In 2017, for the third year in a row, Chinese phone and electronic good imports exceeded the value of oil imports to the US.For decades US trade policy’s biggest focus was on the country’s astronomical imports of oil. But the oil bill has moderated significantly in recent years, due to the domestic shale oil production boom and the (associated) drop in global oil prices.Lately, and more particularly since Donald Trump arrived in the White House, the focus has turned to trade with China. President Trump says he wants to reach a deal to reduce the US’s USD375bn merchandise trade deficit with China by USD100bn. Meanwhile, he maintains the threat of tariffs on Chinese imports, with some of them set to enter into force in a few weeks. (See also US-China trade update – Parsing the rhetoric, 27

Topics:

Thomas Costerg considers the following as important: Macroview

This could be interesting, too:

Cesar Perez Ruiz writes Weekly View – Big Splits

Cesar Perez Ruiz writes Weekly View – Central Bank Halloween

Cesar Perez Ruiz writes Weekly View – Widening bottlenecks

Cesar Perez Ruiz writes Weekly View – Debt ceiling deadline postponed

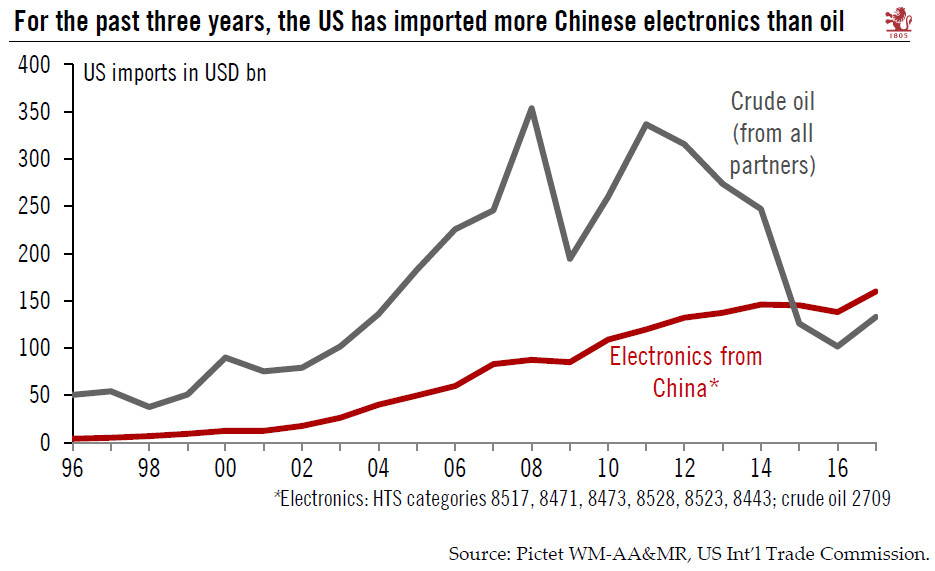

In 2017, for the third year in a row, Chinese phone and electronic good imports exceeded the value of oil imports to the US.

For decades US trade policy’s biggest focus was on the country’s astronomical imports of oil. But the oil bill has moderated significantly in recent years, due to the domestic shale oil production boom and the (associated) drop in global oil prices.

Lately, and more particularly since Donald Trump arrived in the White House, the focus has turned to trade with China. President Trump says he wants to reach a deal to reduce the US’s USD375bn merchandise trade deficit with China by USD100bn. Meanwhile, he maintains the threat of tariffs on Chinese imports, with some of them set to enter into force in a few weeks. (See also US-China trade update – Parsing the rhetoric, 27 March 2018.

President Trump has been less vocal about how he specifically intends to achieve this USD100bn reduction in the US-China trade deficit, a deficit that is partly due to surging demand for China-made electronics, in particular cell phones, tablets, computers and screens. Imports of electronics from China rose 15.9% in 2017, reaching a new record high. The seven-year compounded annual growth rate is +5.6% per annum. For a third year, electronics imports from China in 2017 were higher than the US’s oil import bill.

It is not yet clear Trump’s tariffs will actually hit China-made electronic goods imports, even though the US Trade Representative said telecom equipment is in the crosshairs. More importantly, will tariffs manage to tackle the US’s ‘addiction’ to imported cell phones ? That is unclear. Some demand may simply shift to other phone-assembling countries like Vietnam if tariffs make Chinese imports more expensive.