In the years before the 2008 financial crisis, investors flocked to equities in fast-growing emerging economies. But when the crisis put the brakes on global growth, that attraction to emerging markets proved a fickle one, and investors sought safe haven in less risky investments. In late 2016, however, the pendulum is swinging back again, with investors citing several reasons for renewed confidence in emerging market equities. Among the most surprising? Their politics are relatively more stable than in the developed world. Start with Latin America: In Brazil, embattled president Dilma Rousseff was ousted in August and her successor, Michael Temer, is advocating pro-business measures such as the auctions of infrastructure and energy contracts to private companies that won’t, unlike in previous years, require partnerships with state agencies. In Argentina, the 2015 election of President Mauricio Macri ended a decade of populist rule, and Macri has carried out a series of economic reforms, including removing export taxes and allowing Argentina’s peso to float freely. The settlement of old debts, in particular, allowed the country to return to the international credit market for the first time in 15 years. In Asia, the bright spots are Indonesia and India.

Topics:

Alice Gomstyn considers the following as important: Argentina, Asia, Brazil, developed markets, emerging market equities, emerging markets, equities, India, Indonesia, Investing: Features, Latin America

This could be interesting, too:

Marc Chandler writes US Dollar Soars and US Rates Jump

Marc Chandler writes Nervous Calm Hangs over the Markets

Marc Chandler writes Continued Backing Up of US Rates Extend the Greenback’s Gains

Marc Chandler writes Run on the Dollar Stalls after the Market Boosted Odds of another 50 bp Fed Cut

In the years before the 2008 financial crisis, investors flocked to equities in fast-growing emerging economies. But when the crisis put the brakes on global growth, that attraction to emerging markets proved a fickle one, and investors sought safe haven in less risky investments. In late 2016, however, the pendulum is swinging back again, with investors citing several reasons for renewed confidence in emerging market equities. Among the most surprising? Their politics are relatively more stable than in the developed world.

Start with Latin America: In Brazil, embattled president Dilma Rousseff was ousted in August and her successor, Michael Temer, is advocating pro-business measures such as the auctions of infrastructure and energy contracts to private companies that won’t, unlike in previous years, require partnerships with state agencies. In Argentina, the 2015 election of President Mauricio Macri ended a decade of populist rule, and Macri has carried out a series of economic reforms, including removing export taxes and allowing Argentina’s peso to float freely. The settlement of old debts, in particular, allowed the country to return to the international credit market for the first time in 15 years.

In Asia, the bright spots are Indonesia and India. Equity strategists on Credit Suisse’s Global Markets team believe that Indonesian President Joko Widodo will have more room to pursue his reform agenda after securing support from the country’s second-biggest party, and the country is already benefiting from a recently approved tax amnesty scheme. In India, promising reforms include the recent passage of a bankruptcy bill and another overhauling the tax structure for goods and services. Compare all of the above to the politics in the developed world, which has witnessed a host of populist movements that could usher in measures damaging to economic growth, including protectionist policies and immigration limits, and the developing world seems surprisingly stable, politically speaking.

Growing populism in both the U.S. and Europe has already helped prompt minimum wage hikes and, more broadly, wage growth in developed markets has outpaced productivity growth. The wage trend, the Global Markets strategists say, is the key driver of margin compression in developed markets. The situation stands in sharp contrast to that in emerging markets, where overall wage growth recently fell below productivity growth for the first time in a year; in China and Brazil, it’s the first time in a decade. In large part due to the widening wage-productivity gap, the Bank forecasts a 60 basis point increase in margins for emerging market companies by the end of 2016.

The currency landscape also appears favorable for emerging market equities. Despite a strong rally over the past year, emerging world currencies (excluding China) are still the cheapest they’ve been since the early 2000s. Global Markets strategists estimate that 25 percent of total returns come from currency movements, calling it “the critical driver of performance.” Strategists also note that there are signs that central banks in some countries are working to keep their currencies cheap by building up foreign exchange reserves. This has a tendency to bolster equities because central banks usually don’t fully “sterilize” their increases in foreign reserves—that is, they don’t mop up all the extra liquidity they create when spending their domestic currency on foreign assets. And that additional liquidity will boost domestic asset prices, strategists say.

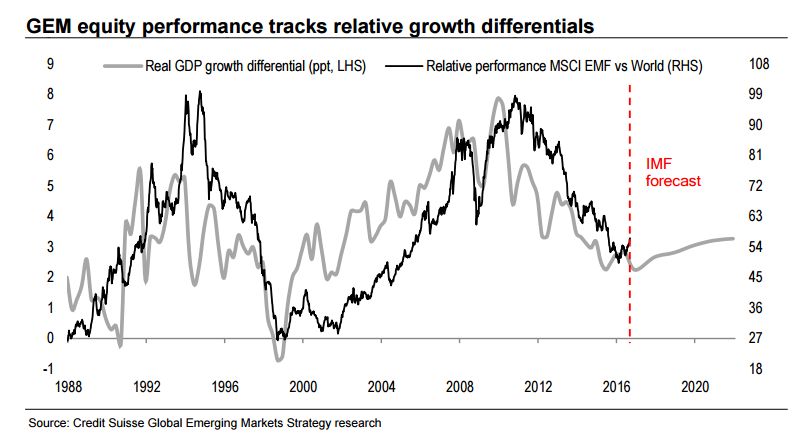

Though GDP growth in emerging markets has long outpaced that of developed markets, the gap has shrunk in recent years. But the strengths of emerging markets today have both Credit Suisse and the International Monetary Fund projecting that the gap will widen once again, with emerging markets’ growth increasingly leaving developed markets in the dust over the next decade. Yet the valuations of emerging market equities have yet to reflect those views. On a sector-adjusted basis, emerging market equities are trading at a 15 percent price-to-earnings discount to developed market equities. On a price-to-book basis, they look even cheaper, trading at 30 percent discount to developed markets, near the bottom of their ten-year range (as of September 2nd). Western shoppers often savor shopping opportunities in developing countries, which offer discounts they can’t get at home. It may again be time for investors to do the same.

The post Emerging Equities Outshine Developed Markets appeared first on The Financialist.