China’s economy beat consensus growth forecasts in 2017 and we have revised up our own forecast for 2018.The Chinese economy ended 2017 on a strong note, rising 1.6% over the previous quarter and, growing by 6.9% in real terms over 2017 as a whole, thus beating the consensus forecast as well as our own estimate (both at 6.8%). The strong 2017 growth number marks the first full-year acceleration in the Chinese economy since 2010, and can be accredited to the synchronised global economic expansion and a booming domestic consumer sector.The GDP figures underline China’s ongoing transition from an investment-driven economy towards a consumption- and service-driven one. By sector, the tertiary sector (mainly services) continues to be the key driving force of the economy, accounting for 59.6%

Topics:

Dong Chen considers the following as important: China GDP growth, Chinese fixed asset investment, Macroview

This could be interesting, too:

Cesar Perez Ruiz writes Weekly View – Big Splits

Cesar Perez Ruiz writes Weekly View – Central Bank Halloween

Cesar Perez Ruiz writes Weekly View – Widening bottlenecks

Cesar Perez Ruiz writes Weekly View – Debt ceiling deadline postponed

China’s economy beat consensus growth forecasts in 2017 and we have revised up our own forecast for 2018.

The Chinese economy ended 2017 on a strong note, rising 1.6% over the previous quarter and, growing by 6.9% in real terms over 2017 as a whole, thus beating the consensus forecast as well as our own estimate (both at 6.8%). The strong 2017 growth number marks the first full-year acceleration in the Chinese economy since 2010, and can be accredited to the synchronised global economic expansion and a booming domestic consumer sector.

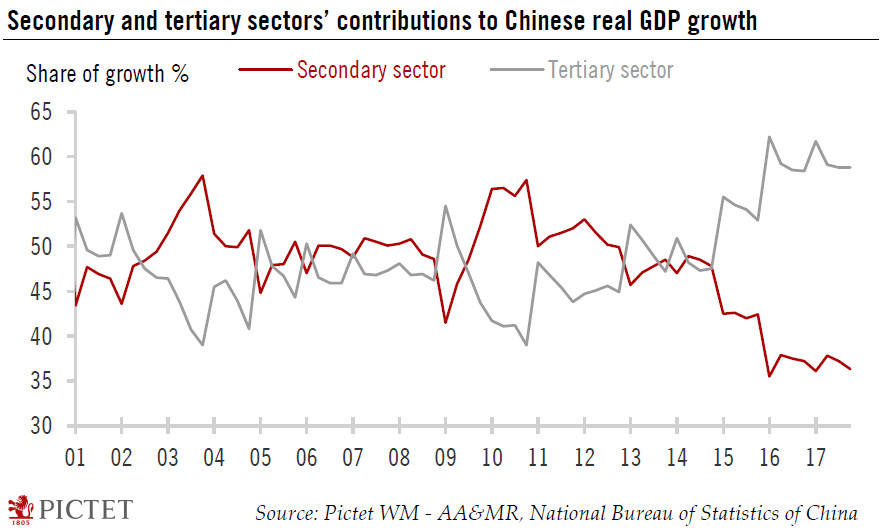

The GDP figures underline China’s ongoing transition from an investment-driven economy towards a consumption- and service-driven one. By sector, the tertiary sector (mainly services) continues to be the key driving force of the economy, accounting for 59.6% of the headline growth in 2017, while the secondary sector’s contribution (mainly manufacturing) was 40.4% (see Chart).

In light of the continued strength of external demand and signs of stabilisation in fixed-asset investment, we have decided to revise up our Chinese GDP forecast for 2018 to 6.5% from 6.3% previously.

China’s growth momentum will likely moderate somewhat in 2018, but the potential downside in fixed-asset investment may be less than what we had earlier expected. The upward revision of our outlook for the Chinese economy this year is mainly based on the stronger-than-expected global economy and potentially less downside in fixed investment.

The risks to our more bullish view of the Chinese economy in 2018 include increasing trade protectionism, especially from the Trump administration, and the possibility that the headwinds caused by the Chinese government’s efforts to deleverage the economy and to reduce pollution are stronger than expected.

We do not believe a full-scale trade war between the US and China is likely. But there are signs that the Trump administration is starting to apply more protectionist measures against the US’s trading partners, (although so far, these measures have been limited in scope). Policy mistakes in China itself cannot be ruled out. We will continue to monitor future developments closely and will re-evaluate our scenarios accordingly.