losses in the event of a default.

Historical performance of Case-Shiller US National and 20-City Composite Home Price Index – click to enlarge.

Defaults, foreclosures and REO inventory.

Read More »