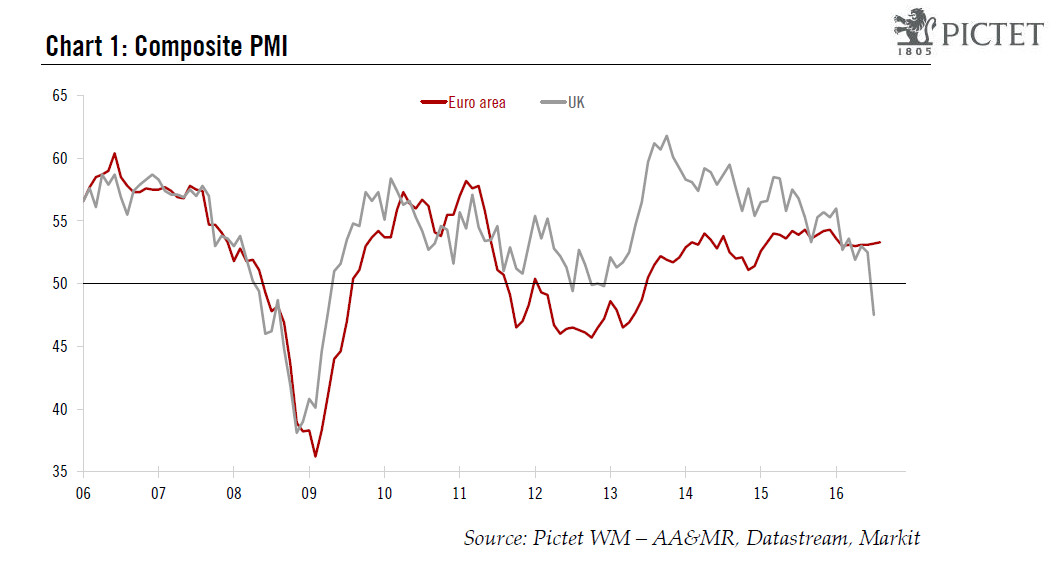

Yesterday’s flash purchasing managers index (PMI) surveys showed again a rather resilient picture for the euro area after the UK vote to leave the EU. The euro area composite ‘flash’ PMI index posted a marginal increase from 53.2 in July to 53.3 in August, slightly above consensus expectations (53.1) and reaching a seven month high. The sector breakdown showed that the services sector index increased from 52.9 in July to 53.1 in August, above consensus expectations (52.8). By contrast, the manufacturing PMI fell marginally (-0.2 to 51.8).Looking at the breakdown by sub-indices, the main culprit for weak manufacturing activity was new orders and employment falling on the month. The output index remained unchanged. As for services sectors, despite the increase in the headline index, service providers provided a sign of caution—new business rose, but business expectations fell.Overall, the average (July and August) PMI for Q3 (53.3) is slightly higher than in Q2 (53.1). Thus, the euro area composite PMI looks consistent with GDP growth of around 0.3% q-o-q in Q3, the same pace as in Q2. As a result, we see no reason to change our forecast at this stage and are maintaining our forecast for euro area GDP growth of 1.5% this year.

Topics:

Nadia Gharbi considers the following as important: economic growth, euro area economy, Euro area PMI, Macroview

This could be interesting, too:

Joseph Y. Calhoun writes Weekly Market Pulse: Questions

Joseph Y. Calhoun writes Weekly Market Pulse: It’s An Uncertain World

Joseph Y. Calhoun writes Weekly Market Pulse: Look Up In The Sky! It’s A UFO! Or Not!

Joseph Y. Calhoun writes Weekly Market Pulse: A Fatal Conceit

Yesterday’s flash purchasing managers index (PMI) surveys showed again a rather resilient picture for the euro area after the UK vote to leave the EU.

The euro area composite ‘flash’ PMI index posted a marginal increase from 53.2 in July to 53.3 in August, slightly above consensus expectations (53.1) and reaching a seven month high. The sector breakdown showed that the services sector index increased from 52.9 in July to 53.1 in August, above consensus expectations (52.8). By contrast, the manufacturing PMI fell marginally (-0.2 to 51.8).

Looking at the breakdown by sub-indices, the main culprit for weak manufacturing activity was new orders and employment falling on the month. The output index remained unchanged. As for services sectors, despite the increase in the headline index, service providers provided a sign of caution—new business rose, but business expectations fell.

Overall, the average (July and August) PMI for Q3 (53.3) is slightly higher than in Q2 (53.1). Thus, the euro area composite PMI looks consistent with GDP growth of around 0.3% q-o-q in Q3, the same pace as in Q2. As a result, we see no reason to change our forecast at this stage and are maintaining our forecast for euro area GDP growth of 1.5% this year. As for the ECB, the resilience of the euro area PMI surveys after the UK vote to leave the EU suggests that the monetary institution will see no need for immediate stimulus.

By country, PMI surveys suggest a moderate pace of expansion in France and solid growth in Germany. There was also positive news from the rest of the euro area, where we have no PMI indicators at this stage but where Markit suggested that activity has picked up after the slowdown in Q2.

As for the UK, it is worth highlighting than in contrast to July, there is no Flash estimate in August. UK PMI will be released on September 1 and 5.