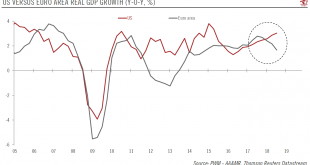

While growth in France rebounded, Italy stalled in Q3. Our full-year forecast for the euro area remains unchanged but is clearly at risk. According to initial estimates, growth in the euro area slowed in Q3 to 0.2% q-o-q (quarter on quarter) from 0.4% in Q2. These latest GDP results were below consensus expectations and our own forecast. This was the weakest quarterly growth figure for the euro area since Q2 2014 and...

Read More »Euro area’s initial growth figures for Q3 prove disappointing

While growth in France rebounded, Italy stalled in Q3. Our full-year forecast for the euro area remains unchanged but is clearly at risk.According to initial estimates, growth in the euro area slowed in Q3 to 0.2% q-o-q (quarter on quarter) from 0.4% in Q2. These latest GDP results were below consensus expectations and our own forecast. This was the weakest quarterly growth figure for the euro area since Q2 2014 and marks the widest divergence vis-à-vis the US since 2015.Advanced estimates...

Read More »Euro construction momentum could remain strong

The acceleration in construction activity is boosting capital expenditure and supporting the euro area’s cyclical upturn.Since the beginning of the year, euro area capital expenditure has picked up noticeably. The acceleration has been mainly driven by the construction sector (which accounts for almost 50% of total capital expenditure), while business equipment has continued to expand strongly. Construction activity is still 19% below its pre-crisis (2008) level, and has room to improve....

Read More »Euro area flash PMIs show resilient activity

Yesterday’s flash purchasing managers index (PMI) surveys showed again a rather resilient picture for the euro area after the UK vote to leave the EU. The euro area composite ‘flash’ PMI index posted a marginal increase from 53.2 in July to 53.3 in August, slightly above consensus expectations (53.1) and reaching a seven month high. The sector breakdown showed that the services sector index increased from 52.9 in July to 53.1 in August, above consensus expectations (52.8). By contrast, the...

Read More » Swiss Economicblogs.org

Swiss Economicblogs.org