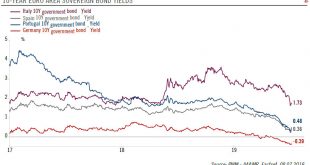

Prospects of more ECB easing has contributed to an across-the-board rally in euro sovereign bonds yields and could help limit volatility in peripheral bonds.Since Mario Draghi in June signalled the European Central Bank’s (ECB) readiness to embark on more easing should the euro area economy fail to regain speed, euro sovereign bonds yields have fallen across the board, with the 10-year Bund yield briefly moving below -0.4% (the same level as the deposit rate) in intraday trading on July 4.We...

Read More »World trade and manufacturing hit by tariffs

In June, the world PMI manufacturing index recorded its second consecutive month below 50, suggesting that global manufacturing is contracting.Global manufacturing sentiment deteriorated further in June. Markit Economics’ World purchasing managers’ index for manufacturing fell to 49.4 from 49.8 in May, the second month in a row it was below the 50 threshold, suggesting that global manufacturing activity is contracting. One needs to go back to 2012 to see something comparable. Even if the...

Read More »Weekly View – The dark horse wins

The CIO Office's view of the week ahead.Christine Lagarde stole headlines this week with her unexpected nomination to succeed Mario Draghi at the ECB. Both equities and bond markets rallied sharply around the world on the news. Given Ms. Lagarde’s past history of support for the ECB’s easy monetary policy, her appointment was taken as confirmation that the ECB will continue on its renewed dovish course after its new president takes the helm. In our view, Lagarde’s political background could...

Read More »House View, July 2019

Pictet Wealth Management's latest positioning across asset classes and investment themes.Asset allocationAlthough the US-China ‘trade truce’ and dovish central banks are giving a short-term fillip to equities, our analysis suggests that expansion of valuations from here is limited, making us globally cautious on equities. But we see opportunities in high-quality stocks in individual sectorsWe remain underweight government bonds given low yields, except US Treasuries, on which we are neutral....

Read More »Trade and disinflation keep central banks dovish

Global central banks are in dovish, if not outright easing, mode, as they seek to maintain easy monetary conditions to counteract an uncertain trade outlook and disinflationary forces.Global central bank rhetoric has turned even more dovish lately, encapsulated by the latest Federal Reserve (Fed) meeting and the European Central Bank (ECB) policy forum in Sintra, both in June. With global manufacturing slowing and inflation failing to pick up much, the Fed has signalled clearly that its next...

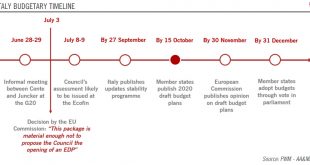

Read More »A truce between Rome and Brussels

For now, Italy has avoided Brussels' Excessive Deficit Procedure. But tensions are set to rise again in the autumn when Italy presents its 2020 budget package.In its mid-year budget revision, the Italian government lowered its 2019 deficit target. The government pointed to better-than-expected revenues for this revision, including tax revenues that were EUR3.5bn higher than expected and an additional EUR2.7bn in other revenues (including dividends from state-owned companies). Furthermore,...

Read More »Opposing Forces

[embedded content] Markets find themselves caught between opposing forces: on the one hand an ageing economic cycle and continued trade tensions; on the other, central banks intent on prolonging growth as long as possible, according to Christophe Donay, Chief Strategist and Head of Asset Allocation, Pictet Wealth Management. This tug of war, high valuations and evidence a lot of good news has already been priced in, mean we expect equities to trade sideways in the near term.

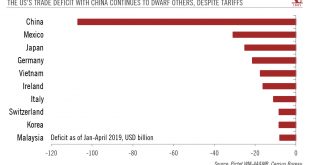

Read More »Fragile truce in Osaka

The US and China reached a ‘trade truce’ on the margins of the G20 summit this weekend, but existing tariffs remain in place. And we are only a tweet away from more Trumpian upheaval.The US and China leaders agreed on a truce during their much-anticipated meeting at the G20 summit in Osaka this weekend. Bilateral trade talks will restart. Trump put to bed the threat of additional tariffs, although the existing tariffs on roughly half of Chinese imports will stay at 25%. Importantly, Trump...

Read More »Weekly View – TIMEOUT

The CIO Office's view of the week ahead.The headline event at last week’s G20 summit in Osaka was the bilateral meeting between the Chinese and US presidents to discuss trade. After their last meeting ended in a stalemate, the world waited to see who would be first to blink. The rather anticlimactic outcome was that both sides have agreed not to add any new tariffs for now. The only real positive news is that Trump agreed to a partial lift on the Huawei ban, although without any clarity on...

Read More »On the ground in over 80 countries – neutral, impartial and independent

The organisation that became the ICRC was founded in Geneva over 150 years ago, and has grown into a global organisation which is constantly expanding its activities while remaining true to the Swiss values that inspired it.After Henri Dunant, a Geneva businessman, had seen the devastation of the Battle of Solferino in Italy, he published a book calling for improved care for wounded soldiers in wartime. So an International Committee for Relief to the Wounded was convened in 1863 and...

Read More » Perspectives Pictet

Perspectives Pictet