Swiss Franc The Euro has risen by 0.07% to 1.071 EUR/CHF and USD/CHF, February 6(see more posts on EUR/CHF, USD/CHF, ) Source: markets.ft.com - Click to enlarge FX Rates Overview: The bullish enthusiasm that carried the S&P 500 to new closing highs yesterday is helping Asia Pacific and European shares today. The MSCI Asia Pacific Index rose for the third session with Tokyo, Hong Kong, and Korea jumping two percent. Europe’s Dow Jones Stoxx 600 gapped to new...

Read More »Three Credit Suisse investors back Tidjane Thiam in board battle

Relations between Thiam and Rohner appear to have been deteriorating. (Keystone / Walter Bieri) Credit Suisse’s top shareholders have thrown their support behind chief executive Tidjane Thiam and called on chairman Urs Rohner to quit, in a high-stakes power struggle at the Swiss bank following a spy scandal last year. Relations between Mr Rohner and Mr Thiam have been increasingly strained since revelations that Credit Suisse hired a corporate espionage company to...

Read More »USD/CHF Price Analysis: Multiple upside barriers to check bulls amid overbought RSI

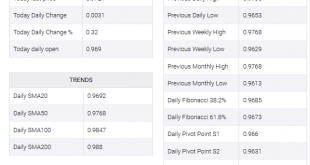

USD/CHF registers four-day winning streak, nears one-week high. A falling trend line since December 25, seven-week-old horizontal resistance limits the immediate upside. Overbought RSI conditions increase the odds of a pullback. USD/CHF remains mildly positive while gaining 0.07% to 0.9745 amid the pre-Europe session on Thursday. Overbought RSI conditions, coupled with multiple key resistance lines, question the pair’s further upside. As a result, sellers will look...

Read More »USD/CHF clings to gains above 0.9700 mark, US data eyed for fresh impetus

USD/CHF gains positive traction for the third consecutive session on Wednesday. Optimism over coronavirus treatment triggered a fresh wave of global risk-on trade. The USD benefitted from surging US bond yields and remained support ahead of data. The USD/CHF pair surged through the 0.9700 round-figure mark and climbed to near one-week tops in the last hour, albeit retreated few pips thereafter. The pair gained some follow-through traction for the third consecutive...

Read More »Food bank: a third of Swiss food ‘goes to waste’

In Switzerland, 133,000 employed persons are affected by poverty, both in terms of income and deprivation. (© Keystone / Georgios Kefalas) About a third of the food produced for Swiss consumption went to waste last year, according to the food bank foundation Schweizer Tafe/Table Suisse. That is the equivalent of 2.6 million tonnes of food. Five percent of the losses occurred in the retail trade. The foundation collected 3,820 tonnes of food that was not for sale but...

Read More »Shhhh: Repo Operation in Process

In a bit of holiday news no one will care about, the Treasury announced it would return to selling twenty-year treasury bonds to aid in funding the nation’s trillion-dollar deficit. It was 1986 when the Treasury last issued twenty-year paper. Of course the question is: who or what will be the buyers? Daniel R. Amerman, CFA, is keeping a steady eye on the Treasury and Fed’s operations and has come to the conclusion, In just the last four months, the U.S. government...

Read More »FX Daily, February 5: Markets Extend Recovery, but Look for a Pause

Swiss Franc The Euro has risen by 0.13% to 1.0716 EUR/CHF and USD/CHF, February 5(see more posts on EUR/CHF, USD/CHF, ) Source: markets.ft.com - Click to enlarge FX Rates Overview: The S&P 500 gapped higher and surged 1.5% yesterday, the most since in six months, helping set the stage for a continued recovery in global equities, and stoked risk appetites more broadly. An experimental antiviral treatment is to begin clinical testing. All of the markets in the...

Read More »Study spotlights niche market for solo Chinese tourists

The Titlis mountain is a key destination for Chinese tourists in Switzerland. The tourism industry in central Switzerland could benefit from increased efforts to focus on individual holidaymakers from China, according to a study. A report by the Lucerne University of Applied Sciences and Artsexternal link found that guests from China travelling individually in Europe take a special interest in culinary events and that they are likely to receive information about new...

Read More »USD/CHF Price Analysis: Registers three-day winning streak, probes 21-day EMA

USD/CHF extends recovery from mid-January lows. A ten-week-old falling trend line, short-term horizontal resistance area will challenge the pair’s latest pullback. The pair’s break of yearly low can push the bears towards late-2018 lows. USD/CHF takes the bids to 0.9700 during the pre-European session on Wednesday. That said, 21-day EMA limits the pair’s immediate upside amid the bullish MACD signals. Even if the pair manages to clear the 0.9700 mark on a daily...

Read More »Philip Morris International to axe jobs in Switzerland

© Vitezslav Vylicil | Dreamstime.com The tobacco company Philip Morris International (PMI) has unveiled plans to cut jobs at its sites in Lausanne and Neuchâtel. A total of around 265 jobs are likely to go. Most of them will be transferred to the UK, Portugal and Poland. The company has opened formal processes in both cantons and those affected will be informed between now and the end of March 2020, it said. The company said its restructuring plans are part of its...

Read More » SNB & CHF

SNB & CHF