Rohner speaking at a news conference last October, following the discovery that the Credit Suisse management spied on former executives including wealth manager Iqbal Kahn. (Keystone/Ennio Leanza) The chairman of the Credit Suisse bank says he does not expect to be voted out of office before his term ends next year following the departure of the bank’s CEO on Friday amid a surveillance scandal. Urs Rohner says he has received “clear responses” from shareholders...

Read More »Controlling the Narrative Is Not the Same as Controlling the Virus

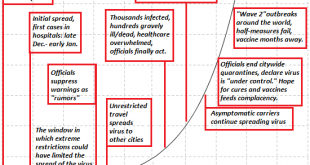

Are these claims even remotely plausible for a highly contagious virus that spreads easily between humans while carriers show no symptoms? It’s clear that the narrative about the coronavirus is being carefully managed globally to minimize the impact on global sentiment and markets. Authorities are well aware of the global economy’s extreme fragility, and so Job One for authorities everywhere is to scrub the news flow of anything that doesn’t support the implicit...

Read More »The Fight for Liberty and the Beltway Barbarians

In the conservative and libertarian movements there have been two major forms of surrender, of abandonment of the cause. The most common and most glaringly obvious form is one we are all too familiar with: the sellout. The young libertarian or conservative arrives in Washington, at some think-tank or in Congress or as an administrative aide, ready and eager to do battle, to roll back the State in service to his cherished radical cause. And then something happens:...

Read More »Central banks weigh up response to Libra and bitcoin

Creating money may soon look entirely different in the digital age. (Keystone / Lm Otero) Central banks are contemplating a response to alternative money systems, such as bitcoin or Libra, with new digital versions of their own currencies. They go by the name of Central Bank Digital Currencies, or CBDCs. Libra’s stablecoin project launched in Geneva last year was a “watershed” moment that “kicked everyone in the pants”, Michael Sung, a professor at Fudan University,...

Read More »Drivers for the Week Ahead

Risk-off sentiment intensified last week; the dollar continues to climb This is another big data week for the US; the US economy remains strong Fed Chair Powell testifies before the House Tuesday and the Senate Wednesday; the Senate holds confirmation hearings for Fed nominees Shelton and Waller Thursday President Trump will unveil his budget proposal for FY2021 beginning October 1 this Monday Eurozone and UK have heavy data weeks Riksbank meets Wednesday and is...

Read More »USD/CHF trades at fresh 2020 highs above 0.9760 ahead of NFP

CHF struggles to find demand as a safe-haven on Friday. US Dollar Index pushes higher above the 98.50 mark. Nonfarm Payrolls in US is expected to come in at 160K in January. The USD/CHF pair closed the last four trading days in the positive territory and continued to edge higher on Friday to touch its best level since December 27th at 0.9772. As of writing, the pair was up 0.2% on the day at 0.9763. The sour market mood fails to help the CHF find demand as a...

Read More »Is the SNB In Control of the Amount of Sight Deposits?

The current monetary environment in Switzerland is as far from ordinary as can be imagined: negative interest rates (from -0.75% in the short term to -0.25% for 50Y govt bonds) and oceans of liquidity (M0 has grown to 50% of M3 from pre-crises levels of around 8%). The Swiss National Bank faces criticism because it is seen as contributing to this state of affairs. Both the critique and the counter-arguments have many facets. Let us pick just one of them: is the SNB...

Read More »Switzerland spends more than the EU on education

A primary school class in Aargau, northern Switzerland (Keystone) Switzerland’s public finances rose by 1.7% in 2018 to CHF232.6 billion ($238.8 billion) compared with 2017. As a percentage of the total, Switzerland spent more on education and less on defence than the European Union. The largest budget item remained social protection, costing almost CHF92 billion or 39.4% of the total, the Federal Statistical Office (FSO) said on Thursdayexternal link. This is...

Read More »Credit Suisse falls back on Swiss roots to restore order

Thiam lost out in a Credit Suisse power battle, much to the surprise of many observers. (Keystone / Walter Bieri) Credit Suisse’s board has defied the wishes of several major shareholders with the surprise axing of chief executive Tidjane Thiam. He has been replaced with Swiss national, and current head of the bank’s domestic operations, Thomas Gottstein. The bank appears to be going back to its Swiss roots in a bid to re-stabilise its business and reputation...

Read More »COT Black: German Factories, Oklahoma Tank Farms, And FRBNY

I wrote a few months ago that Germany’s factories have been the perfect example of the eurodollar squeeze. The disinflationary tendency that even central bankers can’t ignore once it shows up in the global economy as obvious headwinds. What made and still makes German industry noteworthy is the way it has unfolded and continues to unfold. The downtrend just won’t stop. According to Germany’s deStatis, factory orders in December 2019 were down sharply yet again....

Read More » SNB & CHF

SNB & CHF