Trump’s trade tariffs should have a very small impact and may be a ploy to reach a trade agreement.The Trump Administration last week announced tariffs of 25% on USD 60bn worth of imports from China (out of USD 506bn of total Chinese merchandise imports). The list of products targeted still has to be thrashed out. The official aim is to sanction China for alleged theft of US firms’ intellectual property; the US Trade Representative (USTR) estimates the damage amounts to USD 50bn.But President Trump also sees the tariffs as a way to pressure the Chinese authorities into a ‘deal’, with the aim to reduce the bilateral trade deficit by USD 100bn. Such a deal would echo US trade policy towards Japan in the 1980s, when the US negotiated quotas on Japanese cars.Since the announcement, media

Topics:

Thomas Costerg and Dong Chen considers the following as important: Macroview

This could be interesting, too:

Cesar Perez Ruiz writes Weekly View – Big Splits

Cesar Perez Ruiz writes Weekly View – Central Bank Halloween

Cesar Perez Ruiz writes Weekly View – Widening bottlenecks

Cesar Perez Ruiz writes Weekly View – Debt ceiling deadline postponed

Trump’s trade tariffs should have a very small impact and may be a ploy to reach a trade agreement.

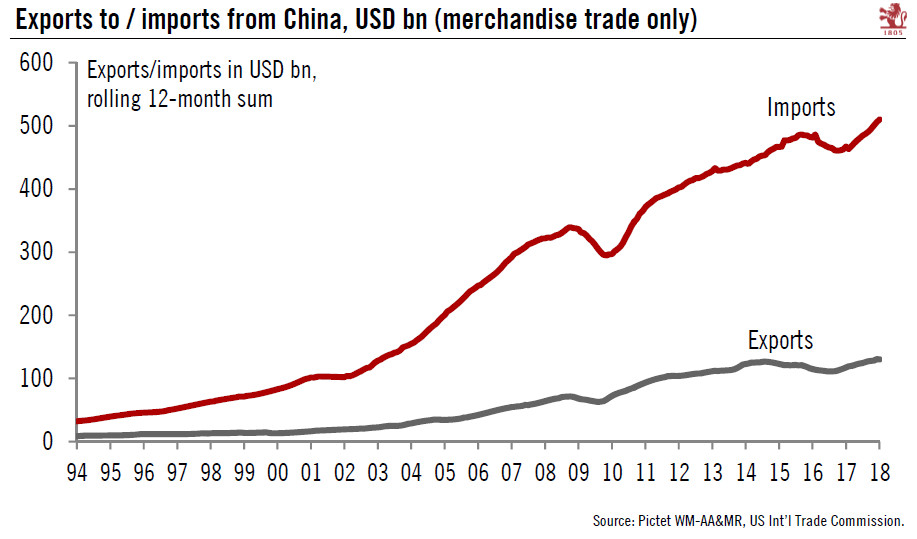

The Trump Administration last week announced tariffs of 25% on USD 60bn worth of imports from China (out of USD 506bn of total Chinese merchandise imports). The list of products targeted still has to be thrashed out. The official aim is to sanction China for alleged theft of US firms’ intellectual property; the US Trade Representative (USTR) estimates the damage amounts to USD 50bn.

But President Trump also sees the tariffs as a way to pressure the Chinese authorities into a ‘deal’, with the aim to reduce the bilateral trade deficit by USD 100bn. Such a deal would echo US trade policy towards Japan in the 1980s, when the US negotiated quotas on Japanese cars.

Since the announcement, media reports have been suggesting that a trade ‘deal’ is possible and that early discussions have been held. The good news is that Treasury Secretary Steve Mnuchin has kept the door open to his Chinese counterparts and seems eager to find an agreement.

Assuming US trade rhetoric does not escalate, we think the impact of the tariffs on both US GDP and inflation this year should be below 0.1 percentage point. We therefore maintain our 2018 forecasts of 3.0% annual GDP and 1.9% core PCE inflation for the US. In fact, the impact could be even less as it is plausible that the tariffs will be diluted.

For China, the impact of the tariffs on growth is similarly limited, and also likely to be below 0.1% of GDP. The Chinese government has a strong incentive to avoid a trade war with the US. A trade agreement that involves China promising to lower trade barriers and grant wider market access to US industries is possible.

As a result, we are leaving our GDP growth forecast for China of 6.5% in 2018 unchanged for the moment. In addition, we believe there is still a chance that the US tariffs will not materialise, at least not fully if, as seems possible, both countries reach a trade agreement.