While ambitious initiatives like the One Belt One Road plan will continue to support companies and while valuations appear reasonable, careful stock-picking is required.A high level of investment in infrastructure in China is set to continue into the medium term. Under the latest Five Year Plan (FYP), for 2016-20, the transportation sector is to see CNY15 trillion (USD2.2trn) of capital expenditure, much of which will go into roads and railways. Another major domestic project, the Xiongan New Area, also implies large ongoing infrastructure spending.Spending will be supported by a growing trend for public-private partnerships (PPPs). Since 2013, the government has been actively promoting PPPs, with improvements to legislation and a shift in focus from just tendering projects to ensuring

Topics:

Wen-Ping Tan considers the following as important: chinese infrastructure, Chinese investment spending, Chinese PPP, Macroview, One Belt One Road

This could be interesting, too:

Cesar Perez Ruiz writes Weekly View – Big Splits

Cesar Perez Ruiz writes Weekly View – Central Bank Halloween

Cesar Perez Ruiz writes Weekly View – Widening bottlenecks

Cesar Perez Ruiz writes Weekly View – Debt ceiling deadline postponed

While ambitious initiatives like the One Belt One Road plan will continue to support companies and while valuations appear reasonable, careful stock-picking is required.

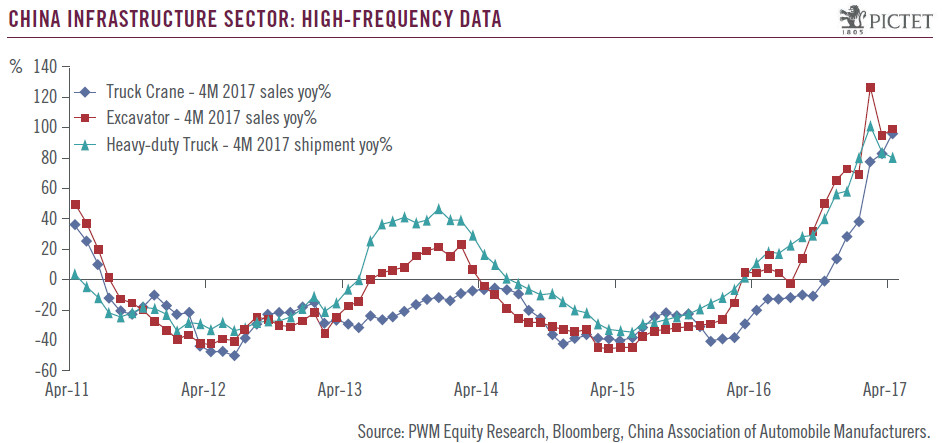

A high level of investment in infrastructure in China is set to continue into the medium term. Under the latest Five Year Plan (FYP), for 2016-20, the transportation sector is to see CNY15 trillion (USD2.2trn) of capital expenditure, much of which will go into roads and railways. Another major domestic project, the Xiongan New Area, also implies large ongoing infrastructure spending.

Spending will be supported by a growing trend for public-private partnerships (PPPs). Since 2013, the government has been actively promoting PPPs, with improvements to legislation and a shift in focus from just tendering projects to ensuring implementation. These developments should help boost new orders for Chinese infrastructure sector enterprises and improve orders-to-revenue conversion. The sector will also benefit from China’s hugely important One Belt One Road (OBOR) project, designed to develop trade and investment links with Asia, the Middle East and Europe. This well-financed project is intended to expand China’s geopolitical reach, but also to export its infrastructure capacity.

Valuations for Chinese infrastructure firms appear reasonable. The Hong Kong listed China infrastructure construction sub-sector (i.e. H-shares) is currently trading at an attractive multiple of 8.0x on 12-month forward P/E, markedly below its 10-year average of 9.7x, and 53% below its last peak in 2009. Leverage is high in parts of the sector, but continued robust growth should help to address high net debt/equity.

China infrastructure companies should see continued solid momentum in new contract orders over the coming years, both domestically and from overseas, underpinned by domestic transportation investment, the OBOR and Xiongan New Area initiatives, and PPP projects. Conversion of the backlog of new contract orders to revenue should also improve. As a result, we are bullish on the sector. But it is important to see infrastructure as a medium term play, given projects’ long gestation periods and the lumpiness of revenue flows. Careful stock-picking is vital, favouring companies with a track record of successful implementation and keeping in mind leverage concerns.