A Week to Remember Today we look back to the recent past with singleness of purpose. Context and edification for the present economy is what we’re after. We have questions… How come the recovery has been so weak? Why is it that, nearly seven years after the official end of the Great Recession, the economy’s still mired in a soft muddy quagmire? Squinting, focusing, and refocusing, there’s one particular week that rises above all others. Photo credit: Talks at Google Hank the scaremonger – in meetings behind closed doors, he threatened Congressmen with financial apocalypse and even martial law if they didn’t hand over 0 billion in tax payer money with essentially no oversight. This has been independently confirmed by several Congressmen. Griffin’s “The Creature from Jekyll Island” is often decried as “conspiracy theory” by establishment shills, but it inter alia contains an eerie prediction of practically everything that eventually happened in 2008. Wild days on Wall Street – the crash wave of 2008 On Saturday September 20, 2008, Treasury Secretary Hank Paulson delivered a draft of the Troubled Asset Relief Program (TARP) to Congress for review. If you recall, it had been another wild week. On Monday, September 15, after 158 years of operation, Lehman Brothers vanished from the face of the earth…Dick Fuld, “The Gorilla,” be damned.

Topics:

MN Gordon considers the following as important: Debt and the Fallacies of Paper Money, Featured, Hank Paulson, Jim Bunning, newsletter, On Politics, The Stock Market

This could be interesting, too:

Nachrichten Ticker - www.finanzen.ch writes Die Performance der Kryptowährungen in KW 9: Das hat sich bei Bitcoin, Ether & Co. getan

Nachrichten Ticker - www.finanzen.ch writes Wer verbirgt sich hinter der Ethereum-Technologie?

Martin Hartmann writes Eine Analyse nach den Lehren von Milton Friedman

Marc Chandler writes March 2025 Monthly

A Week to Remember

Today we look back to the recent past with singleness of purpose. Context and edification for the present economy is what we’re after. We have questions…

How come the recovery has been so weak? Why is it that, nearly seven years after the official end of the Great Recession, the economy’s still mired in a soft muddy quagmire? Squinting, focusing, and refocusing, there’s one particular week that rises above all others.

Hank the scaremonger – in meetings behind closed doors, he threatened Congressmen with financial apocalypse and even martial law if they didn’t hand over $700 billion in tax payer money with essentially no oversight. This has been independently confirmed by several Congressmen. Griffin’s “The Creature from Jekyll Island” is often decried as “conspiracy theory” by establishment shills, but it inter alia contains an eerie prediction of practically everything that eventually happened in 2008.

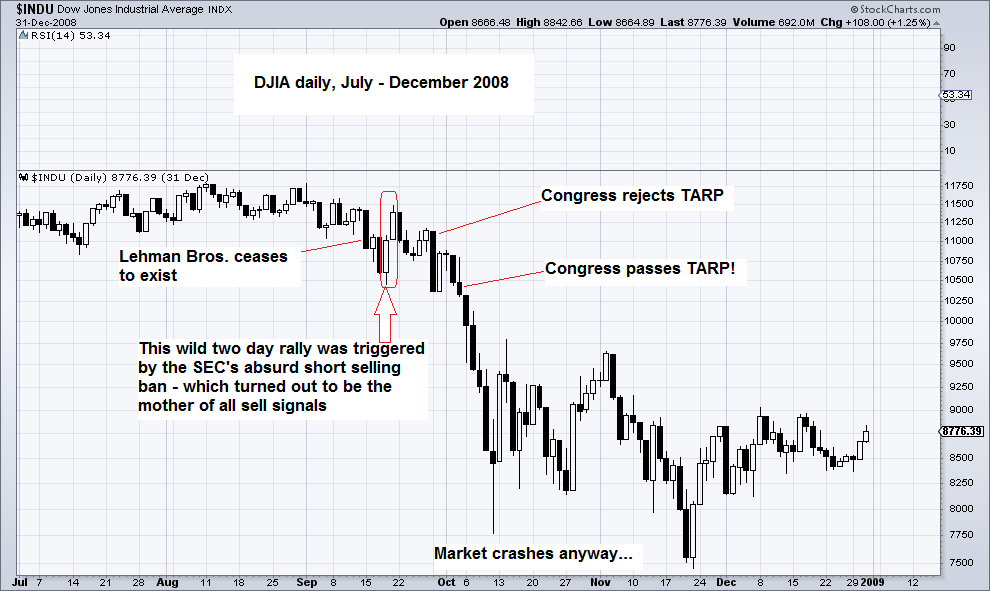

Wild days on Wall Street – the crash wave of 2008On Saturday September 20, 2008, Treasury Secretary Hank Paulson delivered a draft of the Troubled Asset Relief Program (TARP) to Congress for review. If you recall, it had been another wild week. On Monday, September 15, after 158 years of operation, Lehman Brothers vanished from the face of the earth…Dick Fuld, “The Gorilla,” be damned. All week the sky relentlessly fell on financial markets. Even money market funds were in full panic. In fact, a record $169.03 billion of capital had vacated money market funds in the week ended September 17. |

That same day, the Wall Street Journal’s headline was, “U.S. to Take Over AIG in $85 Billion Bailout.” On top of that, the Primary Fund broke the buck – falling to $0.97 cents a share. The SEC also went so far as to impose a 10 trading-day ban on short sales of 799 financial stocks.

The Free Market is Dead

Certainly, this week of bank bailouts, busted money markets, and extreme SEC intervention was unsettling. But looking back in retrospect, bringing it into context with the present, one brief statement above all others captures the essence of it all, both then and now.

Kentucky Senator Jim Bunning said on September 19:

|

Kentucky senator Jim Bunning – in order to save the village, it had to be destroyed. Photo credit: Getty Images |

Bunning’s remarks turned out to be both accurate and prescient. For he uttered them prior to the insanity of quantitative easing. If the free market wasn’t already dead with the rollout of TARP, in the post quantitative easing world it is a corpse.

Free markets, in particular free credit markets have been destroyed. The rewards of accumulating capital through saving no longer exist. Unfortunately, a lifetime of saving will no longer support people through their golden years by living off the interest. These days a lifetime of saving only buys you a cup of coffee.

At the same time, asset prices have been so distorted has become near impossible to tell what represents an investment and what a speculation. For example, ExxonMobil recently lost its Triple A credit rating, a grade it had maintained since 1930. Like many other corporations, broken credit markets have enticed them to practice financial engineering.

The Cure is Worse than the Disease

The Fed’s monetary policies have made funding share buybacks and dividend payments with borrowed money an attractive management tactic. In the face of stalling business prospects, these short-term gimmicks can make business operations appear healthy. But surely even someone with a Masters in Finance can recognize this is merely transferring money from bond holders to shareholders.

Naturally, executives love borrowing money to buyback shares…especially those receiving handsome compensation in the form of stock options. For it lines their pockets and gives a short boost to earnings per share. But what it doesn’t do is create new value.

Exxon Mobil Corp, dailyin spite of the weak oil price, the stock price of XOM has been successfully “engineered” back to its highs – alas, for the first time since 1930, the company no longer enjoys an AAA rating – |

In ExxonMobil’s case, without the proper price signals provided by a free functioning credit market, the company was compelled to shoot itself in the foot. When oil prices were high, also an effect of monetary pumping, executives drained off the cash reserves they would need to weather an oil price decline. Strength garnered through a century of sound business practices evaporated.

Up and down the DOW the story repeats. In 1980, over 60 U.S. companies had a Triple A credit rating. Now, just two companies – Johnson & Johnson and Microsoft – remain.

Such is the fate of a planned economy, with manipulated credit markets, and an elastic currency. Slow growth, and soon no growth, coupled with rising corporate debt and falling operating cash flow is the Frankenstein economy Ben Bernanke and Hank Paulson have gifted us. The net result: the cure has turned out to be worse than the disease.

Charts by: StockCharts

Chart and image captions by PT