We remain constructive on gold, but some other precious metals face issues stemming from a moderate slowdown in global growth and changes in the auto industry.While gold prices have risen about 12% per troy ounce since the beginning of this year, we still have a constructive view of the gold price over the next 12 to 18 months. But does this mean that the outlook for precious metals in general is positive?Notwithstanding fluctuations in the US dollar, gold has generally benefited from a low US 10-year yield since the start of the year and ongoing global uncertainty. Our constructive view comes mostly from prospects for a weaker US dollar and faint upward pressure on US yields, which reduces the cost of holding gold. Furthermore, its use as a hedge against tail risks is likely to continue

Topics:

Luc Luyet considers the following as important: gold demand, Macroview, Metal prices, Precious metals demand, Precious metals outlook

This could be interesting, too:

Cesar Perez Ruiz writes Weekly View – Big Splits

Cesar Perez Ruiz writes Weekly View – Central Bank Halloween

Cesar Perez Ruiz writes Weekly View – Widening bottlenecks

Cesar Perez Ruiz writes Weekly View – Debt ceiling deadline postponed

We remain constructive on gold, but some other precious metals face issues stemming from a moderate slowdown in global growth and changes in the auto industry.

While gold prices have risen about 12% per troy ounce since the beginning of this year, we still have a constructive view of the gold price over the next 12 to 18 months. But does this mean that the outlook for precious metals in general is positive?

Notwithstanding fluctuations in the US dollar, gold has generally benefited from a low US 10-year yield since the start of the year and ongoing global uncertainty. Our constructive view comes mostly from prospects for a weaker US dollar and faint upward pressure on US yields, which reduces the cost of holding gold. Furthermore, its use as a hedge against tail risks is likely to continue being supportive going forward given the current geopolitical and macro background. But the current low inflation environment and low inflation expectations mean that gold’s role as a hedge against high inflation is unlikely to drive prices in the coming 12-18 months.

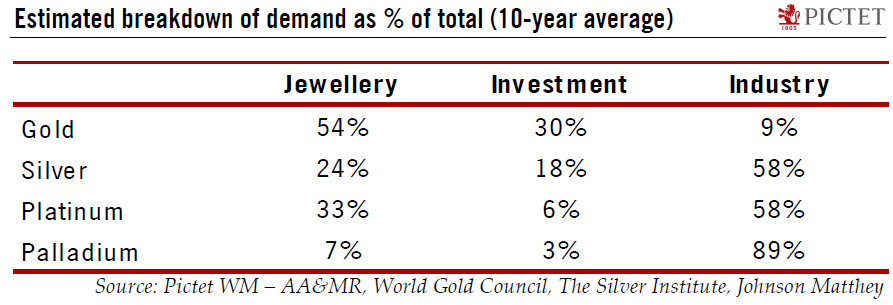

Silver’s performance has been particularly disappointing given the recent recovery in global growth. The fact that silver is currently seen as cheap compared to gold by historic standards suggests that there is potential for a re-rating of silver should the global recovery continue. But our expectation for a moderate slowdown in the US and China in 2018 does not bode well for silver’s performance relative to gold.

Platinum should continue to suffer from the ongoing erosion of diesel’s share of car sales in Europe. although its low valuation compared to other precious metals should provide some support. The upside potential for platinum seems limited.

Palladium could be vulnerable in the coming months given its high valuation, extreme positive sentiment among speculators and weakening US car sales. Given the rise in prices, the trend to replace platinum with palladium in car engines may have run its course as the price of palladium has exceeded the price of platinum since early October, a very rare occurrence.