Shinzo Abe and Haruhiko Kuroda, professional yen assassins Photo credit: Toru Hanai / Reuters Policy-Induced Contrition in Japan As we keep saying, there really is no point in trying to make people richer by making them poorer – which is what Shinzo Abe and Haruhiko Kuroda have been trying to do for the past several years. Not surprisingly, they have so to speak only succeeded in achieving the second part of the equation: they have certainly managed to impoverish their fellow Japanese citizens. Just think about the relentless pressure on the yen in the years following Kuroda’s implementation of the “QQE” policy (colloquially known as “money printing”). Economic growth has gone precisely nowhere, which should be no surprise. No new wealth can be created by printing money. If that were possible, Zimbabwe would be a Utopia of riches. What has happened though is that in US dollar terms, Japan’s economic output is worth about 30% less today than it was in 2012 when the Bank of Japan (BoJ) began to administer its version of bloodletting. In practical terms, Japan’s citizens have to produce 30% more in order to pay for the same amount of goods imported from abroad than they had to produce in 2012. The declared goal of this policy is to “raise inflation”, i.e. to lower the purchasing power of the money the BoJ issues.

Topics:

Pater Tenebrarum considers the following as important: Akagi Nyugyo, Bank of Japan, Central Banks, Debt and the Fallacies of Paper Money, Featured, Fumio Hagiwara, Gari-Gari Kun, Haruhiko Kuroda, Nearest Candlestick Chart, newsletter, Shinzo Abe

This could be interesting, too:

Nachrichten Ticker - www.finanzen.ch writes Die Performance der Kryptowährungen in KW 9: Das hat sich bei Bitcoin, Ether & Co. getan

Nachrichten Ticker - www.finanzen.ch writes Wer verbirgt sich hinter der Ethereum-Technologie?

Martin Hartmann writes Eine Analyse nach den Lehren von Milton Friedman

Marc Chandler writes March 2025 Monthly

Policy-Induced Contrition in Japan

As we keep saying, there really is no point in trying to make people richer by making them poorer – which is what Shinzo Abe and Haruhiko Kuroda have been trying to do for the past several years. Not surprisingly, they have so to speak only succeeded in achieving the second part of the equation: they have certainly managed to impoverish their fellow Japanese citizens.

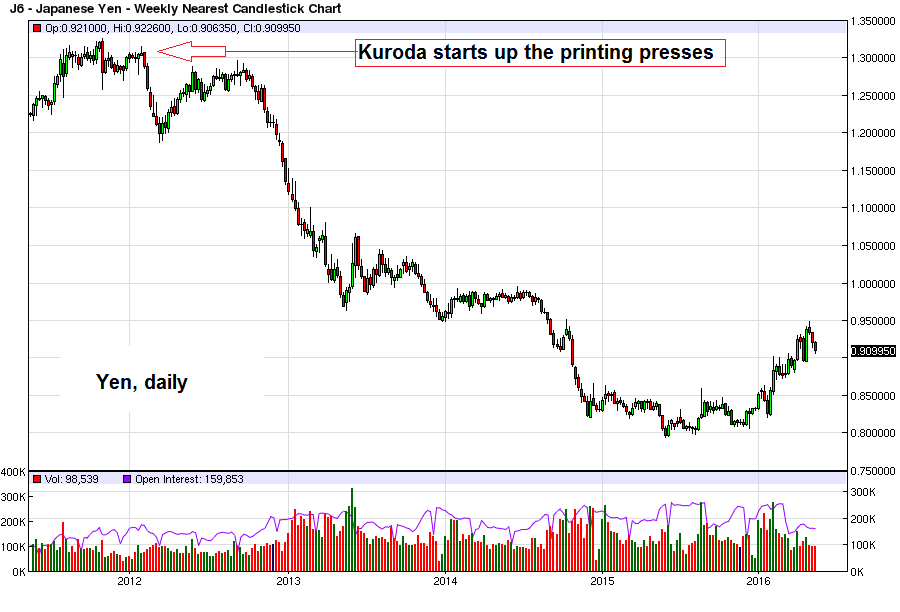

Just think about the relentless pressure on the yen in the years following Kuroda’s implementation of the “QQE” policy (colloquially known as “money printing”). Economic growth has gone precisely nowhere, which should be no surprise. No new wealth can be created by printing money. If that were possible, Zimbabwe would be a Utopia of riches.

What has happened though is that in US dollar terms, Japan’s economic output is worth about 30% less today than it was in 2012 when the Bank of Japan (BoJ) began to administer its version of bloodletting. In practical terms, Japan’s citizens have to produce 30% more in order to pay for the same amount of goods imported from abroad than they had to produce in 2012.

The declared goal of this policy is to “raise inflation”, i.e. to lower the purchasing power of the money the BoJ issues. There has been some “success”, as the real incomes of Japan’s citizens have plummeted since this policy has been instituted. Obviously, this is about as useful as a hole in the head. No-one really knows what this grotesque punishment of Japanese consumers is supposed to be good for.

Japanese Yen – Weekly Nearest Candlestick ChartThe yen plummets due to the BoJ’s policies, impoverishing the Japanese. Not surprisingly, no positive effects whatsoever have been detected so far. |

Many companies have been affected by the BoJ’s inflationary policy as well, and now one of them has finally buckled under the onslaught. The price of Japan’s most popular soda-flavored ice cream bar Gari-Gari Kun, had to be be raised by 10 yen from 60 yen to 70 yen.

Akagi, the company making the popsicle, has held out for 25 years before instituting this price increase. Alas, it could no longer ignore the increase in input costs which Kuroda’s mad-cap money printing effort is primarily responsible for. Here is what one Japanese consumer had to say according to a report in the New York Times:

“We don’t have any more income, but taxes are rising,” said Kazuko Ida, 65, who lives in Tokyo. As a result, she said, she is especially reluctant to spend more. “It’s one thing if luxury items are expensive, but if cheap things aren’t cheap anymore, it’s a real problem.”

It’s a crime: Gari-Gari Kun suddenly costs 70 yen, after being priced at 60 yen for a quarter of a century. Photo credit: Ko Sasaki for The New York Times

It seems to us that the Abe-Kuroda tag team hasn’t really thought things through all that well.

As the company’s marketing manager tells us, the company actually debated for eight years whether to take this momentous step:

“Gari-Gari Kun is meant to be something kids can easily buy with their allowance,” said Fumio Hagiwara, a marketing executive at Akagi Nyugyo, the maker of the ice cream bar. “Even grown-ups have less pocket money these days.”

[…]

Akagi last increased prices a quarter of a century ago, and it debated the recent rise for seven or eight years, Mr. Hagiwara said. The rising cost of raw materials finally forced Akagi’s hand, he said.

At least the company knows that what it has done will hurt its customers, and in contrast to Mr. Kuroda and his colleagues on the BoJ board, had the decency to apologize to the entire nation.

In fact, it apologized in a very Japanese manner, which is to say, very publicly and thoroughly. The entire staff of the company, all 500 workers from the janitor to the CEO – have bowed their heads in contrition over this fatal act:

The entire staff of Akagi apologizes to Japan for having been forced to raise the price of Gari-Gari Kun

Although it is not really the company’s fault (after all, it has to survive somehow), the people working there are evidently taking the services they provide to their fellow men very seriously. They know that violating the wallets of consumers by means of price increases is a bad thing.

The only people who apparently have yet to realize this are the money cranks running the world’s central banks.

Conclusion

There is no way prosperity can be increased by issuing more money. Wealth is not a matter of numbers in accounts. It is completely unimportant how much money there is – what counts is only what this money can buy.

In an unhampered free market economy, the money supply would grow only very slowly. Based on historical experience with metallic money, we know that productivity growth would very likely tend to outpace money supply growth most of the time.

It is an inherent feature of a progressing economy that it is producing more output with the same inputs. With a fairly stable or only slowly growing money supply, prices will therefore tend to decline. People’s incomes would remain fairly steady in nominal terms, but would increase significantly in real terms over time.

The idea that we need price inflation of X percent in order to prosper is simply utterly preposterous nonsense, both in theory and in practice.

Chart by: BarChart

Previous post