In the Pro Market blog, (previous) industry insiders describe the extent of rent seeking activities in pharmaceutical companies (bribing doctors), finance (exploiting information asymmetries vis-à-vis clients).

Read More »Longer-Term Interest Rate Pegs

In his blog, Ben Bernanke discusses the merits of longer-term interest rate targeting as a monetary policy tool. A lot would depend on the credibility of the Fed’s announcement. If investors do not believe that the Fed will be successful at pushing down the two-year rate … they will immediately sell their securities of two years’ maturity or less to the Fed. … the Fed could end up owning most or all of the eligible securities, with uncertain consequences for interest rates overall. On the...

Read More »SNB Foreign Currency Reserves

Rising. Source: SNB. The series “in EUR” is based on the author’s calculations. Note: The exchange rate floor vis-a-vis the Euro was in place from 6 September 2011 until 15 January 2015.

Read More »Exchange Rate Predictability

In a Study Center Gerzensee working paper, Pinar Yesin argues that the IMF’s Equilibrium Real Exchange Rate model (ERER) helps predict medium term exchange rate changes. The reduced form equation relates the real effective exchange rate to macroeconomic fundamentals. … one of the models, namely the ERER model, outperforms not only the other two in predicting future exchange rate movements, but also the (average) IMF assessment. … the IMF assessments are better at predicting future exchange...

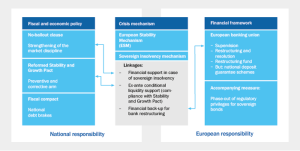

Read More »The German View of The Crisis

On VoxEU, representatives of the German Council of Economic Experts outline the German crisis narrative. In disagreement with the ‘consensus view’ outlined in Baldwin et al. (2015) the German economists including Lars Feld, Christoph Schmidt, Isabel Schnabel and Volker Wieland do not want to implicate the ‘intra-Eurozone capital flows that emerged in the decade before the crisis’ as the ‘real culprits’. … [Rather] it is the government failures and the failures in regulation and supervision...

Read More »Habits

In his blog, John Cochrane discusses plausible features of habit models (that some other models share): Consumption moves more with income in bad times. In bad times, consumers start to pay inordinate attention to rare bad states of nature. [The habit model] also gives a natural account of endogenous time-varying attention to rare events.

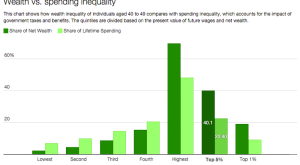

Read More »Spending Inequality

In a New Republic blog, Alan Auerbach and Larry Kotlikoff discuss lifetime spending inequality. Due to taxes and income variability over the life cycle, this is much smaller than wealth or income inequality. Auerbach and Kotlikoff write: The top 1 percent of 40-49 year-olds face a net tax, on average, of 45 percent. … For the bottom 20 percent, the average net tax rate is negative 34.2 percent. … Our standard means of judging whether a household is rich or poor is based on current income....

Read More »Stiff Competition for Brokerage Firms

The Economist reports about the “ostensibly free online services” provided by Robinhood, a share-trading app. Instead of taking commissions from customers, Robinhood receives them from the trading venues to which it steers their orders, a controversial but common practice. It also earns returns from the cash clients leave in their accounts, and plans soon to offer margin trading—the buying of stock with borrowed money—for which it will charge a fee. Earlier posts on fintech.

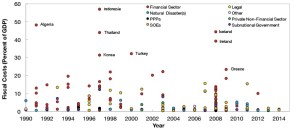

Read More »Contingent Liabilities

On VoxEU, Elva Bova, Marta Ruiz Arranz, Frederik Toscani and Elif Ture discuss contingent liabilities. Their figure 2 illustrates contingent liability realizations by type and year:

Read More »I Would Like to Withdraw A Couple Billion Swiss Francs: Legal Aspects

On his blog, Urs Birchler offers different perspectives on the question whether the Swiss National Bank (SNB) is obliged to pay out banks’ reserves in cash. One view: Reserves are legal tender. The SNB therefore is not obliged to exchange reserves against cash. Another view: According to the law, the SNB is required to provide sufficient cash. Moreover, reserves and cash were meant to be perfect substitutes. Yet another view: Lawmakers would have written a different law had they known that...

Read More » Dirk Niepelt

Dirk Niepelt