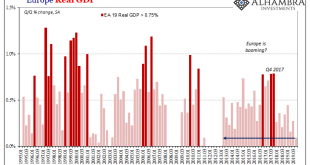

Rolling over in credit stats, particularly business debt, is never a good thing for an economy. As noted yesterday, in Europe it’s not definite yet but sure is pronounced. The pattern is pretty clear even if we don’t ultimately know how it will play out from here. The process of reversing is at least already happening and so we are left to hope that there is some powerful enough positive force (a real force rather than imaginary, therefore disqualifying the ECB)...

Read More »Do People Really Seek to Maximize Profit?

[This article is excerpted from chapter 14 of Human Action.] It is generally believed that economists, in dealing with the problems of a market economy, are quite unrealistic in assuming that all men are always eager to gain the highest attainable advantage. They construct, it is said, the image of a perfectly selfish and rationalistic being for whom nothing counts but profit. Such a homo economicus may be a likeness of stock jobbers and speculators. But the immense...

Read More »All-Stars #92 Jeff Snider: Did anything really get “better” last September?

Please visit our website www.macrovoices.com to register your free account to gain access to supporting materials. Go to : http://bit.ly/2Sg4W54 for Jeff's chartbook

Read More »Dollar Mixed as Some Risk Appetite Returns

The dollar continues to climb; one of side-effects of the virus has been a swelling of the amount of negative yielding debt globally The US primary season got off to a rocky start for the Democrats During the North American session, December factory orders will be reported; the US economy remains strong The UK reported January construction PMI The RBA held rates at 0.75%, as expected; Korea January CPI came in hot at 1.5% y/y The dollar is mixed against the majors as...

Read More »FX Daily, February 4: Relief Rally Fueled by Liquidity not Peak in Coronavirus

Swiss Franc The Euro has risen by 0.21% to 1.0701 EUR/CHF and USD/CHF, February 4(see more posts on EUR/CHF, USD/CHF, ) Source: markets.ft.com - Click to enlarge FX Rates Overview: The combination of the rally in US shares yesterday and the continued efforts of China to inject liquidity helped lift sentiment today. The MSCI Asia Pacific Index snapped an eight-day slide, and many markets jumped more than 1%. Led by energy and materials, Europe’s Dow Jones Stoxx...

Read More »Poverty rate falls slightly in Switzerland

© Chernetskaya | Dreamstime.com In 2018, the percentage of the population in Switzerland living below the poverty line fell from 8.2% (2017) to 7.9%, returning to the same level as it was in 2010. Most affected by poverty were those aged under 18 (9.6%) and those aged over 64 (13.7%). Single parent families (19.3%), those without tertiary education (12.7%) and those without Swiss citizenship (11.6%) were more likely to have incomes low enough to place them below the...

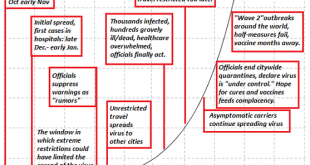

Read More »Brace for Impact: Global Pandemic Already Baked In

If we accept what is known about the virus, then logic, science and probabilities all suggest we brace for impact. Here’s a summary of what is known or credibly estimated about the 2019-nCoV virus as of January 31, 2019: 1. A statistical study from highly credentialed Chinese academics estimates the virus has an RO (R-naught) of slightly over 4, meaning every carrier infects four other people on average. This is very high. Run-of-the-mill flu viruses average about...

Read More »Brexit: Predictions of Economic Doom Show Why People Ignore “Experts”

The headline was unambiguous: ” Brexit Is Done: The U.K. Has Left the European Union .” As of January 31, The European Union (Withdrawal) Act of 2018 has become law and the United Kingdom has begun the withdrawal process from the European Union. The transition process will continue throughout 2020 as the UK and EU governments negotiate the nature of the future relationship between the UK and the EU. Now that the British exit from the European Union is a legal...

Read More »Credit Suisse accused of spying on Greenpeace

© Pincasso | Dreamstime.com According to SonntagsZeitung, the bank Credit Suisse has been spying on Greenpeace. Nearly three years ago, the environmental organisation thwarted security and disrupted the bank’s general assembly with a stunt aimed at shaming Credit Suisse for financing Energy Transfer, a company involved in the construction of the controversial Dakota Access oil pipeline running through reserves in the US state of Dakota. Greenpeace said the...

Read More »Gold Falls 0.6percent After Having A Seven Year Weekly High Close and 4percent Gain In January

Gold falls from seven year high weekly close◆ Gold prices fell 0.6% today after reaching a seven year weekly high close at $1587.90/oz on Friday, gold’s highest weekly price settlement since March 2013, a 4% gain in January and its second straight monthly climb. ◆ Chinese stocks crashed over 7.7% overnight as investors got a chance to react to the worsening coronavirus outbreak which also saw European equities seeing some selling and economically sensitive...

Read More » SNB & CHF

SNB & CHF