As global markets bask in the glow of the Trumpflation recovery, the ECB continues to be busy providing the actual levitating power behind what DB recently dubbed global “helicopter money“, by buying copious amounts of bonds on a daily basis (at least until tomorrow when the ECB goes on brief monetization hiatus, and Italy will be on its own for the next two weeks). According to the latest weekly breakdown of what the...

Read More »Return is “not really a function of yield”

When x happens, yields fall — Rule 1? It’s not a search for yield, it’s a search for safety — Potential Rule 2? Two charts to make the point for us once again from the good folks at BofAML’s relative value department: Click to enlarge. You could also pop in here and have a look at Credit Suisse’s roughly similar argument (and the state of the negatively rate inspired corporate bond market). CS’s point has to do with...

Read More »Negative Rates: Jim Bianco Warns “The Risk Of An ‘Accident’ Is Very High”

In an interesting interview with Finanz und Wirtschaft, Bianco Research president Jim Bianco discusses a variety of topics such as negative interest rates turning the entire credit process upside down, bank balance sheets being even more complex and concentrated than before the financial crisis, energy loans being an accident waiting to happen, the markets having veto power over the Fed, and gold having more room to run. * * * Mr. Bianco, negative interest are causing a lot of stir at the...

Read More »Corporate bonds: February marked by singularly high volatility

Macroview US HY corporate bonds have benefited from the rise in the oil price, whereas European HY corporates are still looking for reassurance from the banking sector. Spreads on corporate bonds widened quite noticeably in February: those on US high-yield issues hit highs not seen since 2011 before narrowing again as China-related fears, worries over the oil price and concern about banks' profitability diminished. The energy and mining sectors were both boosted by the rise in the oil...

Read More »2016 off to a turbulent start

Published: 12th February 2016 Download issue: A turbulent start to a volatile year Global markets had a very difficult start to 2016, with equity markets experiencing one of the largest January falls in history, currency markets also seeing major disruption, and a sharp widening of spreads on high yield corporate bonds. By the end of the month, though, there were signs that a rebound was underway. Although the magnitude of the sell-off was clearly a concern, these developments are not out...

Read More »Playing Defense: European High-Yield

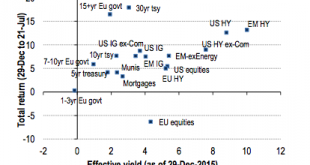

It’s not an easy time to be a fixed-income investor, particularly for those seeking opportunities in the United States. The Federal Reserve’s stated intention to raise benchmark interest rates this year for the first time since 2006 hangs over the U.S. fixed-income market like a pall, threatening to drive bond prices down, introduce volatility, and even create a liquidity crunch. Investors who want (or need) to maintain exposure to fixed income through the rate hike might try looking across...

Read More » Swiss Economicblogs.org

Swiss Economicblogs.org