Second-quarter growth points to a US economy in fine stead, driven by investment spending. Revisions show the savings rate is healthier than thought.US GDP grew 4.1% in the second quarter q-o-q (seasonally adjusted annualised reading, or SAAR), according to the first estimate, up from a revised 2.2% in Q1-2018 (2.0% previously). This is the strongest q-o-q reading since Q3 2014. But there was no particular ‘wow’ effect since the market had expected 4.2%. The y-o-y print, a more accurate and smoother gauge of the underlying strength for the US economy, was 2.8% (up from 2.6% in Q1 2018).One highlight of the report was the strength in private consumption, up 4.0% q-o-q SAAR, more than the 3.0% expected, although this was on the back of soft data in Q1. The bigger story is that US growth

Topics:

Thomas Costerg considers the following as important: Macroview, US GDP, US growth, US investment growth, US policy forecast

This could be interesting, too:

Cesar Perez Ruiz writes Weekly View – Big Splits

Cesar Perez Ruiz writes Weekly View – Central Bank Halloween

Cesar Perez Ruiz writes Weekly View – Widening bottlenecks

Cesar Perez Ruiz writes Weekly View – Debt ceiling deadline postponed

Second-quarter growth points to a US economy in fine stead, driven by investment spending. Revisions show the savings rate is healthier than thought.

US GDP grew 4.1% in the second quarter q-o-q (seasonally adjusted annualised reading, or SAAR), according to the first estimate, up from a revised 2.2% in Q1-2018 (2.0% previously). This is the strongest q-o-q reading since Q3 2014. But there was no particular ‘wow’ effect since the market had expected 4.2%. The y-o-y print, a more accurate and smoother gauge of the underlying strength for the US economy, was 2.8% (up from 2.6% in Q1 2018).

One highlight of the report was the strength in private consumption, up 4.0% q-o-q SAAR, more than the 3.0% expected, although this was on the back of soft data in Q1. The bigger story is that US growth remains underpinned by accelerating investment. This year, we believe investment is on track to grow more than 7%. Q2 data validated this view, with growth of 7.3% q-o-q SAAR (after 11.5% in Q1). The biggest macro threat on the horizon is an escalation of international trade disputes, although we do not think the tangible impact will be visible before 2019.

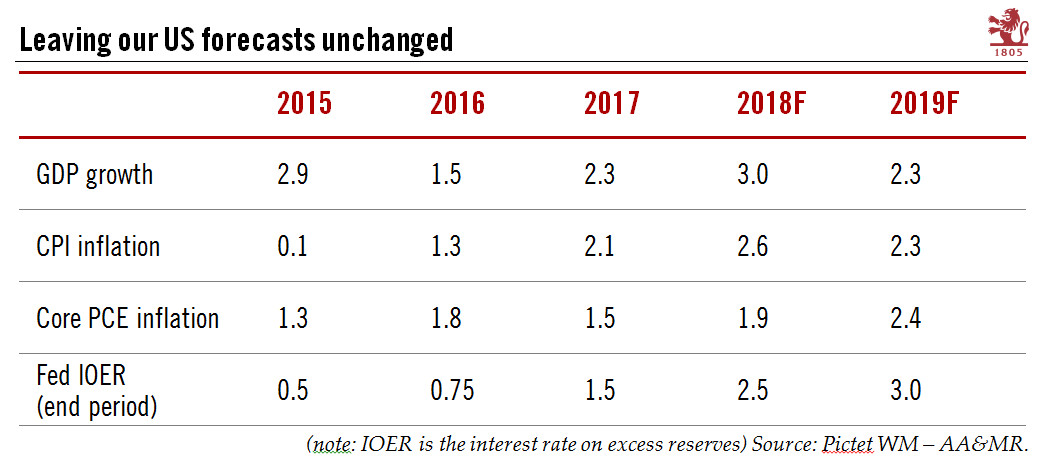

We are keeping our full-year 2018 GDP growth forecast at 3.0%. This assumes the pace of growth in the second half of the year to be broadly comparable to that seen in the first half (3.1%). There are modest downside risks, mostly related to the intriguing weakness in the housing sector lately.

The Bureau of Economic Analysis has also revised previous household income and savings data quite extensively, with the savings rate revised up sharply. The 2017 savings rate rose to 6.7% from the BEA’s previous estimate of 3.4%. The Q2 2018 reading for the savings rate was 6.8% (versus 3.2% in May using previous methodology).

This revision has significant ramifications, since it shows the US consumer as much less financially ‘stretched’ than previously thought. Therefore, there may be more room for the US consumer to spend or leverage up going forward, something that could help prolong the current expansion.