The decision to lower reserve requirements for some lending does not represent a policy shift by the PBoC, still intent on reining in excessive financial leverage.The People’s Bank of China (PBoC) announced on 30 September that it would lower the required reserve ratio (RRR) for selected banks by 50-150 basis points (bps) from the beginning of next January.Specifically, banks eligible for a 50 bps cut to their RRR will include those that have at least 1.5% of their existing loans or of their 2017 new lending extended to under-served sectors such as small enterprises and agricultural businesses. Banks that have over 10% of their loans to these sectors are eligible for an additional 100 bps cut to RRR.After the move, the RRR for most large banks will be reduced to 16.5%, and for most small

Topics:

Dong Chen considers the following as important: China bank liquidity, China reserve requirements, Chinese lending, Macroview, PBoC policy

This could be interesting, too:

Cesar Perez Ruiz writes Weekly View – Big Splits

Cesar Perez Ruiz writes Weekly View – Central Bank Halloween

Cesar Perez Ruiz writes Weekly View – Widening bottlenecks

Cesar Perez Ruiz writes Weekly View – Debt ceiling deadline postponed

The decision to lower reserve requirements for some lending does not represent a policy shift by the PBoC, still intent on reining in excessive financial leverage.

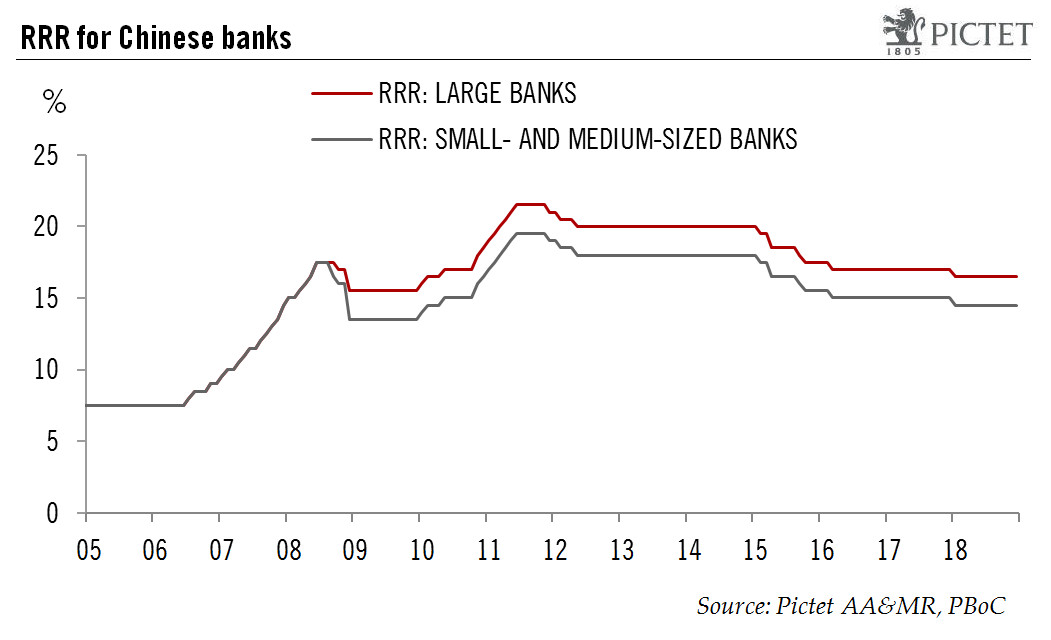

The People’s Bank of China (PBoC) announced on 30 September that it would lower the required reserve ratio (RRR) for selected banks by 50-150 basis points (bps) from the beginning of next January.

Specifically, banks eligible for a 50 bps cut to their RRR will include those that have at least 1.5% of their existing loans or of their 2017 new lending extended to under-served sectors such as small enterprises and agricultural businesses. Banks that have over 10% of their loans to these sectors are eligible for an additional 100 bps cut to RRR.

After the move, the RRR for most large banks will be reduced to 16.5%, and for most small and medium-sized banks to 14.5%. According to our estimate, the targeted RRR cuts may free up Rmb700-800 billion of liquidity.

In our view, the RRR cut mainly serves two purposes. The first is to encourage banks to provide more financing to small and medium-sized enterprises and agricultural entities, which historically have had difficulty obtaining loans from banks. The second, and probably more important, aim is to mitigate the potential liquidity shock that may be triggered by new regulations being introduced at the beginning of next year to curb financial leverage.

We do not believe the RRR cut represents a shift of policy direction at the PBoC. In our core scenarios for 2017 and 2018, we have stated our expectation that the PBoC would maintain a neutral monetary policy stance with a tightening bias. We continue to hold this view despite the recent policy move, for two main reasons. First, the Chinese economy remains resilient for now and we believe there is little probability of a sharp deceleration in the near term. Second, it has become increasingly clear that deflating China’s growing debt bubble is one of the top priorities for the Chinese government right now, and will likely remain so for the next couple of years as well.

In short, we see the PBoC’s latest policy move more as a measure to smooth the potential changes in liquidity conditions rather than as a sign of a policy move toward monetary easing. Financial deleveraging will likely remain an important theme of policies for the rest of the year and for 2018.