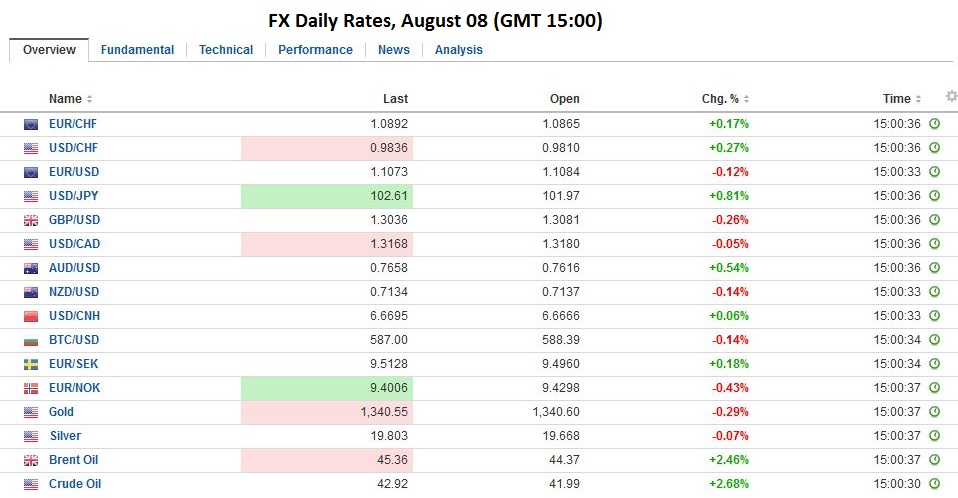

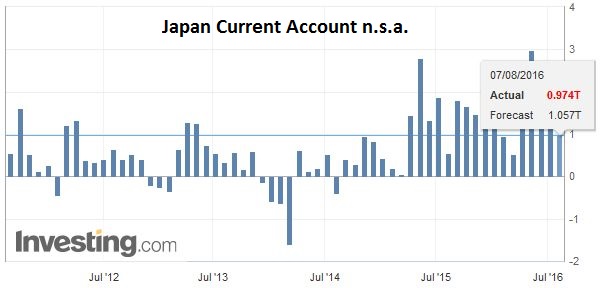

Swiss Franc Click to enlarge. FX Rates Investors favor risk assets today. Global stocks are moving higher in the wake of the pre-weekend US rally that saw the S&P 500 close at record levels. Bond yields are mostly firmer, again with US move in response to the robust employment report setting the tone in Asia. European bonds participated in most of the pre-weekend move and are consolidating today with a slightly heavier tone. UK Gilts are outperforming, with a new record low of 64 bp on the benchmark 10-year issue. The Nikkei’s 2.4% rally was the biggest in nearly a month. It gapped sharply higher, leaving a three-day island in its wake, and closed on its highs. All the Asian equity markets advanced. The MSCI Asia-Pacific Index rose 1.3%, its three consecutive advance and the largest since July 11. Click to enlarge. Japan Japan reported its June current account. There is a strong seasonal pattern that the balance typically deteriorates in June from May. The pattern held. The surplus was nearly halved to JPY974.4 bln from JPY1.809 trillion in May. This comes despite the jump in the trade surplus (to JPY763.3 bln from JPY39.9 bln). Click to enlarge. Source Investing.com Taiwan Four other markets may be particularly interesting. The first is South Korea.

Topics:

Marc Chandler considers the following as important: Bank of Japan, China Exports YoY, China Imports YoY, ECB, Featured, FX Daily, FX Trends, Germany Industrial Production, Japan Current Account, newsletter, Switzerland Consumer Price Index YoY, Taiwan Exports YoY

This could be interesting, too:

Nachrichten Ticker - www.finanzen.ch writes Die Performance der Kryptowährungen in KW 9: Das hat sich bei Bitcoin, Ether & Co. getan

Nachrichten Ticker - www.finanzen.ch writes Wer verbirgt sich hinter der Ethereum-Technologie?

Martin Hartmann writes Eine Analyse nach den Lehren von Milton Friedman

Marc Chandler writes March 2025 Monthly

Swiss Franc |

|

FX RatesInvestors favor risk assets today. Global stocks are moving higher in the wake of the pre-weekend US rally that saw the S&P 500 close at record levels. Bond yields are mostly firmer, again with US move in response to the robust employment report setting the tone in Asia. European bonds participated in most of the pre-weekend move and are consolidating today with a slightly heavier tone. UK Gilts are outperforming, with a new record low of 64 bp on the benchmark 10-year issue.

The Nikkei’s 2.4% rally was the biggest in nearly a month. It gapped sharply higher, leaving a three-day island in its wake, and closed on its highs. All the Asian equity markets advanced. The MSCI Asia-Pacific Index rose 1.3%, its three consecutive advance and the largest since July 11.

|

|

JapanJapan reported its June current account. There is a strong seasonal pattern that the balance typically deteriorates in June from May. The pattern held. The surplus was nearly halved to JPY974.4 bln from JPY1.809 trillion in May. This comes despite the jump in the trade surplus (to JPY763.3 bln from JPY39.9 bln).

|

Click to enlarge. Source Investing.com |

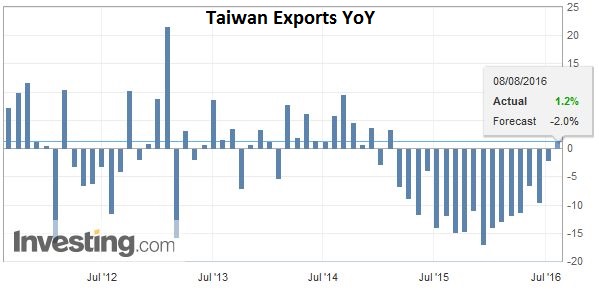

TaiwanFour other markets may be particularly interesting. The first is South Korea. S&P lifted its rating to AA from AA- before the weekend and left the outlook stable. The Kospi advanced 0.6%, and the Korean won was the strongest of the Asian currencies, rising 0.2% against the dollar. In Thailand, voters backed the military-sponsored constitution, which will pave the way for elections. The Thai equity market advanced 1.5%, while the baht slipped almost 0.5%. Taiwan, which has seen strong capital inflows, reported exports rose in July for the first time in 18 months. The Taiwanese equity market rose 0.6%, while the local currency was the second strongest in Asia, rising almost 0.15%.

|

Click to enlarge. Source Investing.com |

ChinaChina reported July reserves in line with expectations and little changed from June at just above $3.2 trillion. It also reported a larger than expected July trade surplus. In dollar terms, the surplus rose to $52.3 bln from $48.1 bln. The driver was not so much stronger exports as weaker imports.

Exports fell 4.4% year-over-year in dollar terms, a touch slower than the 4.8% decline reported in June. In yuan terms, exports rose 2.9% year-over-year, up from 1.3% in June.

|

Click to enlarge. Source Investing.com |

| Imports fell 12.5% in dollar terms, and 5.7% in yuan terms. This compares with an 8.4% drop and a 2.3% fall respectively in June. |

Click to enlarge. Source Investing.com |

Eurozone

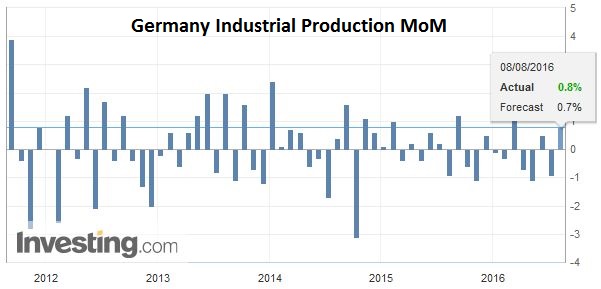

GermanySecond, Germany reported a 0.8% rise in June’s industrial output, and it revised to -0.9% the May decline that was initially reported at -1.3%. The output for investment goods offset the weaker construction and energy output. It follows the unexpected decline in June factory orders (-0.4%) reported before the weekend. Germany will report its June trade balance surplus tomorrow. It is expected to widen to 23.0 bln euros from 21.0 bln in May. The record was set in March at 26.2 bln euros.

|

Click to enlarge. Source Investing.com |

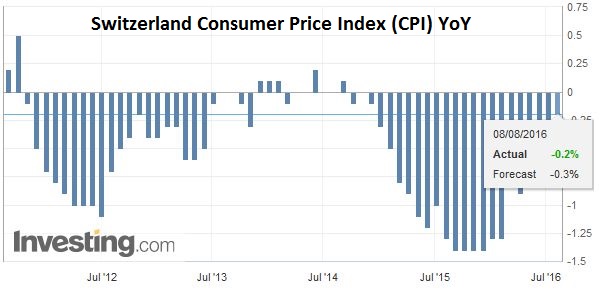

SwitzerlandThird, Switzerland reported July CPI figures. The national measure fell 0.4% in July for a minus 0.2% year-over-year pace. The EU-harmonized measures slipped 0.1% on the month, which is the first decline since January. Nevertheless, due to the base-effect, the year-over-year pace rose to –0.5% from -0.6%. This matches its best level since March 2015. Recall that the year-over-year pace bottomed in January at -1.5%.

|

Click to enlarge. Source Investing.com |

United States

Look for a quiet North American summer session with a light economic calendar.

Graphs and additional information on Swiss Franc by the snbchf team.