Just the other day, President Biden took to the pages of the Wall Street Journal to reassure Americans the government is doing something about the greatest economic challenge they face. Biden says this is inflation when that’s neither the actual affliction nor our greatest threat. On the contrary, recession probabilities have sharply risen as the real economy slows down given the emerging downside to last year’s supply shock. One thing we might agree on, the...

Read More »Still Stuck In Between

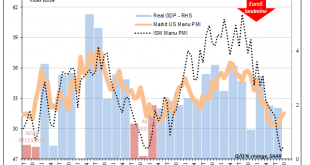

Note: originally published Friday, Nov 1 There wasn’t much by way of the ISM’s Manufacturing PMI to allay fears of recession. Much like the payroll numbers, an uncolored analysis of them, anyway, there was far more bad than good. For the month of October 2019, the index rose slightly from September’s decade low. At 48.3, it was up just half a point last month from the month prior. Most of that was related to a curious surge in New Export Orders. Having dropped to...

Read More »ISM Spoils The Bond Rout!!! Again

For the second time this week, the ISM managed to burst the bond bear bubble about there being a bond bubble. Who in their right mind would buy especially UST’s at such low yields when the fiscal situation is already a nightmare and becoming more so? Some will even reference falling bid-to-cover ratios which supposedly suggests an increasing dearth of buyers. Bid-to-cover, however, is irrelevant. That only tells you about one part of the buying equation, the number...

Read More »ISM Spoils The Bond Rout!!!

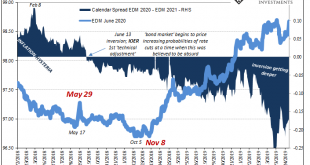

With China closed for its National Day Golden Week holiday, the stage was set for Japan to steal the market spotlight. If only briefly. The Bank of Japan announced last night that it had had enough of the JGB curve. The 2s10s very nearly inverted last month and BoJ officials released preliminary plans to steepen it back out. Japan’s central bank says that it might refrain from buying JGB’s at the long end. This is upside down from when YCC was first attached to QQE...

Read More »The Dismal Boom

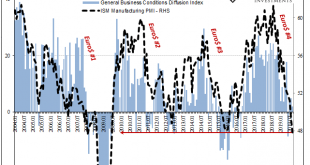

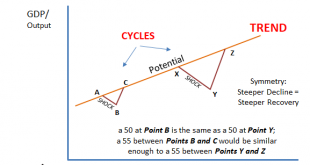

There is a fundamental assumption behind any purchasing manager index, or PMI. These are often but not always normalized to the number 50. That’s done simply for comparison purposes and the ease of understanding in the general public. That level at least in the literature and in theory is supposed to easily and clearly define the difference between growth and contraction. But is every 50 the same? That’s ultimately at...

Read More »Staying Stuck

The rebound in commodity prices is not difficult to understand, perhaps even sympathize with. With everything so depressed early last year, if it turned out to be no big deal in the end then there was a killing to be made. That’s what markets are supposed to do, entice those with liquidity to buy when there is blood in the streets. And if those speculators turn out to be wrong, then we are all much the wiser for their...

Read More »United States: both ISM indices rose in March

Both the ISM Manufacturing index and its Non-Manufacturing counterpart rose m-o-m in March. However, other economic data recently published were rather weak. Our forecast that GDP will grow by 2.0% in Q1 is revised down to 1.5%. However, our forecast for yearly average growth in 2016 remains unchanged at 2.0%. The ISM Manufacturing survey for March 2016 was published on Friday last week. The headline reading bounced back further from 49.5 in February to an eight-month high of 51.8 in...

Read More »United States: the ISM Non-Manufacturing index fell further markedly in January

The US ISM Manufacturing index remained stuck at quite low levels and the Non-Manufacturing index declined further heavily. However, it remained pitched at a still relatively healthy level. The ISM Manufacturing index stabilised at a low level in January. But its Non-Manufacturing counterpart fell further heavily, although it remained pitched at a still relatively healthy level. Nevertheless, together with most other economic data published recently, these surveys unfortunately confirm...

Read More » Swiss Economicblogs.org

Swiss Economicblogs.org