US corporations’ cash accumulation continues unabated, leading to the rise of ‘superstar’ firms that are crushing market competition.We think many keys for understanding the US economy right now – and why it may not be behaving the way textbook economics say it should – are to be found at the microeconomic rather than macroeconomic level. What the microeconomic picture shows is a sharp reduction in the level of market competition due to the rise of a small number of ‘superstar’ firms with increasing market power, i.e. with a strong ability to dominate their markets.The evidence for this lies in US corporates’ almost-abnormal cash flow generation, which has resulted in immense, and growing, piles of cash sitting on their balance sheets, particularly the balance sheets of a select number of

Topics:

Thomas Costerg considers the following as important: Macroview, US cash accumulation, US competition, US competitive landscape, US corporate cash growth

This could be interesting, too:

Cesar Perez Ruiz writes Weekly View – Big Splits

Cesar Perez Ruiz writes Weekly View – Central Bank Halloween

Cesar Perez Ruiz writes Weekly View – Widening bottlenecks

Cesar Perez Ruiz writes Weekly View – Debt ceiling deadline postponed

US corporations’ cash accumulation continues unabated, leading to the rise of ‘superstar’ firms that are crushing market competition.

We think many keys for understanding the US economy right now – and why it may not be behaving the way textbook economics say it should – are to be found at the microeconomic rather than macroeconomic level. What the microeconomic picture shows is a sharp reduction in the level of market competition due to the rise of a small number of ‘superstar’ firms with increasing market power, i.e. with a strong ability to dominate their markets.

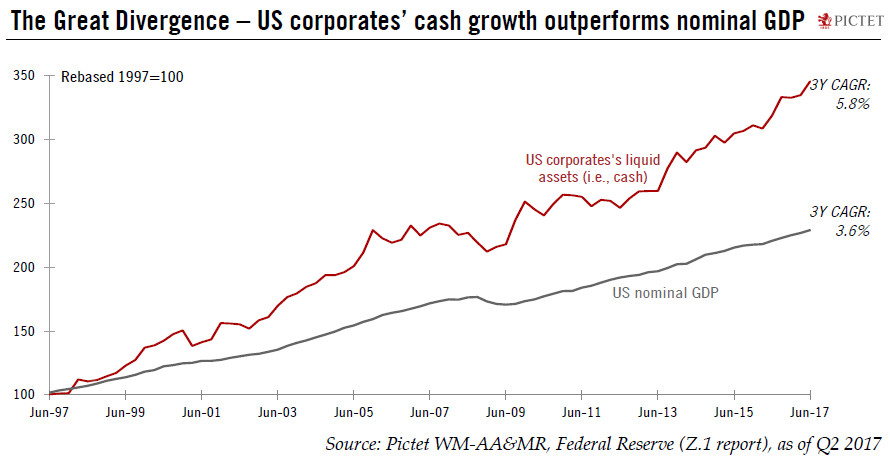

The evidence for this lies in US corporates’ almost-abnormal cash flow generation, which has resulted in immense, and growing, piles of cash sitting on their balance sheets, particularly the balance sheets of a select number of dominant firms. US corporations’ liquid assets amounted to USD 2.26 trillion in Q2 2017, according to Federal Reserve data, growing 8.4% y-o-y, much higher than nominal GDP growth of 3.8%. Viewed differently, corporate cash represented 11.7% of GDP in Q2, the highest since 1955. (The low point was 5.2% of GDP in Q2 1982.)

This phenomenon of reduced market competition across economic sectors, further fuelled by the rise of tech and globalisation, goes some way to solving some of today’s biggest economic puzzles, from the persistence of low inflation (despite a tight labour market) to the sluggish investment picture (despite high corporate confidence). The question for the future is whether this represents a stable or an unstable equilibrium. Although more the case among Democrats than among Republicans (who control Congress), politicians have the tech giants in their sights. And while antitrust bodies have remained quiet, calls have been growing for a more muscular approach and for greater government intervention to ensure fairer competition.