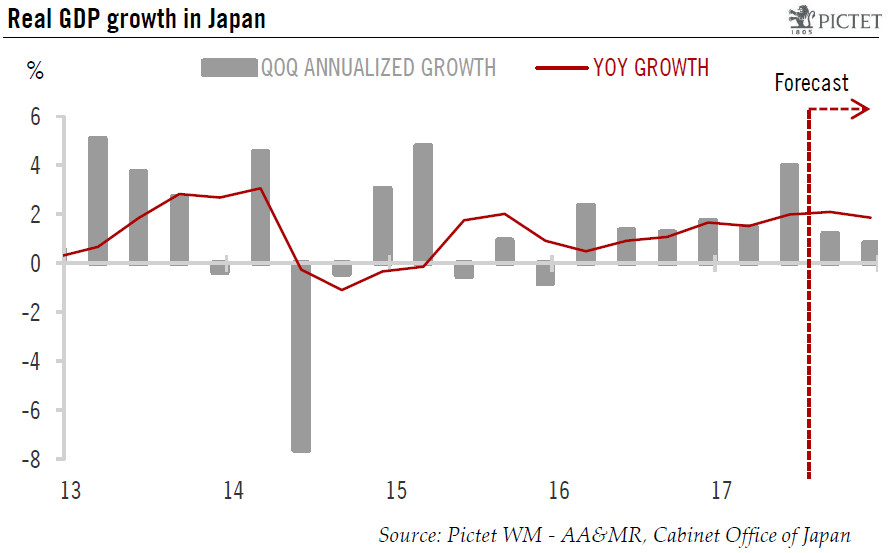

The first estimate for GDP in the second quarter surprised on the upside, pushing us to revise our full-year forecast. But we still believe the Bank of Japan will stick to current monetary policy.The first estimate of Japan’s Q2 GDP showed growth of 1.0% quarter over quarter (q-o-q) in real terms, or 4.0% annualised, beating the consensus estimates (1.6% annualised) by a wide margin. We have therefore decided to revise up our 2017 GDP forecast for Japan to 1.9% from 1.3%.Unlike previous quarters, when the recovery was driven mainly by exports, the strong performance of Q2 2017 was based on solid domestic demand, which has picked up strongly, whether in terms of consumption or investment, and in both the private and the public sectors.On the consumption side, the increasingly tight labour

Topics:

Dong Chen considers the following as important: Bank of Japan policy, Japanese domestic economy, Japanese growth forecast, Japanese inflation, Japanese wage growth, Macroview

This could be interesting, too:

Cesar Perez Ruiz writes Weekly View – Big Splits

Cesar Perez Ruiz writes Weekly View – Central Bank Halloween

Cesar Perez Ruiz writes Weekly View – Widening bottlenecks

Cesar Perez Ruiz writes Weekly View – Debt ceiling deadline postponed

The first estimate for GDP in the second quarter surprised on the upside, pushing us to revise our full-year forecast. But we still believe the Bank of Japan will stick to current monetary policy.

The first estimate of Japan’s Q2 GDP showed growth of 1.0% quarter over quarter (q-o-q) in real terms, or 4.0% annualised, beating the consensus estimates (1.6% annualised) by a wide margin. We have therefore decided to revise up our 2017 GDP forecast for Japan to 1.9% from 1.3%.

Unlike previous quarters, when the recovery was driven mainly by exports, the strong performance of Q2 2017 was based on solid domestic demand, which has picked up strongly, whether in terms of consumption or investment, and in both the private and the public sectors.

On the consumption side, the increasingly tight labour market and rising compensation of employees seem to have finally turned into stronger household consumption. As a result, Japanese consumer confidence and growth in motor vehicle sales have been improving since 2016. Additionally, corporate capital investment seems to be picking up speed. The rebound in capex is being led by the non-manufacturing sectors, which now account for over 70% of all corporate capital investment in Japan

Looking ahead, we expect the Japanese economy to continue to expand moderately through the rest of 2017. While there are some very encouraging signs on the domestic front, the pace of growth in Q2, extremely high by Japanese standards, may not be sustained. Some slowdown in the growth rate in the second half of the year is likely, in our view.

The upside surprise in GDP growth in the second quarter does not change our expectations for the Bank of Japan’s monetary policy, because core inflation still lies way below its 2% target. We still don’t foresee any significant pickup of inflation until at least the second half of 2018. As a result, we expect the BoJ to keep its current monetary policy framework, aimed at maintaining the 10-year Japanese government bond yield at about 0% and the short-term policy rate at -0.1% until there is concrete evidence of sustained inflation momentum in the economy.