'Wake up call' yet to happen as the clock ticks on.A series of votes in the British parliament resulted in little new progress on the Brexit front; the outcome being that Theresa May will return to Brussels to attempt to improve her ‘deal’, which a new parliamentary vote scheduled for mid-February.However, Brussels has rejected the idea of reopening negotiations and it is not clear that mere tweaks will be enough to overcome the intense opposition in parliament to May’s initial deal.Bottom...

Read More »After May’s divorce deal: the road ahead for Brexit

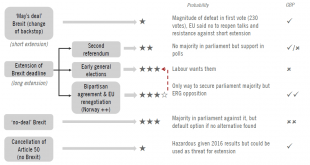

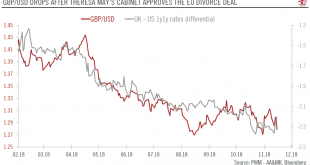

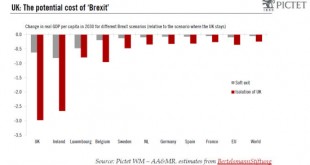

But significant political challenges lie ahead before the 29 March deadline for Brexit. Sterling likely to be in the spotlight for several months.Theresa May’s cabinet has approved her divorce deal with the European Union (EU). A few cabinet secretaries have resigned, including Brexit Secretary Dominic Raab because the deal keeps the UK in a transitory ‘customs union’ with the EU, which in his view continues to give the EU too much influence on UK affairs.The next step is formal approval of...

Read More »No Big Thoughts, but Several Smaller Observations

Summary: Notable that as the CRB Index moves lower, MSCI emerging market equities have done well. European banks are retreating after the stress test results. Tokyo elected its first women governor as this seem to be in part a sign of protest against Abe. August has begun off with clear price action. The US dollar is stronger against nearly all the major currencies. Bond yields are higher. Equities and...

Read More »FX Weekly Preview: EMU Returns to Center Stage in the Week Ahead

Summary: Key event in Europe is not on many calendars–it is a ruling by the European Court of Justice. UK government and Tory Party stabilizing, leaving the Labour Party in disarray. US economy appears to have accelerated into the end of Q2. BOJ’s meeting at the end of the month. Four large dramas being played out among the major high income countries. The drama in the eurozone moves center stage in the...

Read More »Brexit or not, the pound will crash

Status quo, as our generation know it, established in 1945 has plodded along ever since. It is true that it have had near death experiences several times, especially in August 1971 when the world almost lost faith in the global reserve currency and in 2008 when the fractional reserve Ponzi nearly consumed itself. While the recent Brexit vote seem to be just another near death experience we believe it says something...

Read More »Return of the Repressed: Europe’s Unresolved Banking Crisis

Summary The IMF identified three banks that posted the most significant systemic risks. It has been overshadowed by new pressure on Italy’s banks, and. Three UK commercial real estate funds have been frozen to prevent redemptions. The conventional narrative has it backward. It worries about the threats to stability emanating from the periphery in Europe. Policymakers, investors, and economists still refer to...

Read More »UK: To Brexit, or not to Brexit?

We expect the UK to remain in the EU, but the risks are high. Opinion polls suggest a close result, and unless the gap widens markedly between the “Ins” and “Outs”, a prolonged period of uncertainty beckons. Moreover, in the event of Brexit, negotiations could go on for years. Having secured a deal at the European Council meeting on 19 February, PM David Cameron announced that the referendum on UK EU membership will be held on 23 June. Based on the reactions on both sides, it looks like...

Read More » Swiss Economicblogs.org

Swiss Economicblogs.org