Expanding in Ireland DUNMORE EAST, Ireland – We came down the coast from Dublin to check on our new office building. For this visit, we wanted to stay somewhere different than we normally do. So we chose a small hotel on the coast, called the Strand Inn. Irish landscape with alien landing pads. Even the guys from Rigel II have heard about Ireland’s corporate tax rate. Photo credit: Tourism Ireland It is an excellent place for seafood and soda bread on a rainy day. Later, you can go to the bar, get in your cups, and sing sad songs about dead Irish heroes. Ireland has a literate, educated population. It is pleasant… pretty…and has a low corporate tax rate. So, we are expanding here. Apparently, companies escape taxes by moving their headquarters or their technology overseas. We would do the same, but we’ve never been able to figure out how it saves any tax money. Owners end up paying tax in their home countries. And Americans pay U.S. taxes no matter where the money is actually generated. Regardless, we bought a large, 19th-century mansion in the aftermath of Ireland’s real estate bust – which took average property prices down by more than one-third. It seemed like a good deal. But every real estate investment we ever made has turned out to cost more and take more time than we imagined. This time is no exception.

Topics:

Bill Bonner considers the following as important: Debt and the Fallacies of Paper Money, Featured, newsletter, On Politics

This could be interesting, too:

Nachrichten Ticker - www.finanzen.ch writes Die Performance der Kryptowährungen in KW 9: Das hat sich bei Bitcoin, Ether & Co. getan

Nachrichten Ticker - www.finanzen.ch writes Wer verbirgt sich hinter der Ethereum-Technologie?

Martin Hartmann writes Eine Analyse nach den Lehren von Milton Friedman

Marc Chandler writes March 2025 Monthly

Expanding in Ireland

DUNMORE EAST, Ireland – We came down the coast from Dublin to check on our new office building. For this visit, we wanted to stay somewhere different than we normally do. So we chose a small hotel on the coast, called the Strand Inn.

Irish landscape with alien landing pads. Even the guys from Rigel II have heard about Ireland’s corporate tax rate. Photo credit: Tourism Ireland

It is an excellent place for seafood and soda bread on a rainy day. Later, you can go to the bar, get in your cups, and sing sad songs about dead Irish heroes. Ireland has a literate, educated population. It is pleasant… pretty…and has a low corporate tax rate. So, we are expanding here.

Apparently, companies escape taxes by moving their headquarters or their technology overseas. We would do the same, but we’ve never been able to figure out how it saves any tax money.

Owners end up paying tax in their home countries. And Americans pay U.S. taxes no matter where the money is actually generated. Regardless, we bought a large, 19th-century mansion in the aftermath of Ireland’s real estate bust – which took average property prices down by more than one-third.

It seemed like a good deal. But every real estate investment we ever made has turned out to cost more and take more time than we imagined. This time is no exception. Still, it is a handsome, capacious place, which will house more than 150 employees.

The Irish have charming and understandable accents. Many of these employees will be answering calls from all over the world. So, if you call us after September, your call might be routed to County Waterford.

High on the Hog

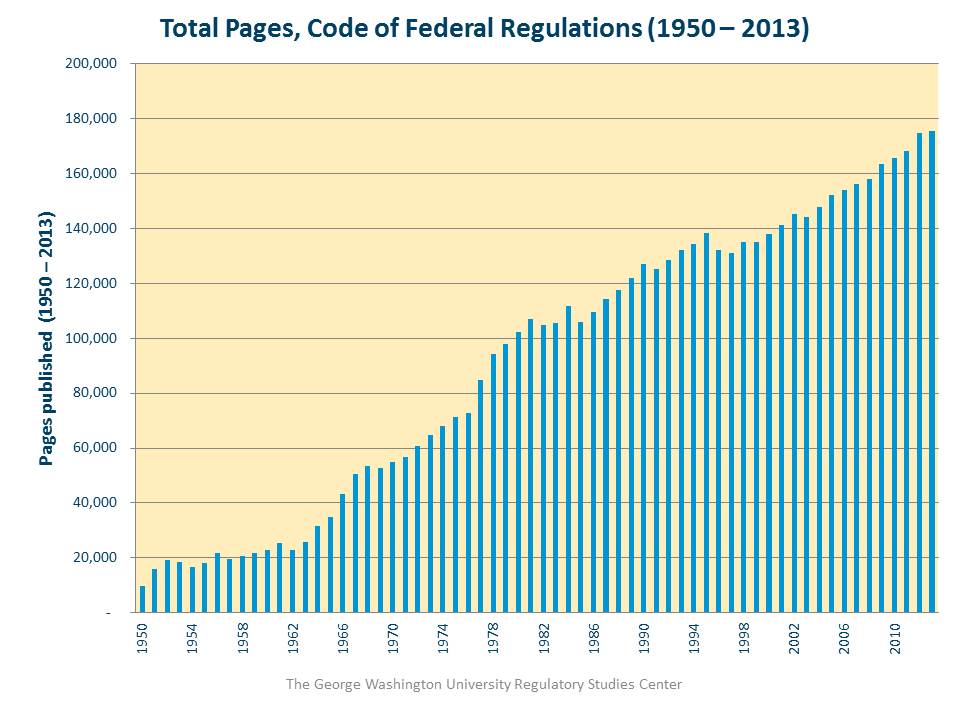

Now, back to the Deep State. Much of its growth is recorded in the pages of the Code of Federal Regulations (CFR). This tracks all the laws laid down by successive governments.

A privilege, a special tax break, a rule, a prohibition, a piece of meat here, a piece of meat there… and soon the foxes are eating high on the hog. But what’s meat for the foxes is poison for the economy.

The relentless growth of Leviathan: Total Pages of Code of Federal Regulations from 10000 in 1950 to 170000 in 2014

(it has continued to grow since then…). No wonder the economy is in the dumps – |

Each piece requires paperwork, delays, permits, accountants, lawyers. You can’t do this… you can’t do that – with so many hurdles in their way, entrepreneurs think twice, capital investment declines, and the economy slows.

Each favor to the foxes is an act of larceny, taking something away from the people who earned it to redistribute wealth, power, and status to the insiders.

From fewer than 25,000 pages when President Eisenhower left the White House, the CFR now has nearly 200,000 pages – each one a honeypot for Deep State cronies. And who reads this stuff?

Do you know what rules and regulations you are breaking right now? Most people are too busy earning their money and raising their families to spend much time tracking the federal bureaucracy and its cronies. But the foxes make it their business to pay attention… and make the rules that work for them.

An honest person is at a great disadvantage.

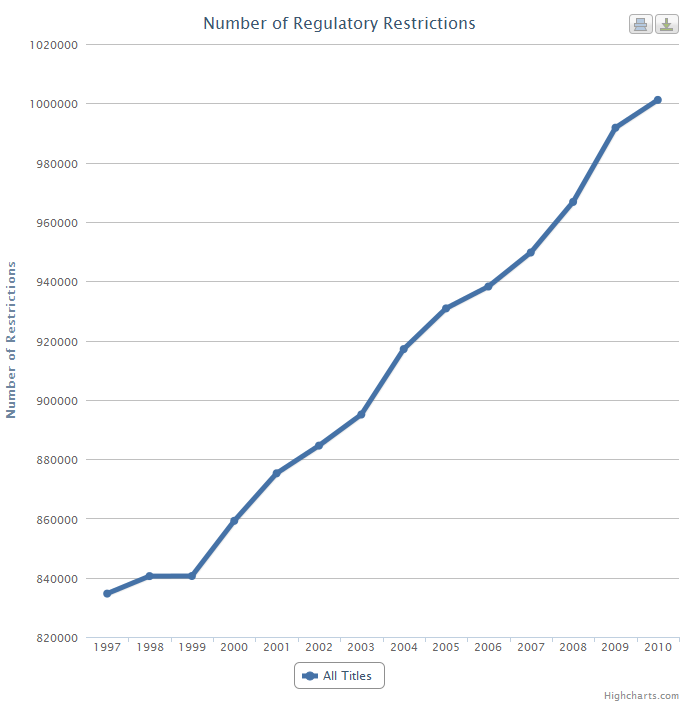

Number of regulatory restrictionsthe chart is a bit dated, but it shows the trend quite well. Once upon a time, none of these restrictions existed. One wonders how the world managed to keep turning! |

Rules and Regulations

Think you’re going to change this system by voting for Hillary or Trump, Democrat or Republican? Maybe, but there’s no evidence of it in the CFR. The number of pages kept rising, year after year, no matter who was in the White House.

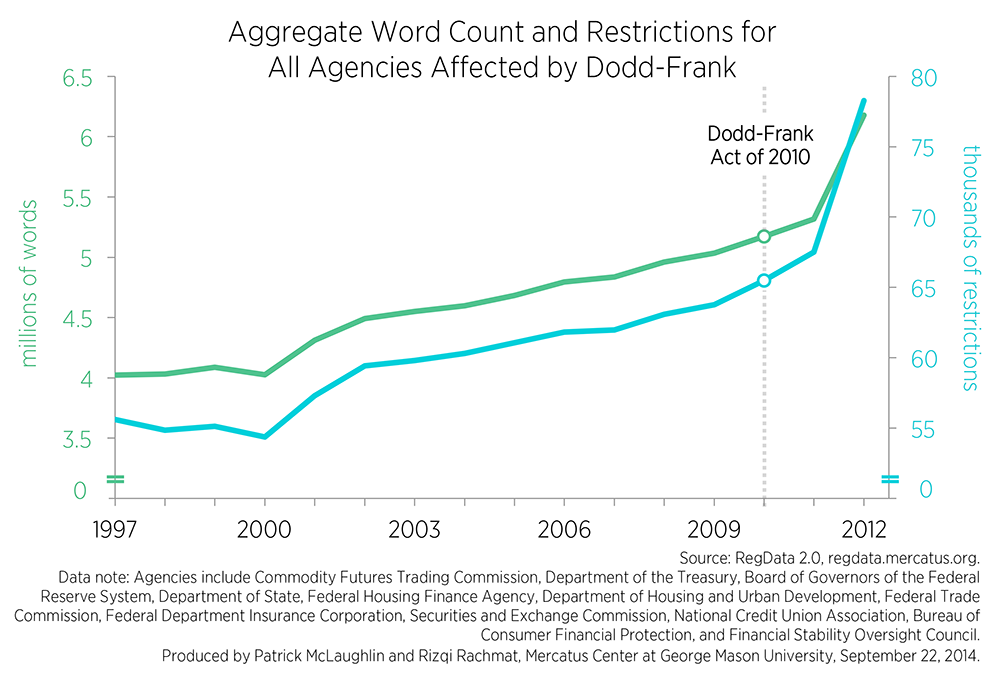

Aggregate word count of Dodd-Frank regulations alone as of 2012(when about one third of the regulatory implementation was finished!). Has the financial system become “safer” because of this? Not one bit actually – on the contrary, it may well be even more dangerous now. The root causes of the crisis (fractional reserve banking, fiat money and central economic planning) have remained untouched |

|

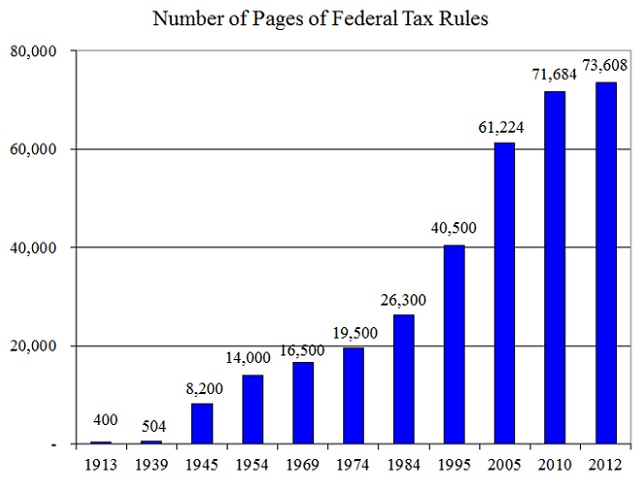

Federal tax rules – from 400 in 1913 to 74,000 in 2012.The cost of compliance alone amounts to $160 billion per year! So why are there so many rules in view of this immense waste? It’s all about cronyism actually. This is why proposals to “simplify the tax code” never get anywhere. Modern-day regulatory democracies are little more than tax farms – and the average citizen fulfills the role of the cattle. Twenty-five thousand pages were added during the Kennedy and Johnson years… another 25,000 under Nixon and Ford… and another 25,000 during the Reagan and George H.W. Bush administrations. Federal spending per capita shows the same basic trend, an almost unbroken uptrend – through Democratic and Republican administrations – stretching back from 2016 to 1952. Under President Eisenhower, domestic discretionary spending per person was under $500. Today it’s over $4,500. Like the Federal Code, real spending per person has increased about nine times in the last 64 years. |

There were two presidents under whom spending went down – Ronald Reagan and Bill Clinton. Go figure. In neither case, however, did it stay down for long. Once Reagan and Clinton were out of the way, the foxes went to work and quickly brought spending back to the trend line.

There were two presidents under whom spending went down – Ronald Reagan and Bill Clinton. Go figure. In neither case, however, did it stay down for long. Once Reagan and Clinton were out of the way, the foxes went to work and quickly brought spending back to the trend line.

What are foxes? Some say they are evil, wily, conniving and duplicitous… essentially rats in expensive coats. Photo via pinterest.com

What will happen to the little foxes under Donald Trump? Or Hillary? The earnings of the top 5% – the “foxy five” – began to diverge from the earnings of everybody else in the mid-1970s. Since then, they increased alongside the FCR and government spending. Rules and regulations multiplied. Spending increased. The foxes got richer; everyone else got poorer. All this happened through both Republican and Democratic administrations. Most likely the foxes will continue to earn more through a Trump or Clinton administration too.

Still to come: insurrection and rebellion down on the ranch…

Charts by: G. Washington University, George Mason University, Highcharts, Daily Caller

Chart and Image captions by PT

The above article originally appeared at the Diary of a Rogue Economist, written for Bonner & Partners. Bill Bonner founded Agora, Inc in 1978. It has since grown into one of the largest independent newsletter publishing companies in the world. He has also written three New York Times bestselling books, Financial Reckoning Day, Empire of Debt and Mobs, Messiahs and Markets.

Previous post Next post