Our model suggests that the Italian government’s strategy for the bad debt problems of the country's banks only will only be credible if economic growth returns Changes in banks’ Non-Performing Loans (NPLs) depend crucially on economic performance, including GDP growth and employment. Put simply, the Italian government’s strategy, or hope, is that even a modest economic recovery leads to a sustained, albeit gradual decline in NPLs and that systemic bank bailouts can be avoided. Moreover, the government has implemented a number of reforms which are expected to improve banks’ asset quality and their business environment. However, the latest GDP data (0% growth in Q2) have reignited fundamental concerns about the state of the Italian economy and the banks, ahead of the Senate referendum.We have used a simple macro model to test the credibility of the government’s strategy by projecting the future changes in Italian NPLs based on macro variables. Our results confirm that modest trend growth of around 0.5-1.0% is needed for NPLs to decline gradually in the next few years. Under our baseline scenario of a modest recovery, therefore, NPLs are likely to stabilise further and indeed decline into 2017, albeit at a frustratingly slow pace. However, NPLs would fail to decline in a mild recession scenario, and would increase further after a larger shock.

Topics:

Frederik Ducrozet considers the following as important: banks, Italy, macroeconomy, Macroview, NPLs

This could be interesting, too:

Marc Chandler writes The Greenback is in Narrow Ranges to Start the Week

Marc Chandler writes Sharp Fall in US Yields ahead of Large Supply

Marc Chandler writes Strategic Ambiguity Leaves Intervention Question Unanswered, but US Dollar has Steadied

Marc Chandler writes The Greenback is Softer Ahead of CPI but Key Chart Points Remain Intact

Our model suggests that the Italian government’s strategy for the bad debt problems of the country's banks only will only be credible if economic growth returns

Changes in banks’ Non-Performing Loans (NPLs) depend crucially on economic performance, including GDP growth and employment. Put simply, the Italian government’s strategy, or hope, is that even a modest economic recovery leads to a sustained, albeit gradual decline in NPLs and that systemic bank bailouts can be avoided. Moreover, the government has implemented a number of reforms which are expected to improve banks’ asset quality and their business environment. However, the latest GDP data (0% growth in Q2) have reignited fundamental concerns about the state of the Italian economy and the banks, ahead of the Senate referendum.

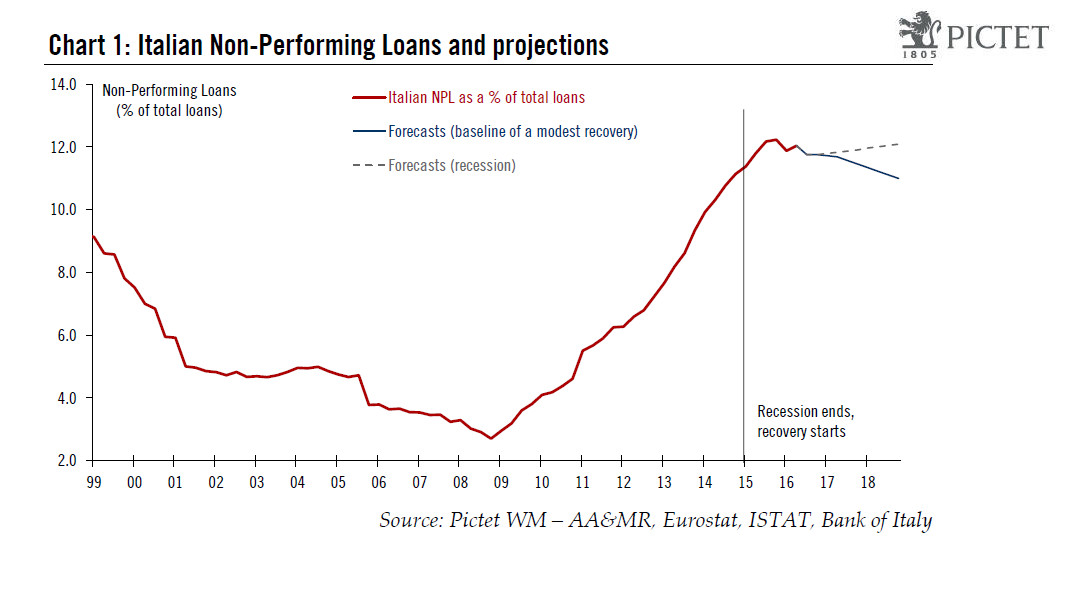

We have used a simple macro model to test the credibility of the government’s strategy by projecting the future changes in Italian NPLs based on macro variables. Our results confirm that modest trend growth of around 0.5-1.0% is needed for NPLs to decline gradually in the next few years. Under our baseline scenario of a modest recovery, therefore, NPLs are likely to stabilise further and indeed decline into 2017, albeit at a frustratingly slow pace. However, NPLs would fail to decline in a mild recession scenario, and would increase further after a larger shock.

In other words, the Italian government’s strategy for banks can only be credible as long as the country returns to growth. If another adverse shock leads to stagnation or recession, some sort of state intervention would eventually be required. Either way, the ECB’s asset purchases are likely to keep Italian public and private borrowing costs lower for longer.

Moreover, a similar approach clearly highlights the benefits of pre-emptive state support in Spain, with the introduction of SAREB (Spain’s ‘bad bank’) leading to a pace of decline in NPLs roughly twice larger than had SAREB not been set up. Spain used around EUR42bn in European bailout funds alone (out of a EUR100bn envelope), or 4% of GDP. The same figure for Italy would be equivalent to EUR65bn, not that far from official estimates of total net NPL exposure at Italian banks.