Improving growth and inflation prospects could help the krona against the euro going forward. The krona is also undervalued against the US dollar, based on fundamentals. At its 7 September meeting, Sweden’s Riksbank decided to keep the repo rate unchanged at -0.5% and to continue to purchase government bonds until the end of the year. The Riksbank acknowledged that the Swedish economy was relatively strong and that inflation was beginning to rise.However, the central bank made clear its concerns about the impact of Brexit and enduring weakness in the European banking sector and stated it was ready to do act again, if needed. These concerns seem a bit exaggerated, in our view. Outside the UK, the short-term impact of Brexit has been relatively mild so far, a full-blown European banking crisis seems unlikely, and the weakness of the banking sector is one of the reasons why the ECB is unlikely to cut rates further.Manageable risks together with an upbeat Swedish growth outlook should be supportive of the Swedish krona (SEK) going forward, especially at the currency is close to its weakest level against the euro since December 2014 (see chart). The krona’s weak exchange rate together with improving prospects for Swedish growth and inflation mean the potential for further euro gains against the Swedish currency in the coming months is limited, in our view.

Topics:

Luc Luyet considers the following as important: Currency valuations, Macroview, Riksbank, Swedish krona

This could be interesting, too:

Marc Chandler writes Serenity Now

Marc Chandler writes US Dollar Soars and US Rates Jump

Marc Chandler writes Nervous Calm Hangs over the Markets

Marc Chandler writes Run on the Dollar Stalls after the Market Boosted Odds of another 50 bp Fed Cut

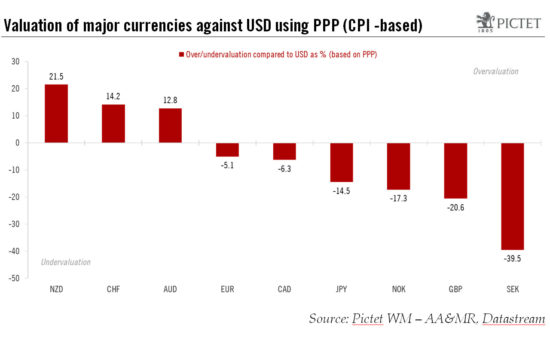

Improving growth and inflation prospects could help the krona against the euro going forward. The krona is also undervalued against the US dollar, based on fundamentals.

At its 7 September meeting, Sweden’s Riksbank decided to keep the repo rate unchanged at -0.5% and to continue to purchase government bonds until the end of the year. The Riksbank acknowledged that the Swedish economy was relatively strong and that inflation was beginning to rise.

However, the central bank made clear its concerns about the impact of Brexit and enduring weakness in the European banking sector and stated it was ready to do act again, if needed. These concerns seem a bit exaggerated, in our view. Outside the UK, the short-term impact of Brexit has been relatively mild so far, a full-blown European banking crisis seems unlikely, and the weakness of the banking sector is one of the reasons why the ECB is unlikely to cut rates further.

Manageable risks together with an upbeat Swedish growth outlook should be supportive of the Swedish krona (SEK) going forward, especially at the currency is close to its weakest level against the euro since December 2014 (see chart). The krona’s weak exchange rate together with improving prospects for Swedish growth and inflation mean the potential for further euro gains against the Swedish currency in the coming months is limited, in our view. Furthermore, as the EUR is at least as exposed to Brexit and bank sector risks as the SEK, a long SEK-short EUR pairing offers a certain hedge against these two risks.

Furthermore, the Swedish krona is significantly undervalued against the USD, according to our analysis. We believe that in the long term the SEK is likely to gradually move back to its PPP-equilibrium value thanks to Sweden’s robust growth outlook and reduced external uncertainties. However, we also recognise that convergence of misaligned currencies towards their PPP equilibrium price is a long-term process. As a result, basing a tactical trade solely on PPP-misalignment may not always bring the desired results.