The resignation of the Mexican finance minister raises further questions over prospects for Mexican assets.Carlos Urzúa, the Mexican Finance Minister, unexpectedly quit on Tuesday. His resignation, announced in a letter in which he set out the “many” disputes he had had with the administration of president Andrés Manuel López Obrador (AMLO), is meaningful from several standpoints. A respected official, Urzúa was seen by financial markets as a moderate, whose commitment to fiscal prudence reassured investors struggling to decipher AMLO’s economic north star. His departure also reveals profound tensions within the government between those aiming for ideology-led policies – which Urzúa denounced – and those advocating orthodox economic policies.Arturo Herrera, the current Deputy Finance

Topics:

Perspectives Pictet considers the following as important: EM equities, Macroview, Mexican equities, Mexican finances, Mexico

This could be interesting, too:

Marc Chandler writes US-China Exchange Export Restrictions, Yuan is Sold to New Lows for the Year, while the Greenback Extends Waller’s Inspired Losses

Marc Chandler writes French Government on Precipice, Presses Euro Lower

Marc Chandler writes Yen Jumps on Rate Hike Speculation

Marc Chandler writes Ueda Lifts Yen, Leaving Euro and Sterling Pinned Near Lows

The resignation of the Mexican finance minister raises further questions over prospects for Mexican assets.

Carlos Urzúa, the Mexican Finance Minister, unexpectedly quit on Tuesday. His resignation, announced in a letter in which he set out the “many” disputes he had had with the administration of president Andrés Manuel López Obrador (AMLO), is meaningful from several standpoints. A respected official, Urzúa was seen by financial markets as a moderate, whose commitment to fiscal prudence reassured investors struggling to decipher AMLO’s economic north star. His departure also reveals profound tensions within the government between those aiming for ideology-led policies – which Urzúa denounced – and those advocating orthodox economic policies.

Arturo Herrera, the current Deputy Finance Minister, was quickly appointed to replace Urzúa. Herrera’s appointment comes at a time when fiscal issues are back in the spotlight. In the near term, he will have to deal with the shaky finances of Pemex, the state-owned oil company, and start the 2020 budget discussions in a context of slowing economic growth. The coming months will therefore prove crucial for him to build credibility and restore confidence in the current administration’s willingness to maintain fiscal discipline.

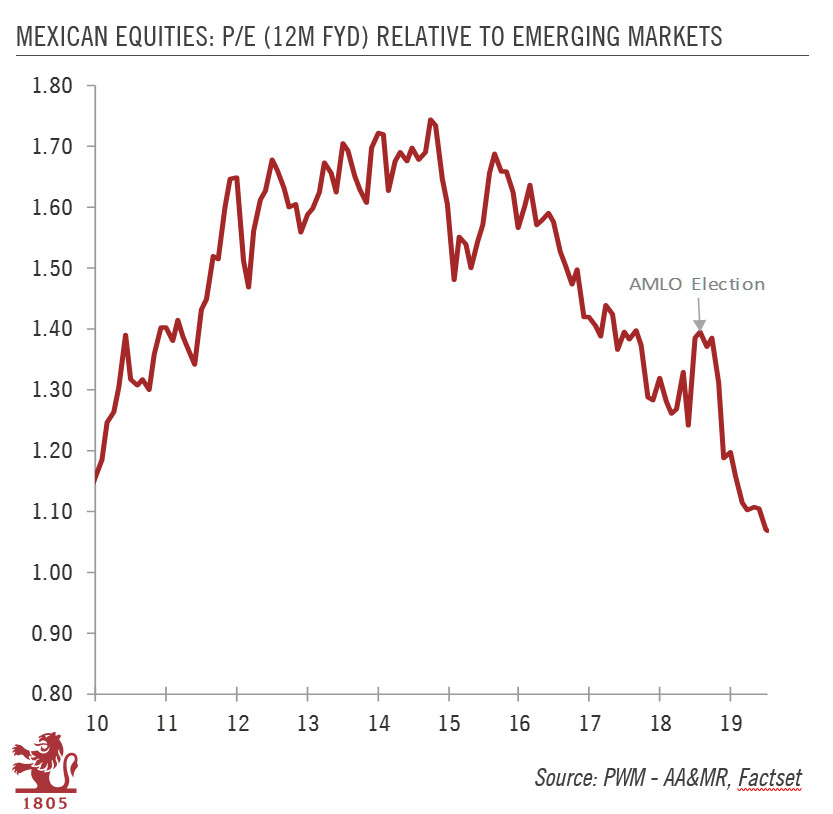

As for equities, AMLO’s election last July marked a stark regime change for Mexican stocks. Price-to-earnings ratios (12-month forward) dropped from 16x to 13x within a few months, re-accelerating a trend that started in 2015 (see chart). The valuation premium over emerging markets, which reached 75% in 2014, has since shrunk to 7% and is still decreasing. Earnings have proved resilient and offset the valuation impact, yet only in local currency terms.

Looking forward, earnings growth expectations for Mexican equities remain robust for now. Nevertheless, one can hardly argue that there has been any meaningful improvement in Mexico’s economic environment since the election. First, strong uncertainties persist, be it on the government’s economic direction (e.g. cancellation of the Mexico City airport, Pemex’s strategy, bank fees), or trade relations with the US. In addition, growth is slowing while inflation remains above the central bank’s target, preventing the launch of quick easing measures despite high real rates.

All in all, we see potential downside risk to earnings, justifying compression in valuation ratios and are relatively unexcited by the Mexican peso. Given the lack of any potential catalyst for Mexican equities in the near term, we believe other emerging markets offer stronger fundamentals (e.g. India), less policy uncertainty (e.g. Brazil) or potentially stronger turnaround stories (e.g. South Korea).