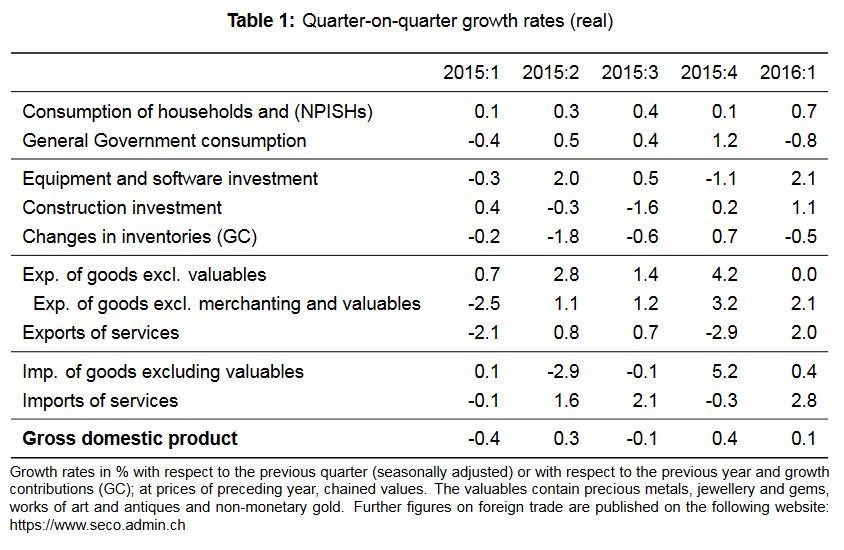

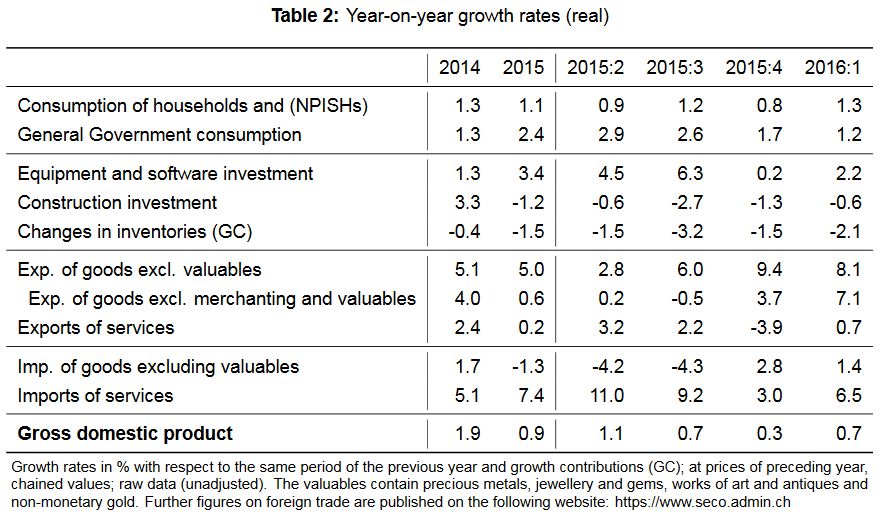

Bern, 01.06.2016 – Switzerland’s real gross domestic product (GDP) grew by 0.1% in the 1st quarter of 2016.* GDP was underpinned by consumption expenditure from private households and investments in construction and equipment but curbed slightly by government consumption. On the production side, the picture was mixed: whilst financial services and the hotel and catering industry saw a decline, value added in manufacturing, construction and the healthcare sector increased. In comparison with the 1st quarter of 2015, GDP grew by 0.7% and the GDP deflator lost 1%. Household consumption expenditure and that of non-profit institutions serving households (NPISH) increased by a strong 0.7% in the 1st quarter of 2016. This broad-based growth was fuelled mainly by the healthcare category as well as housing and energy. By contrast, spending on clothes and shoes continued to drop, while there was also a fall in general government consumption (-0.8%). Investments in equipment rose by 2.1% due mainly to investment in other transport equip-ment, which is largely immune to business cycles. Meanwhile, investments in construction grew by 1.1%. Exports of goods (excluding non-monetary gold, valuables and merchanting) rose by 2.1% in the 1st quarter of 2016, thanks chiefly to the watches/precision tools/jewellery category.

Topics:

SECO considers the following as important: Featured, Gross Domestic Product, newsletter, Swiss Macro

This could be interesting, too:

Nachrichten Ticker - www.finanzen.ch writes Die Performance der Kryptowährungen in KW 9: Das hat sich bei Bitcoin, Ether & Co. getan

Nachrichten Ticker - www.finanzen.ch writes Wer verbirgt sich hinter der Ethereum-Technologie?

Martin Hartmann writes Eine Analyse nach den Lehren von Milton Friedman

Marc Chandler writes March 2025 Monthly

Bern, 01.06.2016 – Switzerland’s real gross domestic product (GDP) grew by 0.1% in the 1st quarter of 2016.* GDP was underpinned by consumption expenditure from private households and investments in construction and equipment but curbed slightly by government consumption. On the production side, the picture was mixed: whilst financial services and the hotel and catering industry saw a decline, value added in manufacturing, construction and the healthcare sector increased. In comparison with the 1st quarter of 2015, GDP grew by 0.7% and the GDP deflator lost 1%.

Household consumption expenditure and that of non-profit institutions serving households (NPISH) increased by a strong 0.7% in the 1st quarter of 2016. This broad-based growth was fuelled mainly by the healthcare category as well as housing and energy. By contrast, spending on clothes and shoes continued to drop, while there was also a fall in general government consumption (-0.8%).

Investments in equipment rose by 2.1% due mainly to investment in other transport equip-ment, which is largely immune to business cycles. Meanwhile, investments in construction grew by 1.1%.

Exports of goods (excluding non-monetary gold, valuables and merchanting) rose by 2.1% in the 1st quarter of 2016, thanks chiefly to the watches/precision tools/jewellery category. Most of the other categories, including chemical/pharmaceutical exports and metals/machinery/electronics, also saw a slight increase. After a strong growth in the previous quarter, imports of goods (excluding non-monetary gold and valuables) were up by 0.4% in the 1st quarter of 2016, boosted by transport equipment and the watches/precision tools/jewellery category. However, there were falls in the chemicals/pharmaceuticals and energy categories.

Following a negative result in the previous quarter, exports of services (including tourism) and imports of services both enjoyed growth in the 1st quarter of 2016, adding 2.0% and 2.8% respectively.

On the production side of GDP, there were significant falls in value added in the financial services sector (-3.0%) and the hotel and catering industry (-2.1%) as well as drops in the sectors of education (-1.7%) and public administration (-0.6%). This contrasts with a slight recovery in trading (0.3%) following several quarters of negative results. The figures were also bolstered by manufacturing (0.9%), construction (2.0%), and healthcare and social work (2.1%).

Many of the prices on the expenditure side of GDP continued to fall in comparison with the 1st quarter of 2015, albeit less sharply than in previous quarters. The deflator for private consumption lost 1.2% on the corresponding quarter in the previous year, whilst those for government consumption (0.5%) and investments in construction (0.1%) were both up slightly. The deflator for investments in equipment continued to drop by 1.2%. Foreign trade prices once again saw the most significant falls in comparison with the 1st quarter of 2015, although the downward tendency slowed down as well. The deflator for exports of goods and services (excluding non-monetary gold and valuables) decreased by 3.6%, with that for imports of goods and services (excluding non-monetary gold and valuables) down by 3.1%. The GDP deflator fell by 1% in the first quarter 2016 compared to the first quarter 2015.

* Unless stated otherwise the percentage changes with respect to the previous quarter listed here (not annualised) are calculated on the basis of chained series, price, seasonal and calendar adjusted values (X-13ARIMA-SEATS is used for seasonal and calendar adjustment). “Real” is used as an abbreviation for the formulation “data at previous year prices, quarterly chained series with reference year 2010”. The official terminology also uses the phrase “volume changes”. The development of the price indices is commented using comparisons with the previous year, which are based on the changes in the original figures (before seasonal and calendar adjustments).

Gross domestic product, expenditure approach (ESVG 2010) (PDF, 57 kB)

Previous post Next post